The Chinese electric vehicle (EV) maker is back in the news for its improving earnings picture. But a pickup in the stock’s momentum also put it on traders’ radars. Let’s take a look. 👇

Nio’s revenues of $2.7 billion were slightly below expectations, as pricing competition and weakening demand weighed on its sales numbers. However, the company’s renewed focus on profitability helped narrow its loss per share versus expectations and last year’s results.

Looking ahead to its fourth quarter, executives expect just 0.1% to 4.0% YoY revenue growth, which came in well below analyst expectations. Its fourth-quarter deliveries will be up 17.3% to 22.3% YoY, signaling that volumes continue to rise, but average selling prices remain under pressure. 🔻

Additionally, the company still has work to do regarding its margins. Gross margin was just 8%, down from 13.3% YoY. It recently cut 10% of its workforce, with lower material and component costs helping buoy its vehicle margin to 11%. The company is targeting a 15% to 18% vehicle margin in fiscal 2024 but noted it will be difficult to achieve if consumer and pricing pressures remain. 🔺

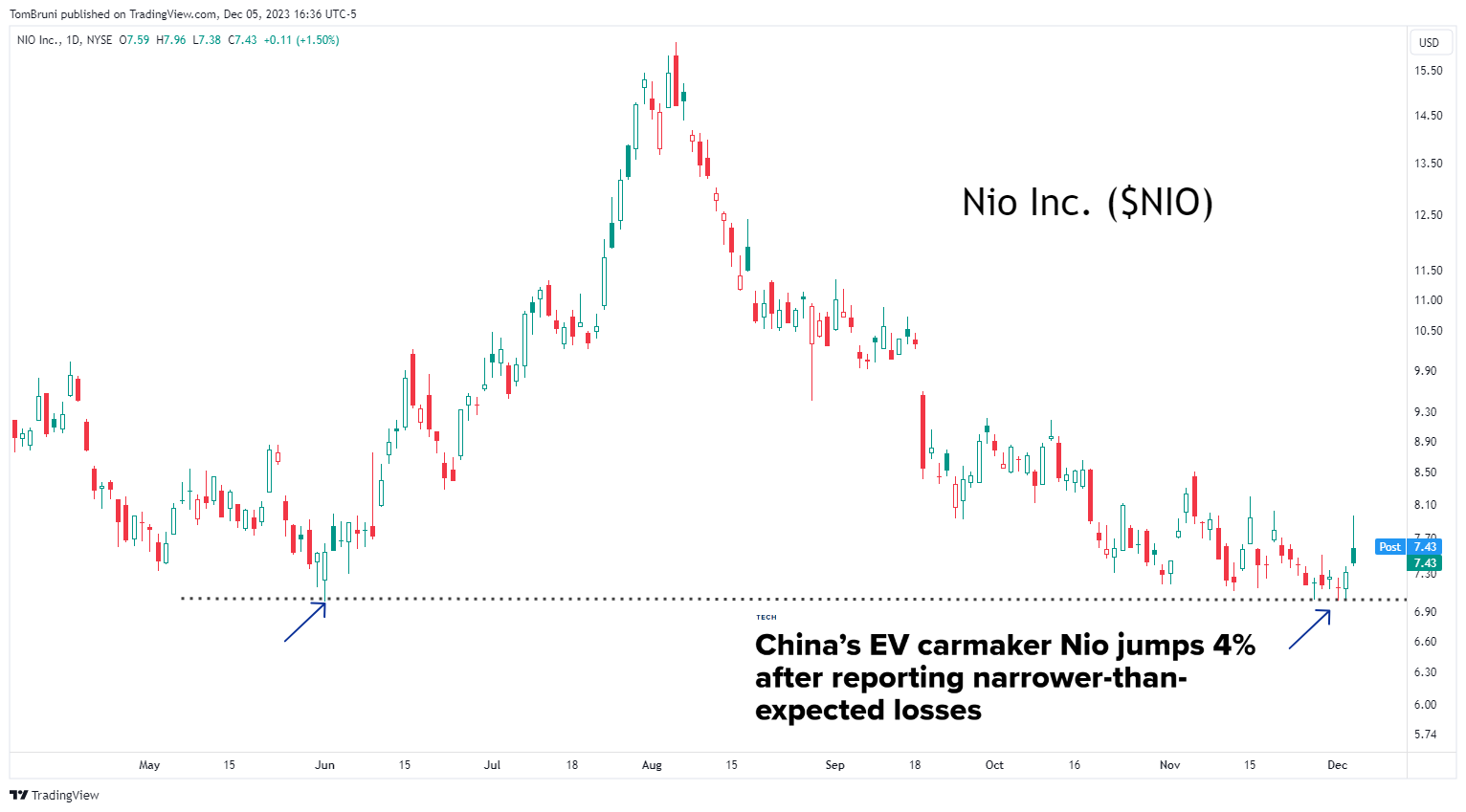

Despite the significant work the company still has to do in its business, traders pointed out that its stock has been putting in work over the last month. Although it’s still underperforming the broader market’s strong rally, it has stopped going down. That’s a start. 🙃

The chart below shows prices stabilizing at their June lows and attempting to turn higher. Although it may seem like a slight shift in momentum, given the recent strength in beaten-down stocks and the outstanding short interest in $NIO shares, some traders suggest today was day one of its short-term turnaround. Time will tell if they’re right. 🤷