Tale of the Tape

Hiya, y’all. Markets hit a new all-time high! 🚀

Nifty and Sensex rallied over +1.5% each on strong macroeconomic data. India’s Q3 GDP growth stood at 8.4%, significantly higher than estimates of 6.5%. Midcaps (+0.9%) and Smallcaps (+0.5%) followed suit. The advance-decline ratio was in favour of the bulls (3:2). 🔥

Most sectors ended in the green. Metals (+3.6%), Banks (+2.4%), Auto (+2.2%) and Oil & Gas (+2.2%) were the top winners. Pharma (-0.9%) and IT (-0.5%) stocks witnessed profit booking. 💰

This smallcap auto component maker could see 14% gains in the next year. Read our top story below to find out more. 📈

Suven Pharma (+12%) was the top NSE 500 gainer after announcing its merger with Cohance Lifesciences. 🤝

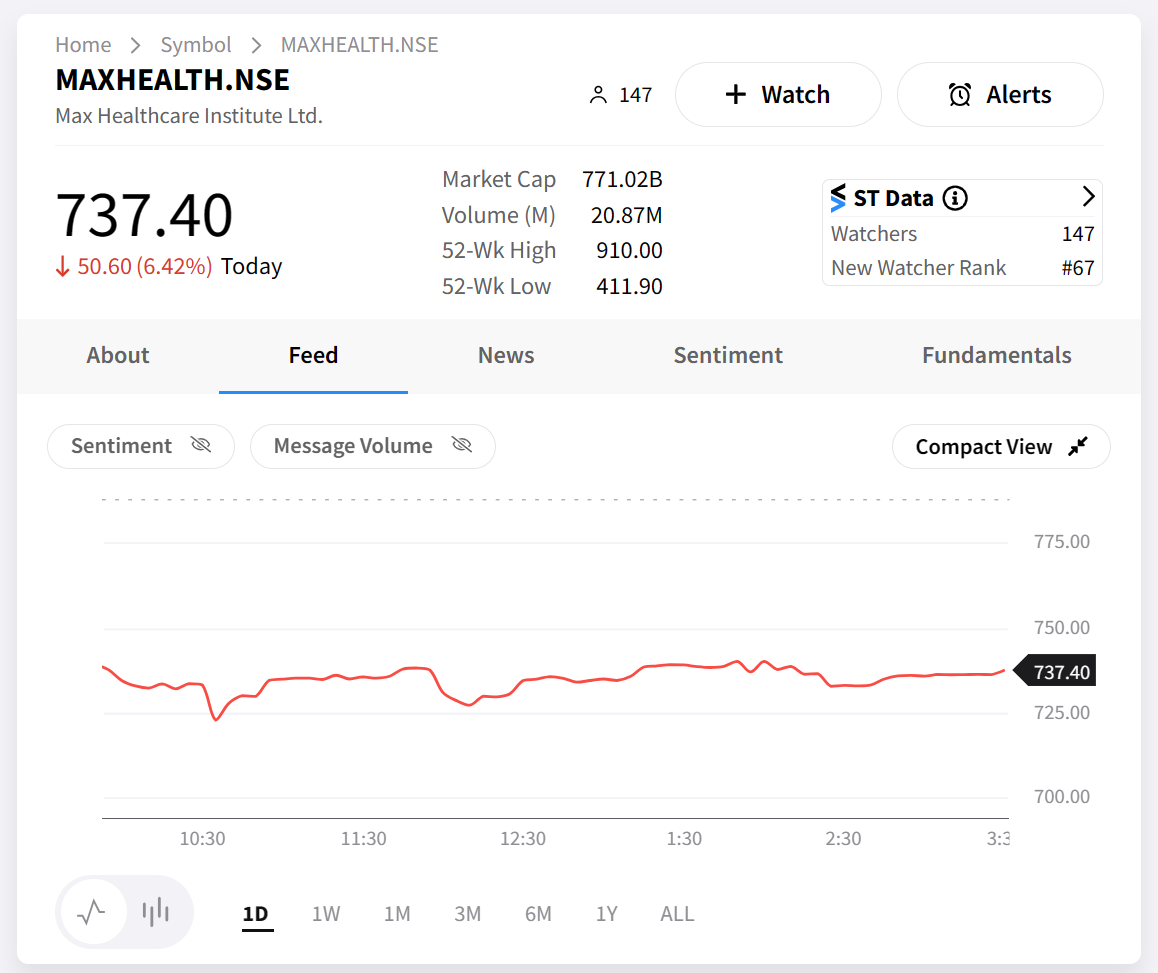

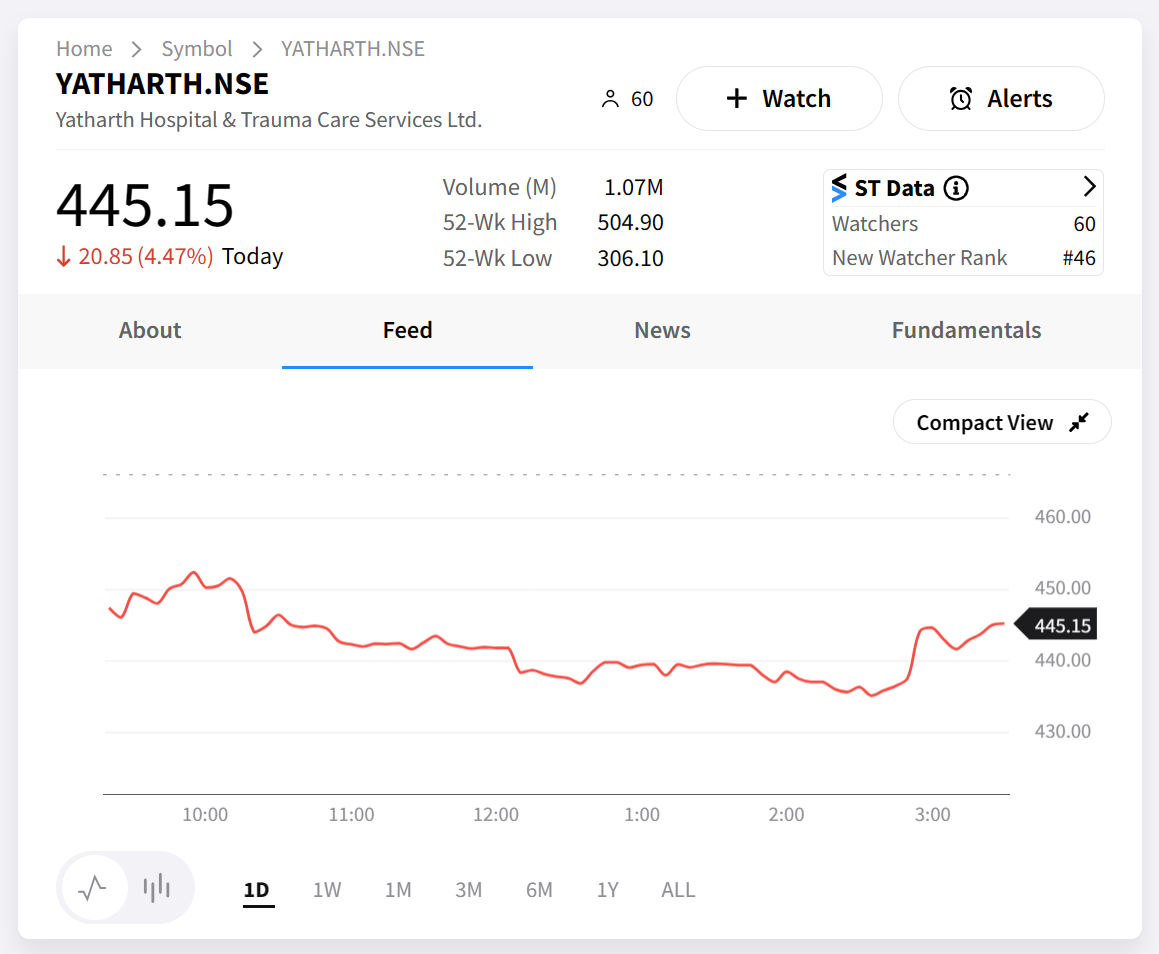

