Tale of the Tape

Howdy guys! Welcome back to the market of stocks. 📈

Nifty and Sensex ended higher for a third straight session in an otherwise boring range-bound day. Midcaps (+0.2%) and Smallcaps (-0.5%) traded mixed. The advance-decline ratio was in favour of the bears (3:2). 🤼

It was a mixed-bag kinda day for sectors. Oil & Gas (+1.9%) was the top winner, while Banks (+0.4%) and Pharma (+0.3%) saw some gains. IT (-0.8%) and Auto (-0.5%) stocks witnessed some selling pressure. 💸

BHEL (+12%) was the top gainer on the NSE 500 today. Read our top story on the stock’s bull vs bear arguments. 💯

RK Swamy’s Rs 423 cr IPO opened for subscription today. Our analysis below will help you decide whether to invest or not. 🤔

NTPC (+4%) was the top Nifty gainer after PM Modi inaugurated a series of projects, including a Rs 17,000-cr thermal plant. 🔥

Inox Wind hit a 5% lower circuit and Suzlon fell -2%. Reports suggest the GOI may bring back the ‘reverse auction’ method for auctioning wind power to energy firms, which is a NEGATIVE. 👎

Tata Steel (-1%) was in focus after CLSA downgraded the stock to a ‘sell’; the brokerage sees a -12% downside from current levels. ✂️

Ami Organics (+6%) gained after receiving two process patents from the GOI. ✅

MOIL jumped 7% after reporting its best-ever February production numbers. 📊

Godrej Properties was up 2% after launching a 62-acre township project in Bengaluru. 🏗️

Mukka Proteins IPO was oversubscribed by 60x subscription on the final day. 🤯

Here are the closing prints:

| Nifty | 22,405 | +0.1% |

| Sensex | 73,872 | +0.1% |

| Bank Nifty | 47,456 | +0.3% |

To The Moon (& Beyond…)

Bharat Heavy Electricals rallied +14% intraday to hit a 12-YEAR-HIGH! Some PSU stocks have lost steam lately (cough cough: Railways, Renewables). But BHEL appears to be defying that trend, for now at least. The big question: how much longer can its run last? Here’s a quick look at the biggest bear & bull arguments. ⚔️

First, the macro stuff. For the unaware, BHEL is a power equipment manufacturer. Yes, it makes critical components for hydro & nuclear power. But its core cash cow is thermal power, most of which is coal. ⚡

The bears believe that the GOI’s emphasis on renewables could hurt BHEL in two ways. One, greater renewable capacity should eat into demand for coal power projects. And secondly, BHEL will be left out in the broader rush to solar or wind. ♻️

The bull argument is that power demand in India is at an all-time high and that renewables simply can’t shoulder the ENTIRE burden. Put simply: before India goes fully renewable, it will likely need MORE thermal power to help in the transition. 💰

Then there’s the micro stuff. One of the biggest bears, brokerage Jefferies, believes that BHEL has been seeing execution issues + an uptick in competition. As a result, the bottom line is hurting. Also, BHEL’s big fixed costs aren’t helping either. There’s a lot of truth to this. ICYMI – BHEL has reported losses for the last three quarters; its gross margins are also down. 📉

The counter-argument from the bulls is that these issues can be solved. They also say that the important thing is its deal pipeline which will keep the topline growing. FYI – it looks like BHEL will end FY24 with an INSANE order book of Rs 65,000 cr! 👍

TL;DR: Whether you’re a bull or a bear, BHEL’s future really just comes down to execution. Can it finish projects, while reining in costs and increasing margins? FYI – Jefferies has a target price of Rs 80 p/sh (-70% downside), while ICICI Securities’ target is Rs 300 p/sh (further +12% upside). 👀

Stocktwits Specials

Markets are at their all-time highs but is it a good time to invest now? In this video, we cover 4 investment ideas by SEBI RAs which can deliver healthy returns even from current levels.

R K Swamy IPO Review

RK Swamy IPO opened for subscription today! The price band is fixed at Rs 270 p/sh – Rs 288 p/sh. The company aims to raise Rs 423 cr from the IPO. 💸

Founded in 1973, the Chennai-based firm is a leading marketing services provider. It has three main verticals: marketing tech & market research (through its brand ‘Hansa’), marketing communications and customer data analytics. Put simply: RK Swamy helps businesses find new customers and reach them. Its key clients include Dr Reddy’s Labs, Mahindra & Mahindra, and the Aditya Birla Group. The nature of this industry tends to result in steady business from long-term clients. But in FY23, new client biz accounted for 16% of RK Swamy’s topline. This shows its aggressive expansion, including a foray into the Bangladesh market. 🌏

FYI – the IPO’s fresh issue of shares comes to Rs 173 cr, while the rest is through the Offer for Sale route (Rs 250 cr). The money raised will be used to set up new IT infra + customer experience centers. 🏢

FY23 snapshot:

