Tale of the Tape

Good evening everyone. Markets snapped their four-day gaining streak. 📉

Nifty and Sensex edged lower as weakness in heavyweight IT and FMCG weighed down the indices. Midcaps (-0.3%) moved in suit, while Smallcaps (-1.2%) saw a much bigger drop. The advance-decline ratio was in favour of the bears (3:2). 👎

It was an even mix of red & green across sectors. PSU Banks (+2.6%) and Auto (+1.3%) saw healthy traction. On the flip side, IT (-1.6%) and FMCG (-1%) witnessed selling pressure. 🔥

Tata Motors was the top Nifty gainer after announcing its big demerger plans. Read our top story on what lies ahead for the stock. 🚀

IIFL Finance was locked in a 20% lower circuit after facing RBI heat over its gold loans. More details below. 🚨

IT stocks took a hit today after CLSA downgraded TCS (-2%) and HCL (-1%) to sell. Infosys (-2%), Wipro (-1%) and LTIMindtree (-2%) fell as well. 😣

Exicom Tele-Systems closed at Rs 225 p/sh; +60% from its IPO price. 💰

Paytm fell 3% after 58.2 lakh shares, or 0.92% equity, changed hands; the buyers and sellers were not immediately known. 🤝

Capri Global was locked in a 20% upper circuit after trading ex-stock split and bonus. 🤑

Macrotech Developers will raise Rs 3,300 cr via QIP. 👍

Westlife Foodworld jumped 7% after the FSSAI verified McDonald’s India uses 100% real cheese. 🍔

Here are the closing prints:

| Nifty | 22,356 | -0.2% |

| Sensex | 73,677 | -0.3% |

| Bank Nifty | 47,851 | +0.3% |

Pedal To The Metal

Tata Motors (+4%) was the top Nifty winner today after surprising investors with a demerger of its company into two entities! That’s right, its commercial vehicles (CV) biz and passenger vehicles (PV) biz will now be two different listed firms. 😎

Some quick deets: The first company will house the full CV business. The second firm will have the domestic passenger car, EV and JLR business. The whole process will take another 12-15 months to be completed. ICYMI – Tata Motors has been running these verticals separately for some time now. Since 2021, they’ve had their own CEOs and have been operating independently. 🧑💼

So what will change? The first positive is ‘value unlocking’. Basically, the CV business goes through rough cycles and typically is valued less by investors. Because of this, it creates a drag on the company’s overall valuations. With both now doing their own things, experts hope the PV business will be valued a lot higher. Also, investors looking to bet on an EV future can now do so without having to worry about the CV vertical. ⚡

Secondly, making Tata’s domestic PV, EV and JLR businesses work more closely is a positive as well. For example: JLR’s electric platform will be used as the foundation for Tata Motor’s ‘EV-first’ models under its ‘Avinya’ brand. Also, the Harrier and Safari SUVs are all built on old JLR platforms. 🚗

That said, why aren’t some brokerages too excited? Well, Tata Motors has already had an INCREDIBLE bull run. The stock is up more than 2x over the last year. It’s unclear how much more value this demerger can help unlock. Also, nobody knows what the auto cycle will look like two years from now. Finally, since the listing will take another 15 months, it doesn’t affect too much right now. 😇

Stocktwits Specials

Markets are at their all-time highs but is it a good time to invest now? In this video, we cover 4 investment ideas by SEBI RAs which can deliver healthy returns even from current levels.

WTF! IIFL Finance

IIFL Finance was locked in a 20% lower circuit after the RBI ordered it to stop issuing gold loans. The regulator cited “material supervisory concerns” in the firm’s gold loan portfolio. Yikes. 👀

What does RBI have to say? There are two sets of concerns. Firstly, when people came to IIFL for loans and pledged their gold, the company allegedly screwed up in scrutinising the weight & quality of the yellow metal. Because of this, there were “breaches” in its loan-to-value ratio. 🚨

Beyond this, it also gave out and collected loans in cash which were “far excess” of the statutory limit. Non-transparency in customer charges and not adhering to the standard auction process were some other key issues. ❌

What does it mean for IIFL? Tbh, it’s significant. Gold loans formed 32% of its AUM (assets under management) in Q3FY24. Not only that, this portfolio is high-yielding (19%) and has a tiny GNPA ratio of just 0.8%. The average gold loan ticket size was Rs 73,700 and it disbursed loans worth Rs 8,984 cr in Q3. 📊

Jefferies says the RBI ban will result in lower co-lending income and even potentially higher cost of funds. If the ban continues for 9 months, the brokerage firm estimates a 25%-30% profit hit. That said, in every crisis, there’s an opportunity. Rivals Manappuram Finance and Muthoot Finance, rallied +10% intraday.