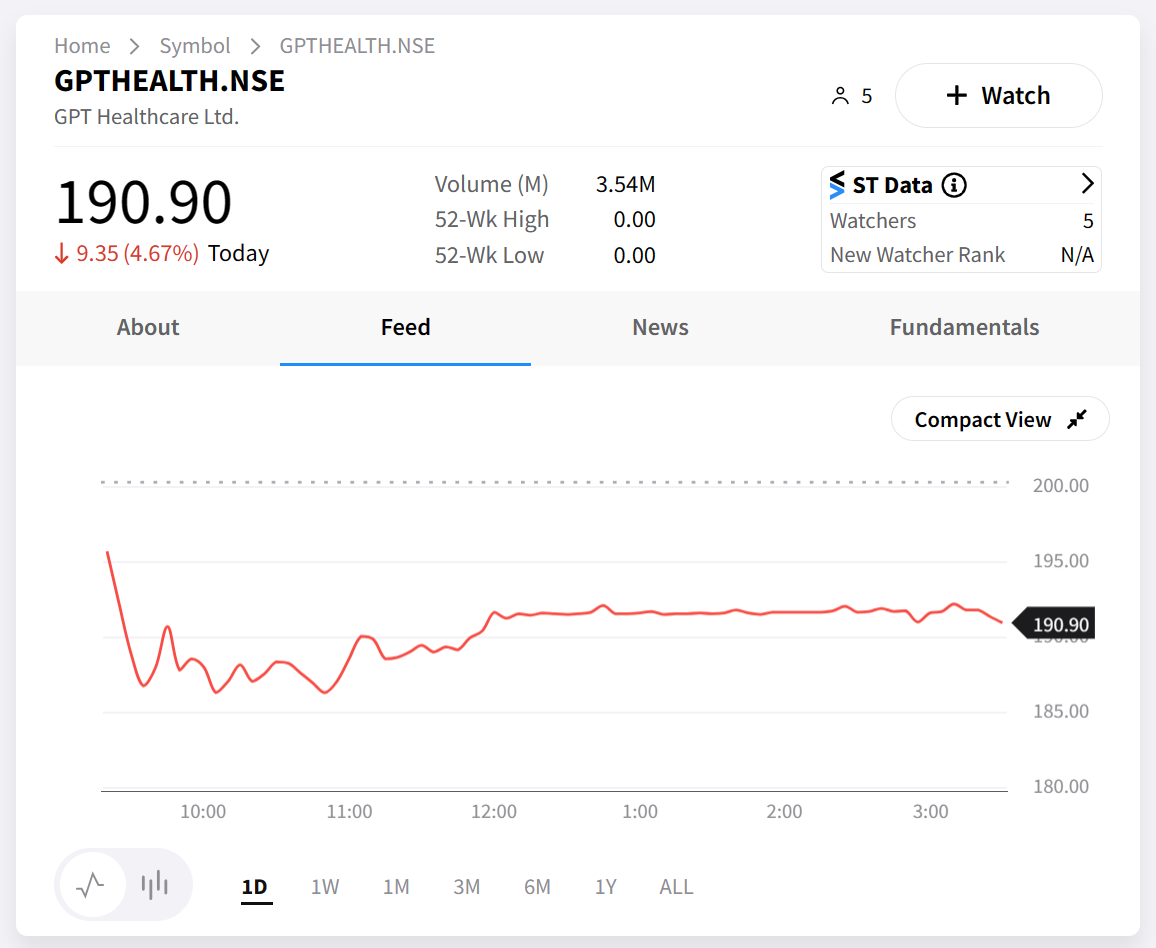

Hospital stocks took a beating for the second day in a row. Max Healthcare (-7%) was the top loser on NSE500. Yathartha Hospital and GPT Healthcare also witnessed deep cuts. Check out their charts below. 🚨

Paytm hit a 5% upper circuit. The company said it snapped ties with its payments bank, while reports said Yes Bank would acquire most of its merchant accounts. 👍

