Tomorrow, the Federal Reserve will make its last interest rate decision for 2023 and update its economic projections. With the market increasing its probability of rate cuts throughout the last few months, it will be a closely watched and discussed event. 👀

We’ll get producer prices tomorrow morning, but today’s focus was on the consumer price index.

Headline CPI rose 0.1% MoM and 3.1% YoY, essentially in line with expectations. Additionally, the core index, which excludes food and energy prices, rose 0.3% MoM and 4% YoY. Those were also in line with estimates. 🔺

While continued disinflation is good news, the rate of change continues to slow. Shelter prices, which account for a third of the CPI weighting, rose 0.4% MoM and 6.5% YoY. That said, analysts still say the lagging impact from its calculation is the primary driver for it staying elevated. 🏘️

Overall, though, services inflation remains a sticky component and highlights the work the Fed still needs to do to achieve its 2% inflation target. Analysts say today’s report should temper the market’s expectations for rate cuts a bit, which it did.

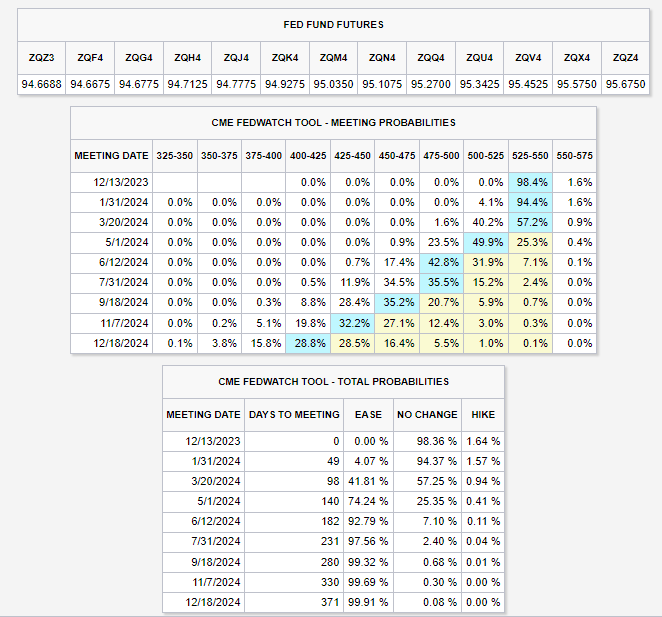

However, looking into next year, the Fed Fund Futures market still shows the market expecting a rate cut as early as May of 2024, with several more to follow. That could be too aggressive and cause the stock and bond market to give back some of its recent gains. ◀️

As for the stock market, the bullish sentiment is alive and well. Not only did the S&P 500, Nasdaq 100, and Dow Jones Industrial Average hit new 2023 highs today. But the S&P 500 Volatility Index (VIX), commonly called the market’s fear gauge, hit new lows. 🐂

It’s unclear what the Fed will do and say tomorrow. But what is clear is that the bulls are betting on a supportive stance, given that the last two months have seen prices rally across the board. 🤷