Tale of the Tape

Happy Wednesday everyone. We’re halfway through the week. 😇

Nifty and Sensex hit a new all-time high before closing flat. Midcaps (+0.3%) and Smallcaps (+0.8%) fared better. Two stocks advanced for every one loser. ✌

Gainers and losers were equally split. Energy topped the charts up +1%. Real Estate (-0.8%) and Media (-0.7%) declined the most. 📉

Ace investor Rakesh Jhunjhunwala increased his stake in Fortis Healthcare (+0.3%) by 0.5%. He also picked up a 1.6% stake in Canara Bank (-3%). 💰

Poultry stocks were in high demand. The Government allowed imports of 1.2 million tonnes of genetically modified (GMD) soymeal. Check out their charts below. 📈

Kaveri Seed (-0.2%) will buy back shares at Rs 850 per share. The buyback price is at a premium of 47% over Wednesday’s closing price. 🤑

Adani Ports & SEZ gained ~4%. The Andhra Pradesh government approved the company’s acquisition of a 10.4% stake in Gangavaram Port for Rs 645 cr. ✅

The Government hiked the sugarcane price to Rs 290 per quintal. The revised price will apply from the new sugar season that starts in October. This is a negative for sugar producers like Balrampur Chini, Dhampur Sugar, and others as it increases their cost of production. 😓

Cryptos corrected sharply. Bitcoin tanked 5%. Ethereum fell ~7%. XRP, ADA, and Doge fell between 9%-10%. 👎

Here are the closing prints:

| Nifty | 16,635 | +0.06% |

| Sensex | 55,944 | -0.03% |

| Nifty Bank | 35,586 | -0.35% |

Value is King

Value funds are back and beating their more popular peers. FYI, Value funds invest in stocks that are relatively cheap but offer strong business fundamentals with reasonable upside. In the last year, most Value funds gave +50% returns. Growth schemes like Largecap and Flexicap have delivered 44% and 46% returns during the same period. 💯

Value investing as a strategy is very popular. It’s been globally popularized by Warren Buffet. But, value investors have struggled over the last few years. Between 2017 to early 2020, growth stocks fared well as the economy slowed and these companies (IT and FMCG) continued their growth. As a result, the Value investing strategy was less popular and the performance deteriorated. 📉

But as the economy shows signs of recovery, this underperformance is reversing. Companies with market leadership and robust financials were available at throw-away prices. Who doesn’t like a good deal? 😎

Experts believe value funds may continue their hot streak as the economy recovers and earnings start catching up. Our only question is – when will ITC start going up? 😜

Breakout Trades

Poultry stocks were all over the place. The Government allowed the import of 1.2 million tons of genetically modified (GMD) soymeal. Soybean meal or extraction is used in animal feed by the poultry companies. Domestic feed prices had 3x in the last few months due to high demand. 🤯

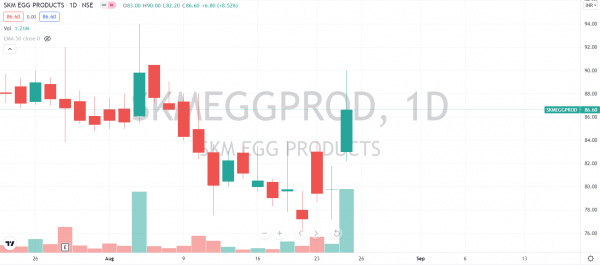

The latest move is a positive as it will help reduce costs plus aid margins. Venky’s India (+12%), SKM Egg (+9%) saw big gains. Here are their charts: 📈

PS. Stock Room Sunday host Saket Malhotra is a fan of Venky’s. Check out his view on the stock. 👍

Delhivering The Goods

Delhivery goes shopping. The logistics service provider acquired its competitor Spoton Logistics. The company did not provide transaction details but reports suggest that it is an all-cash deal worth $300 million. 💸

The acquisition will help boost Delhivery’s B2B vertical. Spoton has a presence across 350 locations covering +22,000 pin codes. It services customers in various industries like auto, pharma, retail, e-commerce, and more. 🚚

Sahil Barua, chief executive officer at Delhivery said:

This development is consistent with our objective of being growth-oriented and building scale in each of our business lines. Over the last 10 years, Delhivery has established a leading position in B2C logistics, and now by combining our truckload business with Spoton’s, we will be on the path to the same position in B2B express as well.

Founded in 2011, Delhivery handles more than 1.5 million packages a day through its 43,000-strong team across India. The company recently raised $100 million as strategic capital from FedEx Corp, and its investors include leading tech investors like SoftBank, Tiger Global, Carlyle Group, and Steadview Capital. But, it’s not done yet. Reports indicate that Delhivery plans to raise $1 billion via the IPO route. Papers could be filed as soon as October. 🔥

Links That Don’t Suck

👮♂️ Ex-manchester United Player Charged With Crypto Fraud

💔 Rolling Stones Drummer Charlie Watts Dies At Age 80

🐠 Why Koi Fish Are So Expensive

🏏 India Vs England: Kohli And Co Look To Maintain Pressure As Bruised Hosts Aim To Hit Refresh Button

🤑 Kylian Mbappe: Real Madrid Make £137m Transfer Bid For Paris Saint-Germain Forward