Pandemic-era darling Zoom Video Communications reported results tonight after hitting all-time lows late last month. And for once, it didn’t disappoint. 👍

The company’s adjusted earnings per share of $1.29 beat expectations of $1.10. Analysts quickly pointed out that the beat was primarily driven by the company cutting sales/marketing and general/administrative expenses. But for Zoom, a win is a win…

Meanwhile, it reported a 3.2% YoY revenue increase, with $1.136 billion topping analyst expectations of $1.12 billion. Strength in its enterprise segment drove the beat, with revenues rising 7.5% YoY to $661 million. It also said 3,731 of its 219,700 enterprise customers contributed more than $100,000 in trialing 12-month revenue. That represents a 14% YoY rise. 📈

As for its retail “online” business, its average monthly churn was down ten bps YoY to 3.00%. Additionally, it’s seeing a larger percentage of its online customers stick around for at least 16 months, rising 250 bps YoY to 73.2%. Retaining and monetizing that pandemic-driven audience is a big part of its growth plan. 💻

Zoom also continues to generate cash from its operations, sitting on roughly $6.5 billion in total cash, cash equivalents, and marketable securities at the end of the quarter. So, while revenue growth is slow, its stabilized earnings and cash pile give it the flexibility to make strategic moves like acquisitions. 💰

Overall, investors remain concerned about its ability to drive results in a highly competitive market. This quarter’s progress shows that revenue growth may have stabilized, but investors want to see it accelerate from current levels.

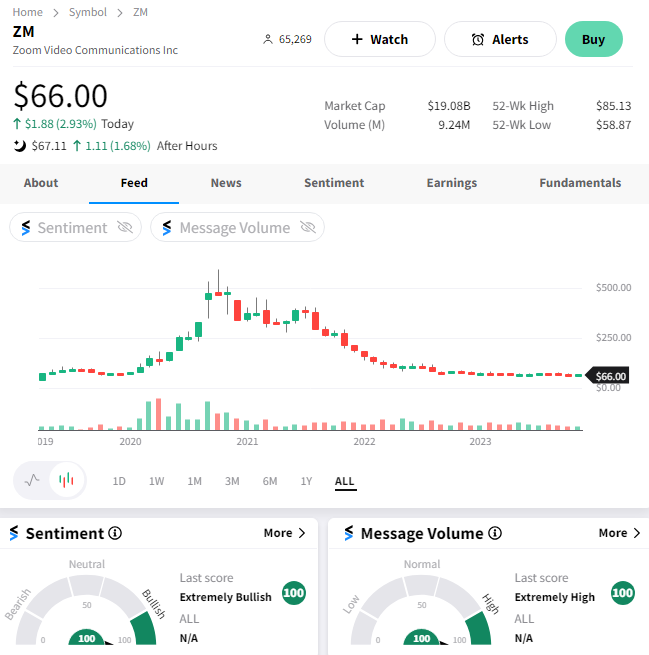

$ZM shares were up marginally as the market digested the news. 🤔