Dr Reddy’s Laboratories (-4%) was the top Nifty loser after reports said it was named in an anti-monopoly lawsuit in the US. 🧑⚖️

Order wins. Larsen & Toubro gained 4% after winning contracts worth Rs 13,368 cr from the Indian Airforce. Waaree Renewable was locked in a 5% upper circuit after bagging a Rs 1,401 cr solar project order. ⚡

Semiconductor reaction. CG Power and Industrial Solutions gained 4% after the GOI approved its project. Tata Investment Corporation hit a 52-week-high after two proposals from its group got the green light. ✅

Here are the closing prints:

| Nifty | 22,338 | +1.6% |

| Sensex | 73,745 | +1.7% |

| Bank Nifty | 47,286 | +2.5% |

Movers And Shakers

Hospital stocks were thrashed for a second day in a row. Max Healthcare (-7%) was the top NSE 500 loser. Meanwhile, Yatharth Hospital (-7%) and newly listed GPT Healthcare (-5%) witnessed deep cuts. 📉

What’s the deal? The Supreme Court slammed the GOI for not coming out with a specific range of prices that private hospitals & clinics can charge for their services. A rule on this was framed 12 years ago but failed to be enforced. 🤦

The apex court has given the GOI a month to come up with a standard rate for procedures. FYI – brokerage Macquarie says this could result in a big profit drop for private healthcare providers. Experts say it’s not just a question of private vs state-owned health services but also whether it’s even possible to standardise rates between small and large-sized private hospitals. 🏥

Price caps have been controversial and a bit of a mixed bag in India. We don’t know how this will end up, but the uncertainty is taking a toll on hospital stocks. Check out their charts below: 🚨

Pullin In The Dough

After listing at an 18% premium in Dec 2023, Happy Forgings hasn’t gone anywhere. Yes, the commercial vehicle industry has been a slow mover. But experts say FY25 could be its year! 🥳

For the unaware: Happy Forgings makes machine components for tractors, trucks and other off-highway vehicles. The company is India’s fourth-biggest forgings player, with a 30% market in CVs and 45% for tractors. FYI – the domestic CV industry is projected to post FLAT volume growth in FY24, which explains the current gloom. But a better outlook may be around the corner. Specifically, there are two positive triggers to watch out for. 👍

The first is the Modi govt being re-elected for a third time and CONTINUING its big infra-capex push. Fleet operators generally hold back big purchases during times of uncertainty. Analysts say orders will pick up after the full Union Budget is presented in July. A patchy monsoon + lower rabi sowing impacted growth in the current year. But, FY25 should be a lot better with normal rains, an extended festive season, and a lower base. 📊

Finally, Happy Forgings has been trying to diversify. Its foray into the ‘industrials’ or non-tractor segment safeguarded earnings growth. Fun fact: despite weak CV & tractor demand, Happy Forgings is set to post ~14% YoY topline growth in FY24. 💸

Big Picture: Things look a little tough now, but as they say the night is darkest before dawn. A rural bounce-back, healthy monsoon and continued infra push by the GOI could be enough to set it on a new re-rating cycle. FYI – Motilal Oswal has a new target price of Rs 1,125 p/sh; +14% from current levels! 😍

In The Pink Of Health

Suven Pharma jumped 7% after announcing its merger with Cohance Lifesciences. FYI – this is BIG news for Suven. 💯

Cohance is a contract manufacturer and the deal will help Suven capitalize on global players looking to diversify away from China. Cohance’s API biz will also help scale up Suven’s formulation vertical. Cohance’s contract manufacturing biz has grown at a CAGR of 30% between FY20-FY23, which is INSANE if you consider how volatile the global pharma industry was from 2022-2023. 💊

The share swap ratio also looks decent. Shareholders of Cohance will get 11 shares of Suven Pharma for every 295 shares of Cohance they own. The deal value wasn’t disclosed, but Suven’s management has said the merger will be “double-digit EPS accretive” in the first year after it takes place! Put simply: the deal will be profitable from day 1. 🤑