Stocktwits Spotlight

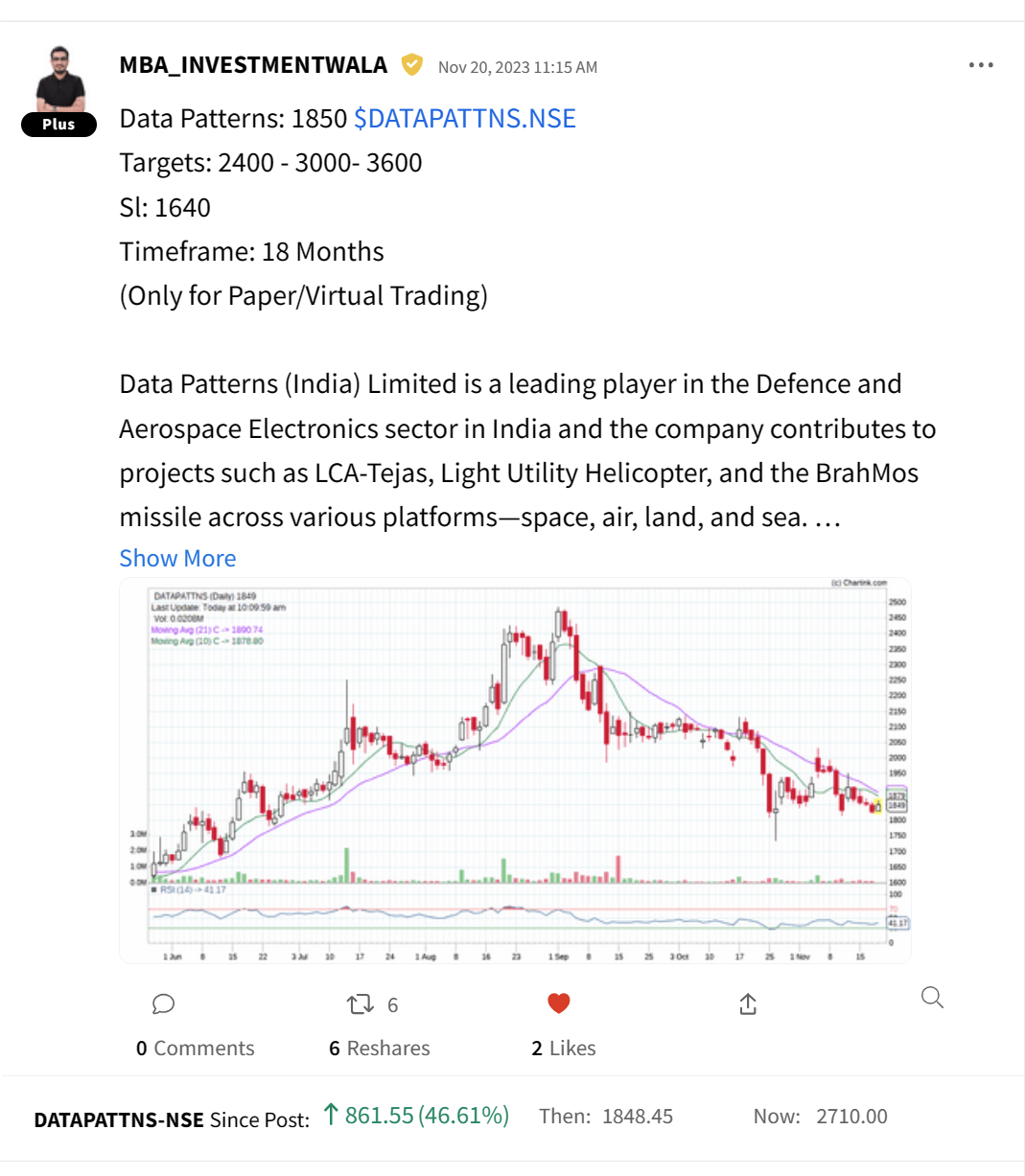

Data Patterns is up +50% in 3 months with still room on the upside for Aditya’s long-term targets! That deserves a huge round of applause. Follow Aditya Hujband for more awesome trading insights and add $DATAPATTNS.NSE to your watchlist and track the latest from our community.

Links That Don’t Suck

💯 4 Stocks to Buy in March 2024 | 2024 Top Picks by SEBI RAs | Tata Power Latest News | RBL Bank News

💬 Stocktwits is hosting a free AMA with Darshit Patel. Click to Ask

🪙 Analyst: Bitcoin To $125,000 By End Of 2025 Is “Very Conservative”