Restaurants have outperformed the rest of the retail space for the last couple of years. Driving that strength was consumers getting out of their houses, shifting their discretionary spending from goods to experiences as they “revenge spent” their way back into the world. 💸

But now, as the job market weakens and student loan repayments begin, some analysts expect consumer spending to be impacted. That could hurt discretionary sectors across the board, especially if inflation remains elevated.

What does that mean for the restaurant industry? After significant outperformance from the group, one Wall Street analyst suggests it could be headed for rougher times ahead. ⚠️

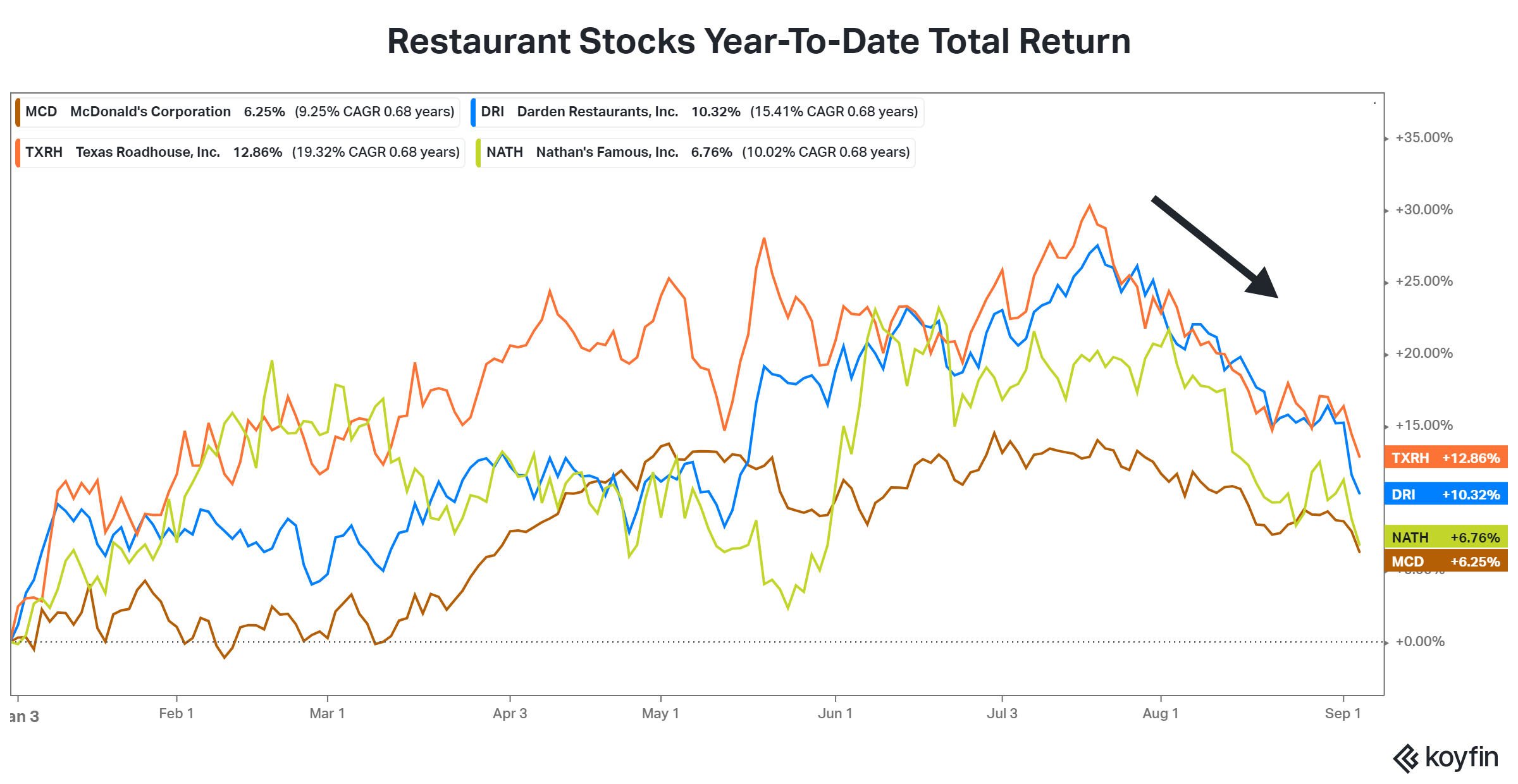

Technician Carter Worth was on CNBC yesterday discussing the restaurant industry breaking down from a technical perspective. He pointed out that many prominent restaurant names like McDonald’s, Darden Restaurants, Texas Roadhouse, and others had peaked during the summer (July) and are now breaking their uptrend. 😰

He believes that the group’s relative underperformance is just beginning and that more weakness is likely ahead.

While Carter didn’t discuss the fundamentals potentially causing this move, it would make sense that the market is pricing in a slowdown at these companies as consumers’ discretionary income gets rebalanced. Wage growth is slowing, student loan bills are returning, and record-high prices for shelter and automobiles are placing significant pressure on people’s wallets. And when it’s time to cut back, unnecessary restaurant spending could be among the first budget items to go. ❌

We’ll have to wait and see if that’s the case. But for now, restaurant stocks are trading cautiously.