The bond market continued to rally during a busy day of economic data, with October’s JOLTs data standing out to investors. Let’s recap it all. 👇

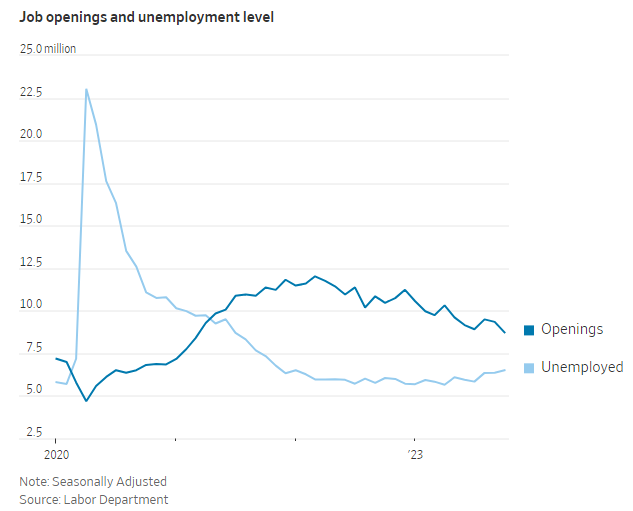

First off, October’s Job Openings and Labor Turnover Survey (JOLTS) signaled a continued slowdown in the labor market. Job openings fell to their lowest level since March 2021, at 8.7 million, while the ratio of openings to available workers ticked down to 1.3:1. That’s well below its peak of 2.0:1 set earlier in the year. 📉

For now, quits remain little changed as workers’ confidence in their ability to get a better job and pay elsewhere erodes. However, layoffs are also stagnant, as employers are hesitant to reduce staffing and risk being unable to replace them in the future if needed.

Investors will be looking ahead to tomorrow’s ADP Employment Report and Friday’s Nonfarm Payrolls Report to see if they confirm the softening seen in several leading job market measures. 📝

This chart from The Wall Street Journal’s labor market recap sums things up nicely, showing the convergence of job openings and unemployed workers. 🤏

Meanwhile, the RCM/TIPP Economic Optimism Index fell again in December, marking its 28th consecutive month in negative territory. A broad-based decline in all measures, including the six-month economic outlook, personal financial outlook, and confidence in federal economic policies, drove the drop. 👎

As for business activity, November’s ISM Services PMI showed continued expansion in the services sector for the eleventh straight month. However, the survey noted that respondents remain concerned about inflation, interest rates, and geopolitical events. Also, rising labor costs and constraints remained despite a cooling market. The S&P Global Services PMI confirmed those trends.

Internationally, ratings agency Moody’s cut China’s credit rating outlook to negative, citing its rising debt levels. It noted that although China has stepped up its fiscal stimulus to aid growth, consumer spending and the property market remain challenged. ⚠️

And lastly, the Reserve Bank of Australia kept interest rates unchanged at its final meeting of the year. Cooling inflation and a softening labor market suggest interest rates may be restrictive enough to slow the economy. However, like other developed country central banks, it is keeping further hikes on the table if needed. ⏯️