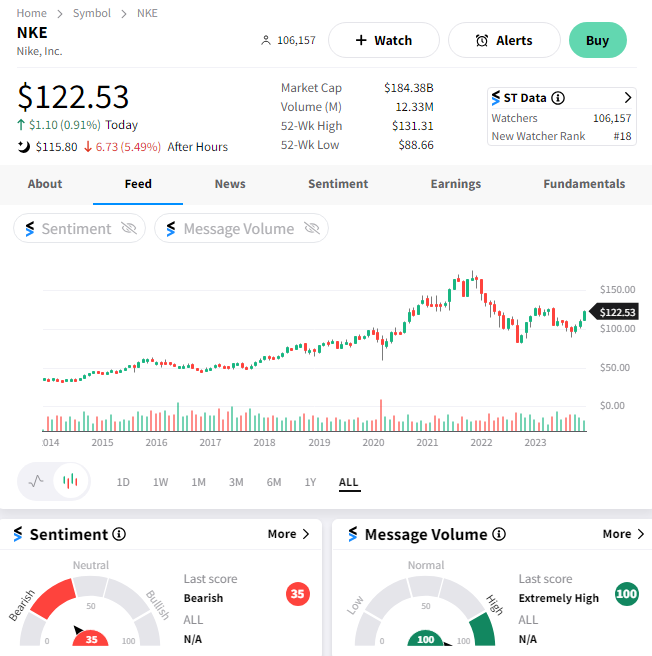

Companies across the spectrum continue to warn about tepid consumer demand, especially regarding discretionary goods purchases. And that trend remains prevalent in the footwear and apparel space, where Nike lives. 👟

Today, the industry giant is in the news after its sales fell short of expectations for the second straight quarter. Revenue of $13.39 billion missed the $13.43 billion anticipated, while earnings per share of $1.03 topped the expected $0.85.

It was reported earlier that the company was quietly laying off employees and preparing to announce a broader restructuring program. Well, that came today as it unveiled plans to cut $2 billion in costs over the next three years as it copes with a “softer” revenue environment. Next quarter will see roughly $400 to 450 million in pre-tax restructuring charges, primarily related to employee severance costs. ✂️

In addition to employee cuts, it’s looking to simplify its product assortment, increase its business’ use of technology/automation, and leverage its scale to drive greater efficiency in its operations. It says those cost savings will be reinvested into future growth initiatives and product innovation, supporting long-term profitability.

On the positive side, its efforts to liquidate excess product helped drive inventories down 14% YoY. Additionally, lower ocean freight costs and pricing actions offset the unfavorable foreign exchange rates and higher product input costs it faced. Gross margins increased by 170 bps YoY to 44.6%, barely eeking out estimates. 📦

As for its weak revenues, its wholesale channel sales were down 2% YoY, while Nike Direct and Nike brand digital sales rose 6% and 4%, respectively. Overall, it remains clear that the wholesale channel remains challenged, given the steep competition and promotional activity happening at retailers. 🛒

Executives looked to lower expectations into next year and also remind investors of its dividends (up 9% YoY) and share repurchase programs, which should partially support the stock price as it turns around the core business. Whether or not that will be enough to keep investors interested in 2024 remains to be seen.

$NKE shares fell about 5% as investors digested the news. 🔻

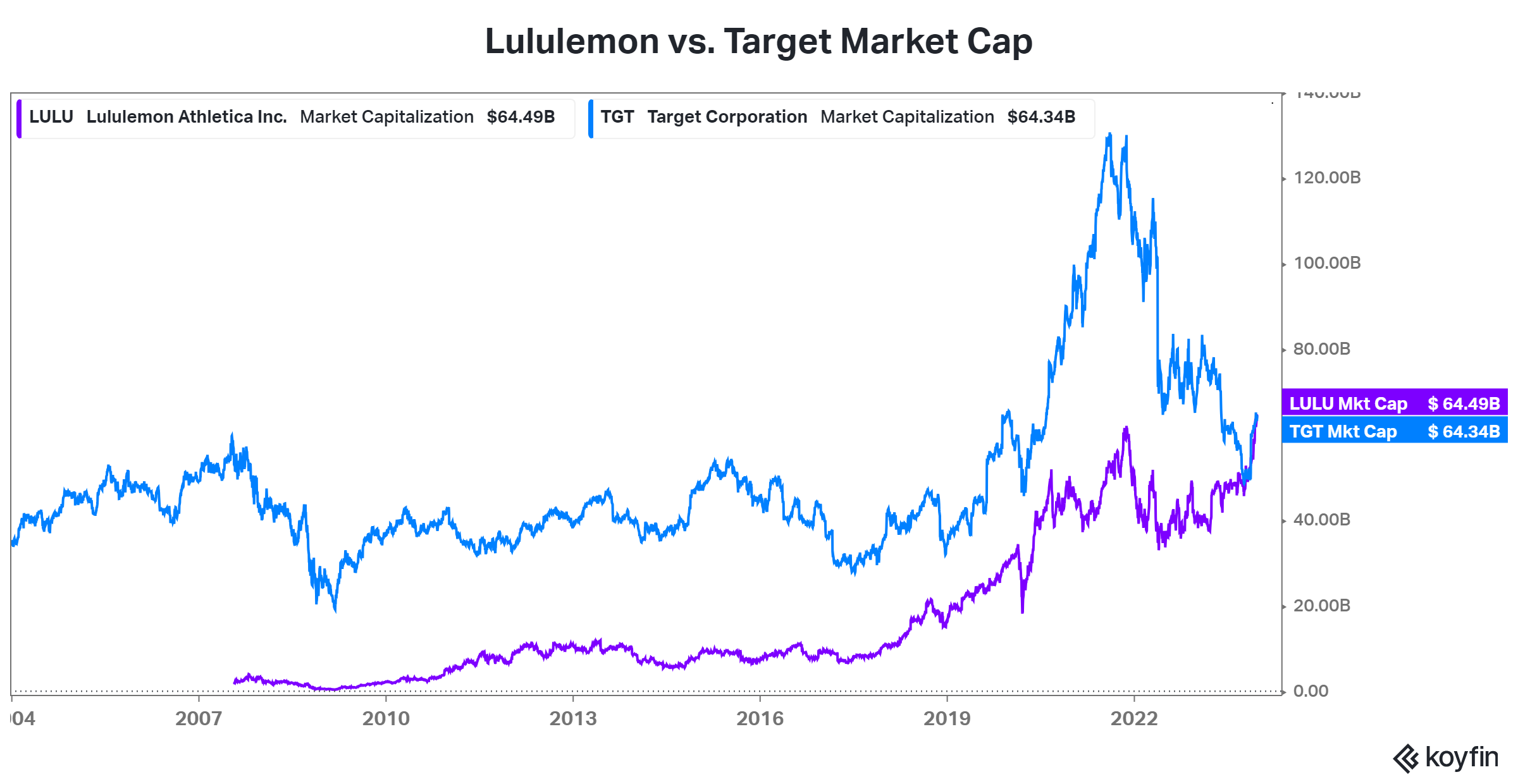

While we’re on the topic of apparel retailers, we wanted to share a crazy stat that CNBC’s Michael Santoli originally shared. Today, the market capitalization of Lululemon surpassed big-box retailer Target for the first time in history. While most analysts don’t expect this relationship to stay flipped long-term, it shows the power of luxury branding even in a highly competitive space. 🤯