One of the critical data points investors are watching into next year is consumer spending. So, what better place to check in on that than Costco? Let’s dive into their first-quarter results. 👇

The membership-based warehouse club operator reported adjusted earnings per share of $3.58 on $57.80 billion in revenues. Earnings topped expectations by $0.17, while revenues aligned with estimates. Higher gross margins helped drive the beat, rising 43 bps YoY to 11.04%. 📊

Here’s how its 3.8% comparable sales, which matched estimates, broke down:

- U.S. +2.0%

- Canada +6.40%

- Other international +11.2%

- E-Commerce +6.3%

Membership revenue was up 8% YoY as more consumers flocked to its private-label brand Kirkland Signature and shopped for consumables and necessities in its stores. Like other retailers, its discretionary categories remain under pressure, but the retailer remains an attractive place to shop as consumers search for bargains. 🛒

Executives remain optimistic heading into 2024, saying the store’s value proposition will continue to attract and retain customers. The company is also rewarding its shareholder base by announcing a special cash dividend of $15 per common share, even as shares sit near all-time highs. 🤑

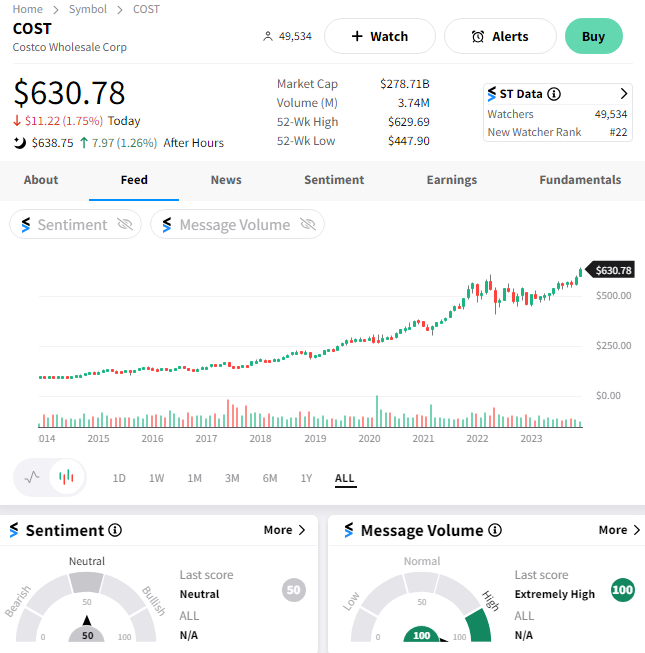

$COST shares are up marginally after the bell as investors digest the news. 🔺