- Revenue: Rs 299 cr; +22% YoY

- EBITDA: Rs 63 cr; +43% YoY

- EBITDA Margin: 20.9% vs 18.13%

- PAT: Rs 31 cr; +63% YoY

Big Picture: Overall marketing spend in India is projected to grow at a CAGR of 14.5% over FY23-FY28 to Rs 35,000 cr. Most experts agree that RK Swamy has been firing on all cylinders even though it operates within a much smaller segment. The biggest positive trigger for the company is how well it expands its pie while maintaining its great margins. FWIW – the IPO is reasonably priced, even in comparison to its listed peers. Current grey market data also suggest it may list at a decent 20% premium! 🤑

Winner Winner Chicken Dinner

Congratulations Ashfaque Khan for winning the Community Star of the Month! ⭐

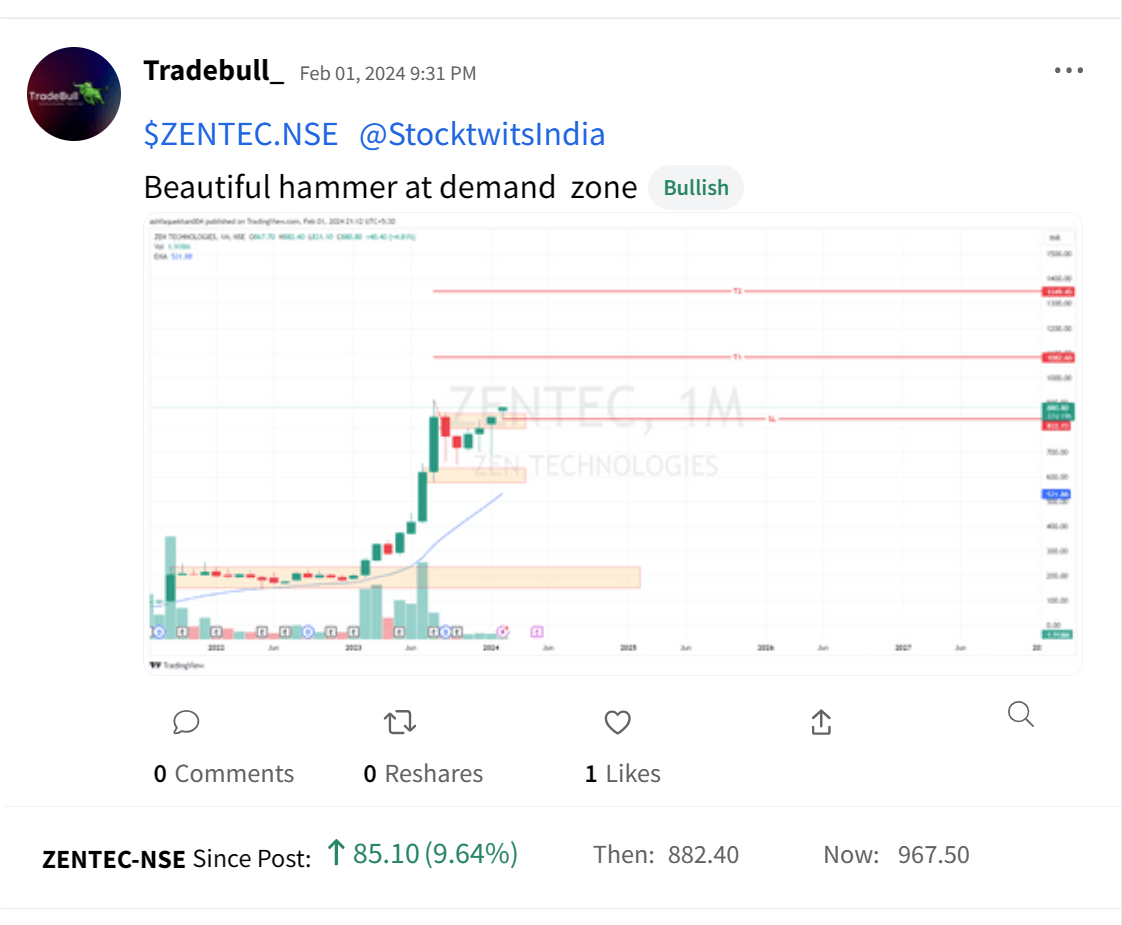

Here are a few investment & trading ideas shared by him on Stocktwits that you must check out: 😎

- $RAILTEL.NSE: https://stocktwits.com/Tradebull_/message/560981828

- $ZENTEC.NSE: https://stocktwits.com/Tradebull_/message/559987061

Ashfaque is a part-time trader and began his journey as an options trader in Feb 2023. But, after making losses for 5 straight months he switched to trading in high momentum cash stocks. He specializes in identifying breakout stocks for the short to medium term. Follow him for more awesome trading insights like these.

Disclaimer: Ashfaque Khan is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.

Links That Don’t Suck

💯 4 Stocks to Buy in March 2024 | 2024 Top Picks by SEBI RAs | Tata Power Latest News | RBL Bank News

💬 Stocktwits is hosting a free AMA with Darshit Patel. Click to Ask

💃 Some Numbers To Show You The Scale Of Ambani Weddings, Because Why Should We Suffer Alone

🔍 Malaysia says MH370 search must go on, 10 years after plane vanished