If it feels like the market is largely finished obsessing about inflation data, it’s because it essentially is. Unless there’s a significant pick up in the core inflation metrics the Fed is watching closely, the market seems set on rates staying steady at next week’s Federal Reserve meeting.

And August’s consumer price index (CPI) data did little to move the needle. 😴

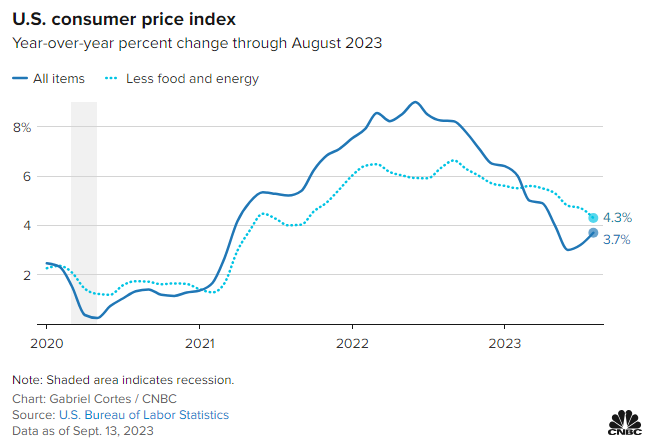

Headline inflation rose for the second month, jumping 0.6% MoM and 3.7% YoY, driven by higher energy prices. Meanwhile, core inflation rose 0.3% MoM and 4.3% YoY, basically as expected.

As a result of the higher headline inflation number, real average hourly earnings fell 0.5% MoM. That should continue to weigh on consumers and the demand side of the inflation equation. Additionally, analysts continue to bet that shelter prices will soon begin to fall and provide another tailwind for core inflation’s decline. 🔻

Other countries have seen an uptick in inflation recently, but U.S. investors aren’t worried about it. The economy continues to chug along, and a weakening labor market should help reduce wages upward-pressure on inflation.

Investors are betting that will continue, and we’ll ride off into the sunset. Unless, of course, some other risk nobody’s talking about yet derails us. But the market has yet to identify that risk. 🕵️♂️

We’ll see if tomorrow’s producer price index (PPI) data changes anything, but expectations are it will not. Either way, it’s worth waking up to hear the European Central Bank’s rate decision and overall outlook, which comes out 15 minutes beforehand. 🤷