The U.S. Labor Department shared November’s job numbers today. The theme of the report was an increase in quit rates, accompanied by a decrease in available job openings.

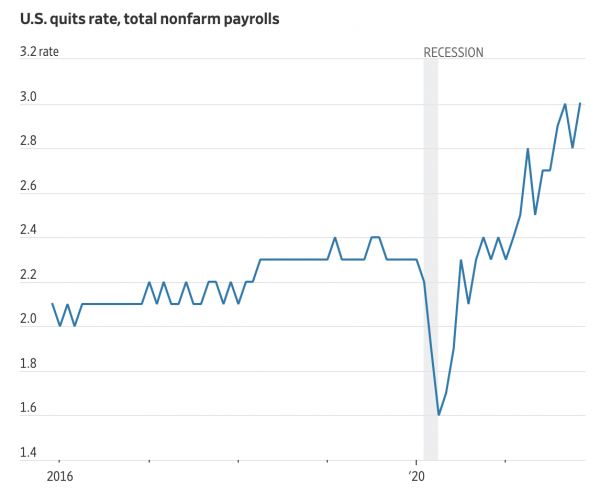

At the end of November, there were 10.6 million job openings, down from 11 million job openings in late-October. At the end of December, there were an estimated 12 million job openings. November’s quit rate hiked to 3%, an 8.9% increase from October’s quit rate. The total number of workers who quit their jobs in November surged to a record 4.5 million. Check it out:

Another trend that continued in November was workers’ migration from previous jobs to new employment opportunities offering greater flexibility. Nick Bunker, a leading economist at Indeed, commented “The low-wage sectors directly impacted by the pandemic continued to be the source of much of the elevated quitting.”

Small firms are getting burned by quit rates. 🔥 Additionally, the retail, leisure, hospitality, business and professional services, healthcare, and social assistance sectors are especially burdened with high quit rates.

It’s anticipated that job openings may slow in Q1 2022 due to Omicron’s spread. In particular, leisure and hospitality industries may experience increased quit rates/slowed growth due to the Omicron variant.