It’s been about a year since the yield curve popped onto investors’ radars, with us discussing it in October and November of 2022. ◀️

As discussed in our posts, a yield curve inversion is not a perfect indicator of a recession, but it has a pretty good track record. That’s because when short-term rates are above long-term rates, investors believe growth (i.e., inflation) will be higher in the short term than the longer term. As such, they demand a higher yield to hold short-term bonds than long-term ones.

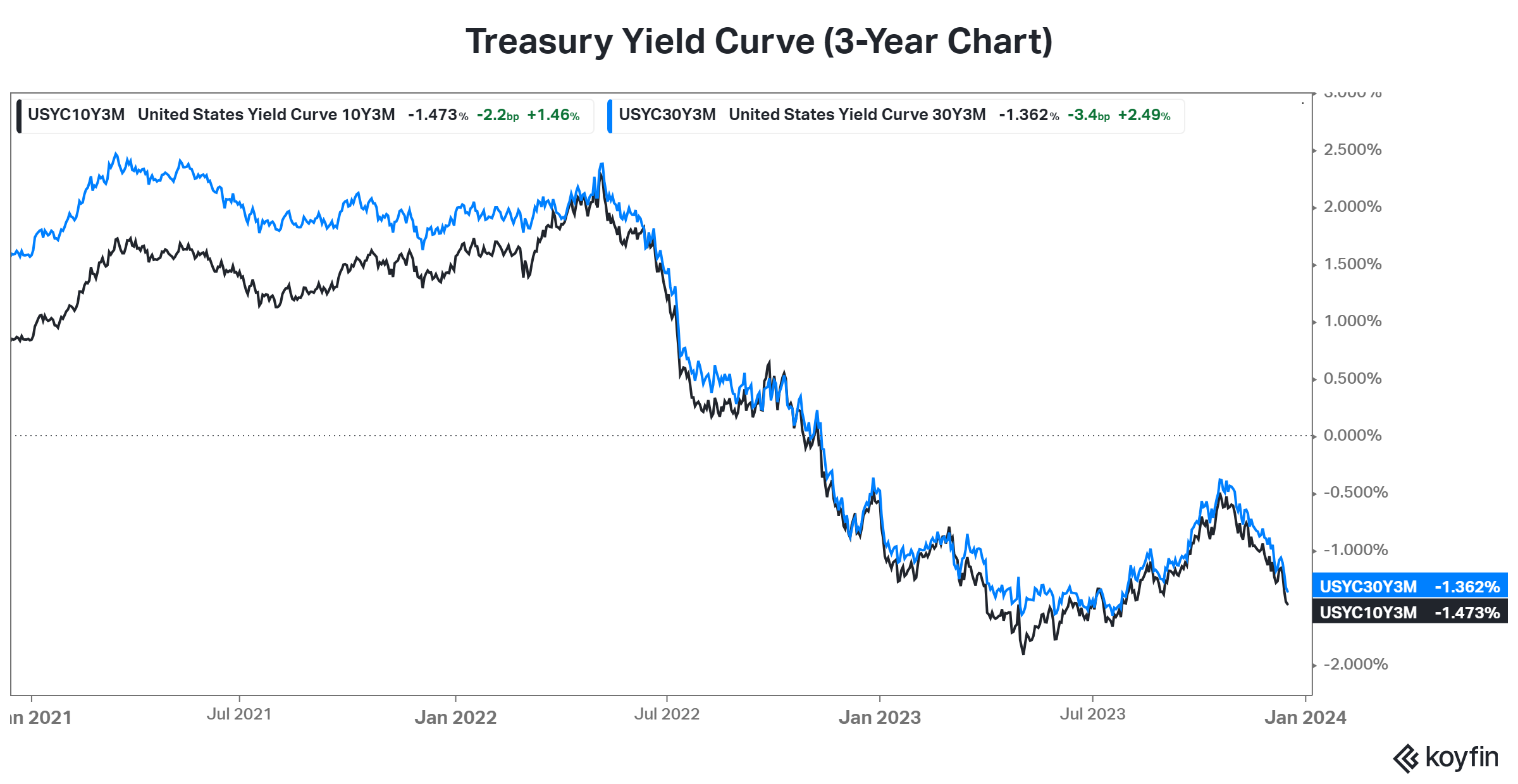

So why is this back on our radar today? Despite the bond market’s epic rebound since late October, long-term yields have fallen faster than short-term ones. As a result, the yield curve’s inversion has deepened and is approaching the lows it set earlier in the year. 📉

So, while the stock market, crypto, and other risk assets continue to party on the prospect of lower nominal interest rates, some analysts say the yield curve suggests we’re not out of the woods yet. However, they admit there doesn’t seem to be a clear catalyst to push the economy into recession and cause the Fed to cut short-term interest rates aggressively. 🤔

In the past, major economic shocks like the financial crisis, a global pandemic, or other overlooked risks were why the economy tipped into recession. Inverted yield curves leave the economy in a vulnerable position but are not in and of themselves the reason for a downturn to begin. In other words, the conditions are set for an economic downturn, but those conditions need a spark to get things going. 🔥

And so far, analysts are unclear what that spark (or risk) will be. We’ll have to wait and see what 2024 brings us. As we saw with 2023 (and every other year to be honest), the market and economy have a habit of surprising us all… 🤷