Overall, a win-win merger. Something super rare these days. 🦄

Stocktwits Spotlight

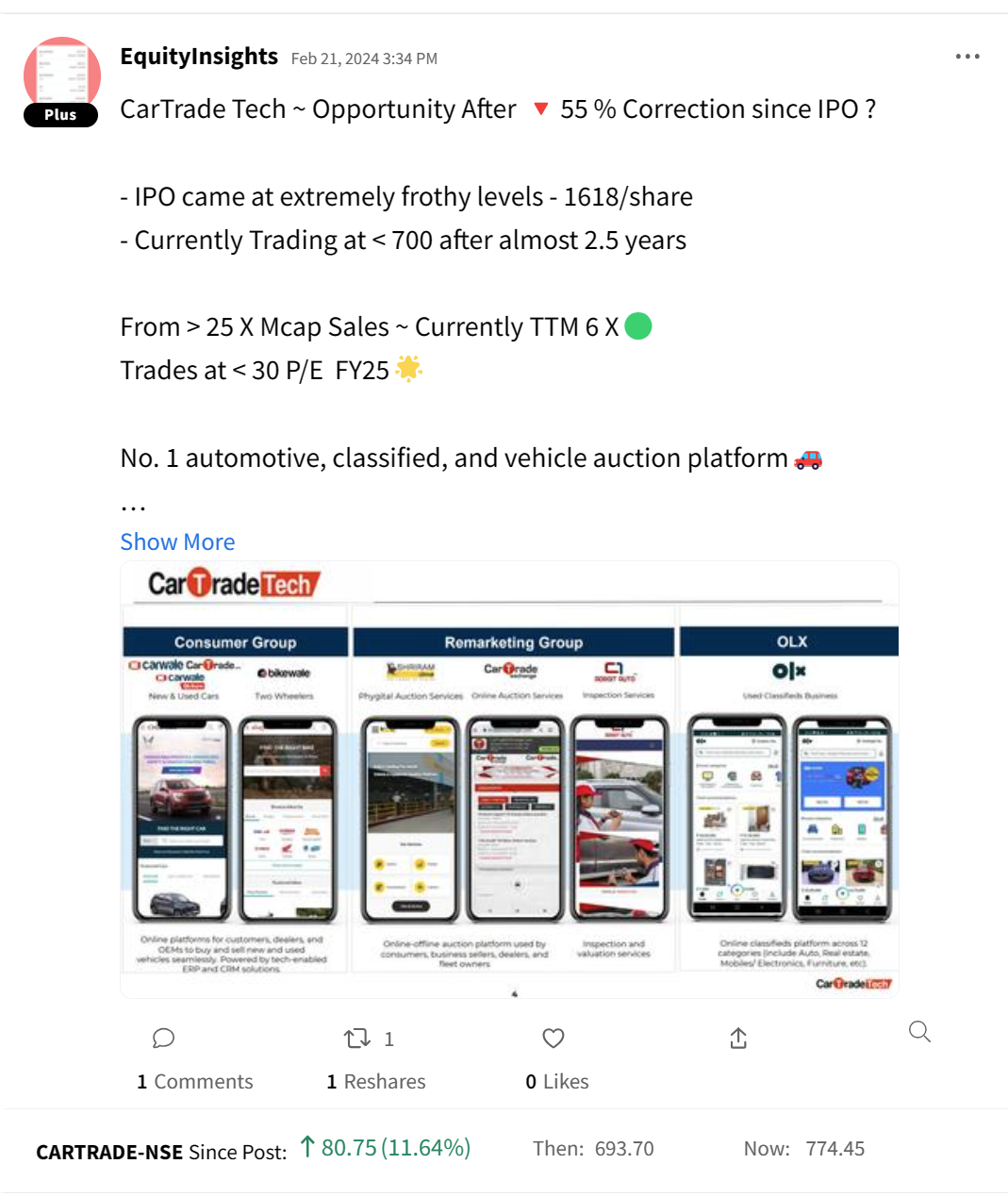

Check out this super in-depth fundamental take on CarTrade Tech by Equity Insights Elite on Stocktwits. Add $CARTRADE.NSE to your watchlist and track the latest from our community. Here’s the link:

Disclaimer: Equity Insights Elite is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.