The Fed’s hawkish tone toward interest rates and inflation kept a lid on the market. However, today’s consumer price index (CPI) data renewed bulls’ hope that we could avoid a “higher for longer” situation after all.

October’s headline consumer price index (CPI) was unchanged MoM and rose 3.2% YoY, below expectations for a 0.1% and 3.3% increase. That was also down from September’s 0.4% MoM rise. 🔻

Excluding food and energy prices, core consumer prices rose 0.2% MoM and 4.0% YoY. That was below the 0.3% and 4.1% increases expected by Wall Street. A key index component, shelter prices, rose just half its 0.6% pace in September, bringing its YoY increase to 6.7%. 🏘️

Wall Street economists have been saying since last year that shelter prices would eventually come down due to the long lag in how it’s factored into the CPI data. With October’s reading, market participants are hopeful that this key metric has finally turned a corner.

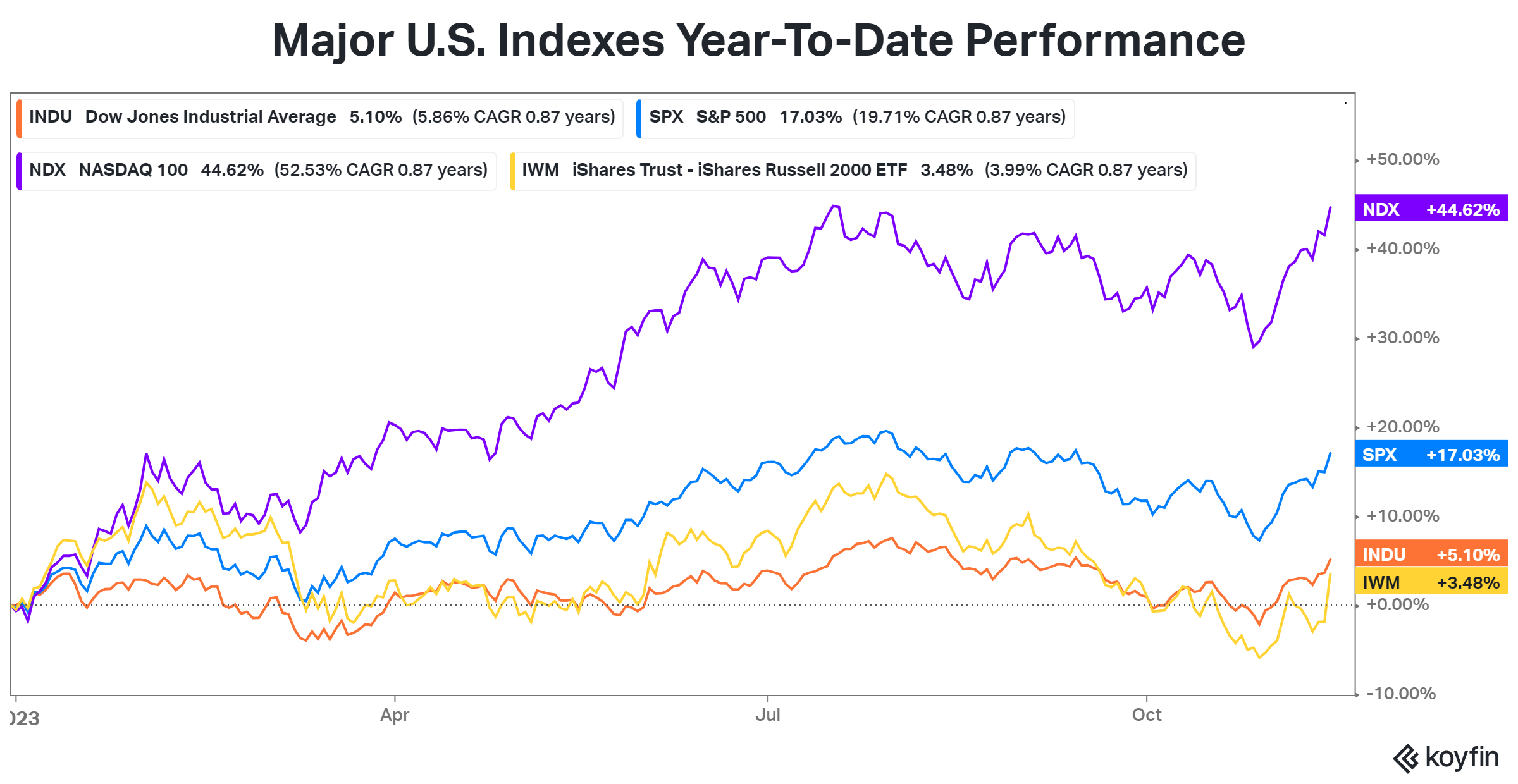

While this one reading is unlikely to change the Fed’s hawkish tone, it did cause the market to increase its expectations of a rate cut in late 2024. As we’ve seen in previous periods, when market positioning is skewed to the downside, even marginal improvements in the data are enough to spark sharp market moves. ⚡

And a sharp market move we got…with all the major U.S. indexes back into positive territory for 2023. Leading the charge remains the tech-heavy Nasdaq 100, up a whopping 45%. Meanwhile, rate-sensitive sectors like real estate, solar, and technology all soared today. 📈

