It’s been a rough ride for electric vehicle startup investors over the years. But it’s been especially tough for investors in Workhorse Group, with today’s earnings results failing to improve their situation. 👎

The company’s third-quarter revenues of $3.03 million were up 95.5% YoY but missed consensus expectations of $20.9 million by a wide margin. It also expects 2023 revenues to come in between $10 and $15 million, while Wall Street was looking for $63 million. 🔻

Executives said results were “significantly impacted” by delays in clean truck and bus vouchers (HVIP) in California. Regarding that, CEO Rick Dauch said, “As of today, I am pleased to report that we have successfully resolved this issue and are moving swiftly ahead.” 🤔

While revenues remain lackluster, the company has cut costs to help narrow its quarterly loss. With that said, it has just $71.9 million in working capital ($38.9 million in cash), which leaves the market concerned about its ability to operate without raising new capital. Management said they’re taking major steps to strengthen their financial position, but it remains to be seen what exactly that looks like.

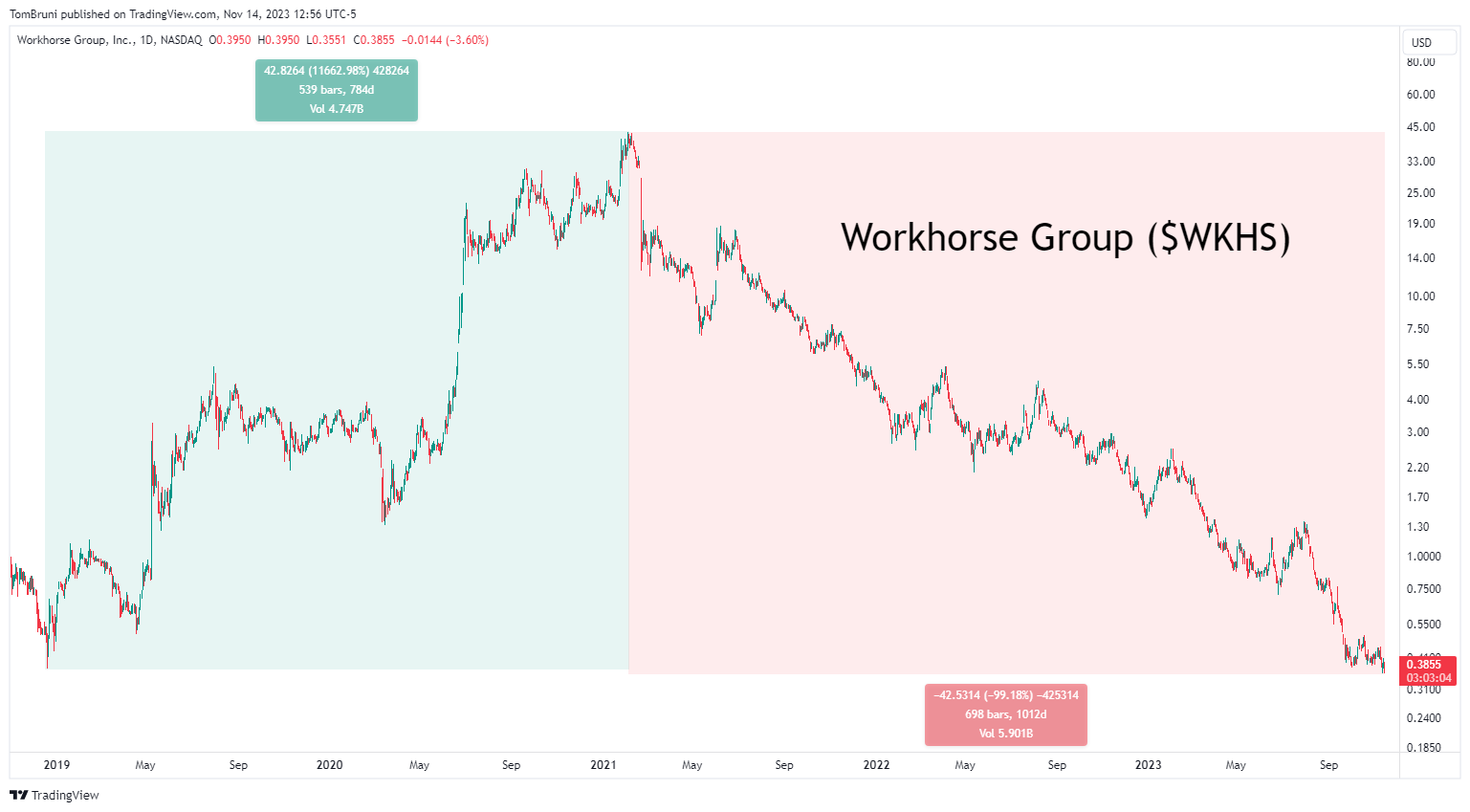

Clearly, Workhorse isn’t moving “swiftly” enough to satisfy investors. $WKHS touched new all-time lows before reversing to close roughly flat on the day. That caps off a wild ride since 2019, where shares rallied nearly 12,000% before crashing over 99% from those 2021 highs. 📉