It was another closely watched day of economic data, with investors focused on employment and consumer sentiment. 👀

Unlike the JOLTs data and ADP employment report that signaled a continued slowdown in the labor market, today’s nonfarm payrolls bucked the trend again. The economy added 199,000 jobs in November, beating estimates of 190,000 and October’s 150,000 figure.

The unemployment rate fell to 3.7% as the labor force participation rate ticked higher. Average hourly earnings rose 0.4% MoM and 4% YoY, hitting levels last seen 2.5 years ago as wage pressures continued to weaken. 🔺

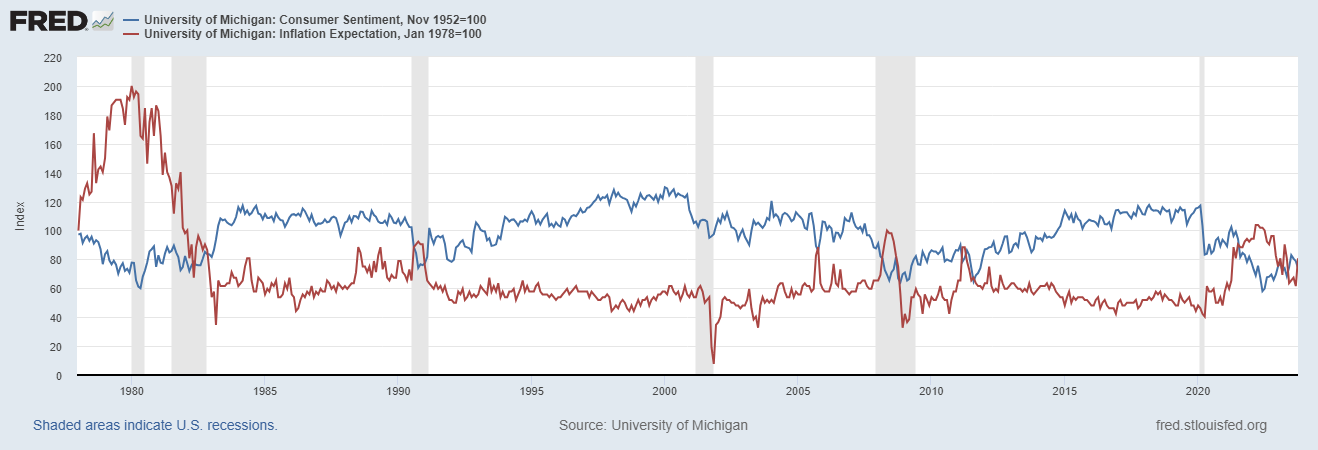

In addition to the labor market ticking up, the University of Michigan consumer sentiment survey jumped 13% in December. That rise erased all declines from the previous four months, primarily due to reduced inflation expectations. 👍

And what’s making consumers feel more hopeful about inflation in the future? Lower gas prices.

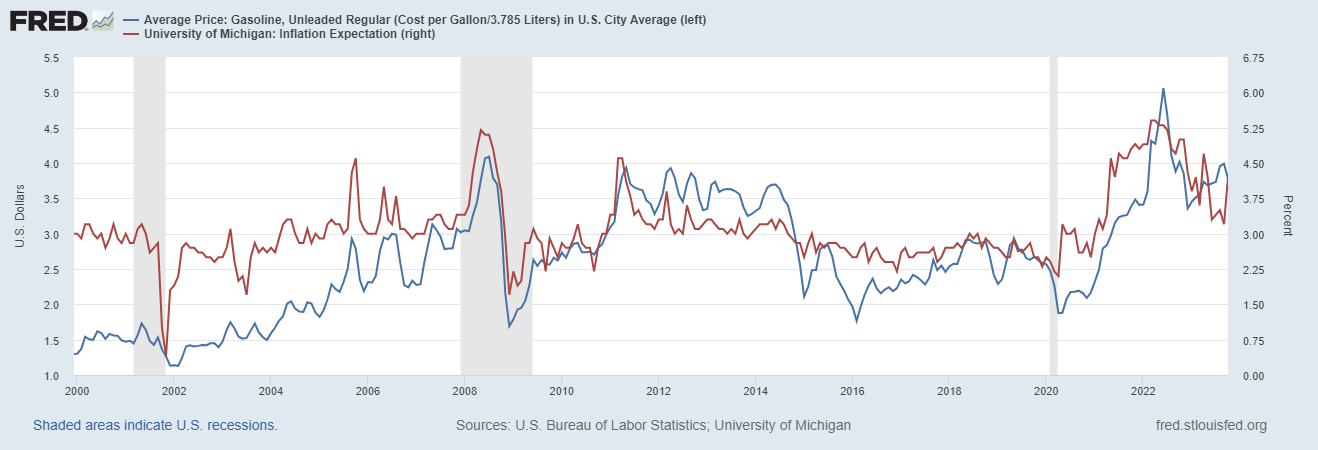

Regarding consumers’ expectations about inflation, the chart below shows it tends to move in line with gas prices. That’s because gas prices are the thing we all see day in and day out as we go about our day. Additionally, when gas prices go up, it tends to result in higher prices for everything else that needs to be produced, shipped, etc. ⛽

As the chart shows, both average U.S. gas prices and consumer inflation expectations have been trending lower since peaking in 2022.

And how does that impact overall consumer sentiment? They move inversely. After all, if you believed the prices of everything around you were going to become more expensive, you’d be pretty pessimistic as well. 😨

Now that we see the impact of gas prices on inflation expectations and subsequently consumer sentiment, how can we track it in real-time? Well, it’s imperfect, but a good gauge would be looking at gasoline futures. Prices in the futures market will take time to work through to the prices we see at the pump, but their trend can at least give us an idea of where inflation and sentiment are headed.

Currently, technical analysts suggest that gasoline futures are at a potential inflection point. They’re now around the $2.10-$2.20 level, where prices have transitioned over the last eight years. History says this is a relevant level in the market; we’ll have to see if it is again this time. 🤷

Right now, the market is pretty pessimistic about the demand for gasoline due to global economic concerns. But we’ll see if that changes and returns gasoline futures to an upward trend. Its next directional move will have significant implications for inflation and consumer sentiment in 2024. 🗓️