Tomorrow’s producer price index (PPI) is expected to show a continued disinflationary trend, given it typically leads to consumer prices. Investors are also focused on retail earnings this week as they try to gauge how the economy will perform this holiday season. 🛒

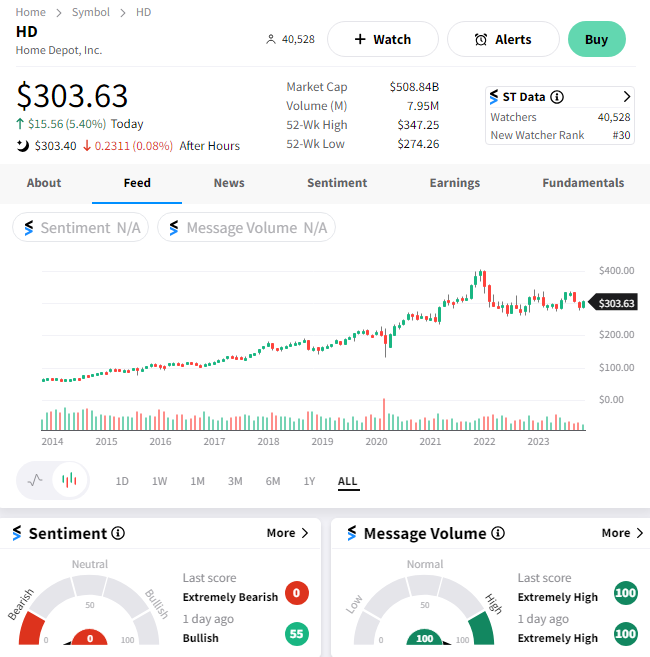

Home Depot kicked off results today, with its $3.81 earnings per share of $37.71 billion in revenues topping expectations.

Comparable sales showed a decline of 3.1% YoY, which was better than the 3.6% decline analysts anticipated. However, it marked a fourth straight quarter of declining comparable sales. Customer transaction volumes also remain challenged, falling over 2% YoY to 399.8 million. And the average ticket size remained flat at $89.36. 📊

Executives have had a cautious view for most of 2023, and that continued, with them narrowing their full-year outlook. They now anticipate sales will fall 3%-4% YoY and earnings to slip 9%-11%. As for inflation, CFO Richard McPhail said, “I think the most important observation we’ve made is that the worst of the inflationary environment is behind us.” 👀

It remains an interesting time for the home-focused retailer, with its core customer base remaining employed with healthy balance sheets. However, the lack of housing market activity due to low affordability and high-interest rates is weighing on demand. Additionally, consumers continue to favor experiences over goods when it comes to their discretionary spending.

Given most of this news was expected by investors and $HD shares are down about 25% from their 2021 highs, the stock experienced a 5% relief rally today. 👍