It was a busy day on the economic front, so let’s recap what you missed. 👇

First, we’ll start with the Federal Reserve’s interest rate decision. The central bank left rates unchanged after pausing at its September meeting, largely as expected.

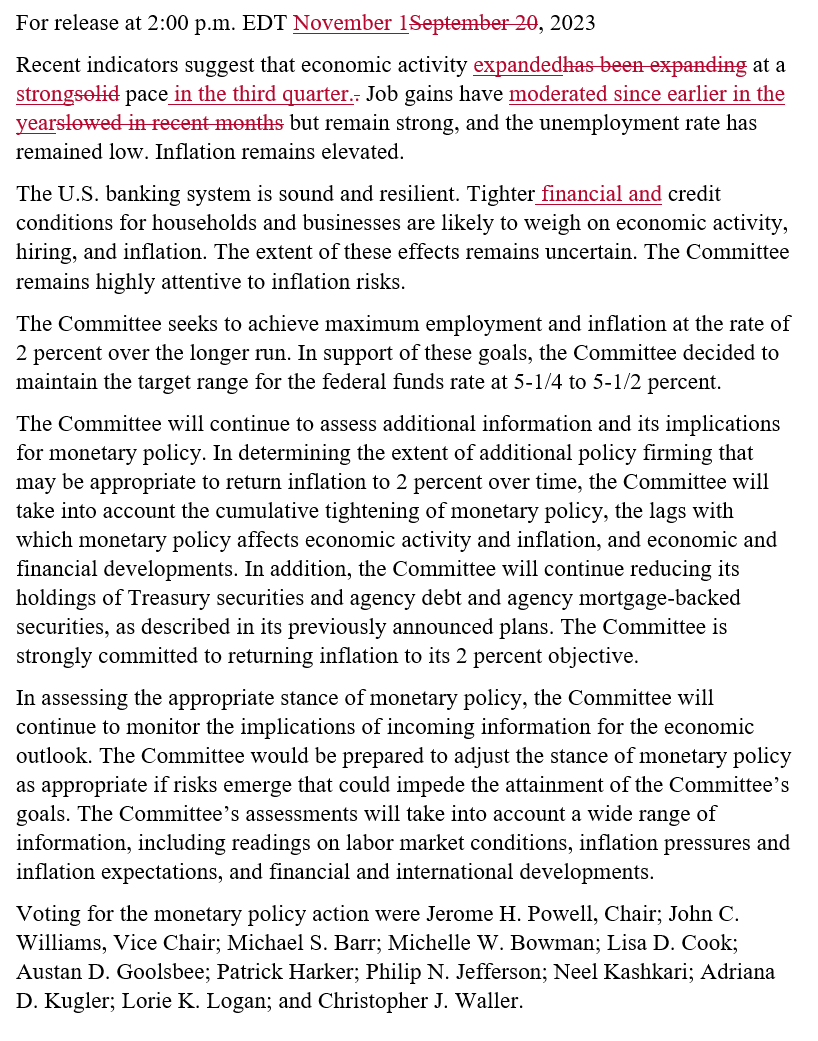

Its red-lined statement showed little change, noting that economic activity remains strong and job gains continue to moderate. Financial and credit conditions are tightening and weighing on economic activity, as it hoped it would. 📝

Following the lackluster statement release, attention turned to Jerome Powell’s press conference. Unfortunately for investors, that didn’t provide much more color either. 📝

Powell acknowledged the recent progress but kept further rate hikes on the table, saying monetary policy might not be restrictive enough for inflation to return to 2%. The supply side of inflation has corrected sharply, but to reach “full price stability,” monetary restraint will have to play a significant role.

Although the decision to keep rates steady at this meeting was unanimous, Powell noted that the Fed’s projections could become stale in the three months between forecasts. As a result, he reiterated the committee will make its December decision based on where the data is at the time. They’ll also provide updated projections (AKA the “dot plot”) at that meeting, which will be heavily scrutinized by investors.

His overall tone was similar to other meetings, giving the committee flexibility by not leaning too strongly in one direction or another. There was an undertone, however, that the risks of “doing too much” and “doing too little” are becoming more balanced. Previously, the primary concern was about not doing enough to tame inflation, especially since the Fed was behind the curve in adjusting rates initially. ⚖️

Moving onto the economic data, the October ADP employment report showed that 113,000 jobs were created, below the estimated 130,000. Wages were up 5.7% YoY, marking their smallest increase since October 2021. And almost all of the job gains continue to come from the services industry. 🧑💼

Helping alleviate that wage pressure is a continued slowdown in the ratio of job openings per available worker. The September JOLTs report showed job openings were flat at 9.55 million, leaving the ratio of job openings to unemployed persons unchanged at 1.5. Levels for quits and hires were also little changed, with layoffs decreasing slightly. 📊

The manufacturing sector readings remained mixed in October. The ISM Manufacturing PMI plunged to 46.7, leaving it in contraction territory for the twelfth consecutive month. Meanwhile, the S&P Global U.S. Manufacturing PMI rose to 50, as the measure looks to stabilize in expansion territory. Albeit volatile, the consensus is that these measures are trying to bottom out and should push back into positive territory by mid-next year. 🏭

It’s also worth noting that many are concerned with the U.S. Federal Government’s debt load, given that higher interest rates will raise the cost of debt servicing going forward. Stanley Druckenmiller said in an interview that the government has been spending like ‘drunken sailors’ and needs to cut entitlements immediately. ⚠️

And lastly, the Swiss National Bank’s chairman said that its intervention with Credit Suisse was needed to avoid a financial crisis. Clearly, governments around the world want to protect systematically important institutions to avoid a repeat of past global financial crises. 🏦