While the leading indicators of employment continue to point to a slowdown, coincident indicators like U.S. nonfarm payrolls and ADP employment data continue to surprise to the upside. For stock market bulls, that may be bad news as it takes hopes of a first-quarter rate cut off the table. 😞

As we’ve discussed, much of the market’s recent rally has come on the back of hopes that the Federal Reserve will cut rates as much as six times in 2024. Disinflation continues across most major metrics, but a tight labor market has kept consumers spending and the economy humming along. As a result, Jerome Powell and the Fed have been hesitant to loosen financial conditions too quickly.

Today’s nonfarm payroll data showed that employers added 216,000 jobs for December, up from November’s 173,000 and better than the 170,000 economists anticipated. The unemployment rate also held steady at 3.7%. 🧑💼

While a monthly average of 225,000 jobs created in 2023 is down from 399,000 per month in 2022, the low unemployment rate and strong job creation describe a labor market that just won’t quit. With that said, the labor force continues to reconstitute itself. Industries like technology that overhired during the pandemic are shedding jobs and those that underhired (or overfired), like travel/leisure, are still hiring. 📊

The ratio of available jobs to available workers remains at 1.4:1, keeping upward pressure on wages. Average hourly earnings topped expectations in December, rising 0.4% MoM and 4.1% YoY. While that number continues to trend lower, its pace of decline is slower than the Fed had anticipated.

As a result of strong hiring and decent wage growth, the Fed is unlikely to risk inflation roaring back by loosening financial conditions too quickly. Jerome Powell and the other FOMC members have been quite clear on that, so the market is having to adjust its rate cut expectations a little.

That’s why the stock market is having trouble so far this year. A strong labor market means financial conditions remain tight for the near future, which means pressure on stock market earnings and the multiple investors are willing to pay for those earnings. It also puts a damper on other long-dated risk assets like crypto. 🧯

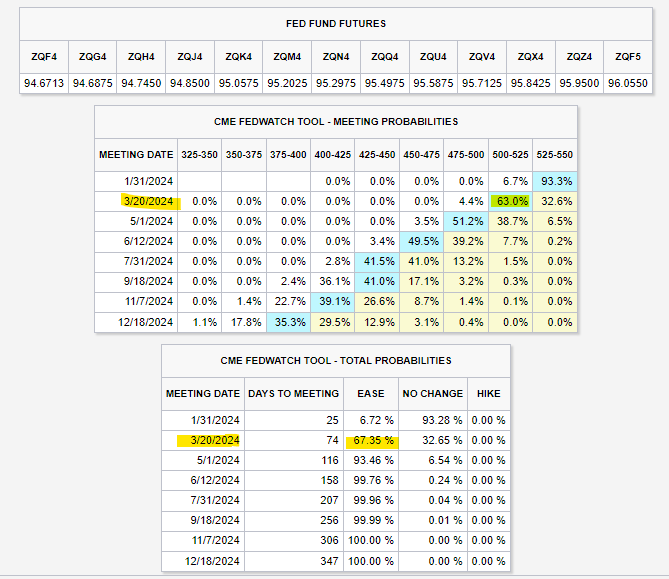

By this time next month, we’ll have another set of inflation and employment data, and the market will likely come to a definitive conclusion on its rate cut expectations. However, for now, the bond market seems to be holding out hope that a March rate cut is still possible…with Fed Fund Futures pricing in a 63% chance of a 25 bp cut. ✂️

Given the recent data, that feels a bit too optimistic, but we’ll have to wait and see what the coming days and weeks bring. If they’re wrong, the stock market may be due for some more turbulence as it adjusts to reality.

We’ll keep you updated, but if you want to keep track of the market’s expectations on your own, you can do so with the CME’s FedWatch tool. 🧭