Tale of the Tape

Happy Friday Jr. everyone. Markets ended flat. 🥱

Nifty and Sensex closed barely up. Investors remained on the sidelines ahead of key announcements by the US Federal Reserve at the Jackson Hole summit. Midcaps and Smallcaps fared better and advanced +0.2% each. 😑

Most sectoral indices ended lower. Metals (-1.3%) continue to see profit booking. PSU Banks (-0.8%) and Pharma (-0.5%) added to the weakness. 📉 FMCG and Energy stocks rose 0.5% each.

Bharti Airtel (-4%) said it will consider raising funds at its Board meeting on Aug 29. 💸

M&M Financial surged 6%. The company appointed Raul Rebello as its chief operating officer (COO). Rebello was the Executive Vice President and Head of Rural Lending & Financial Inclusion at Axis Bank. 👔

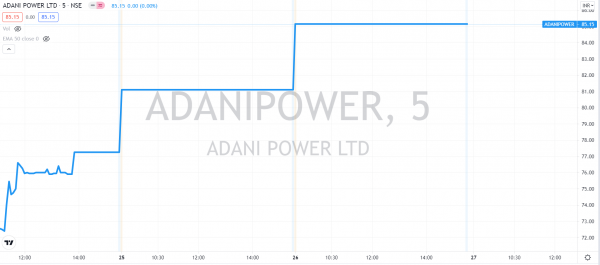

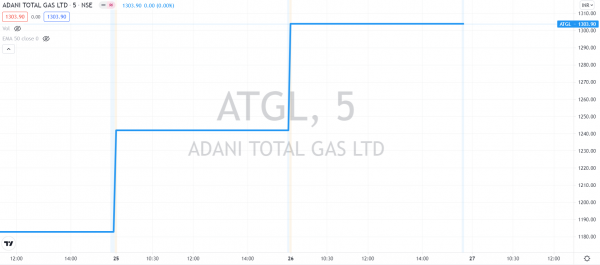

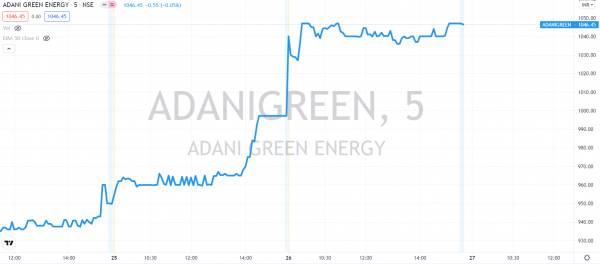

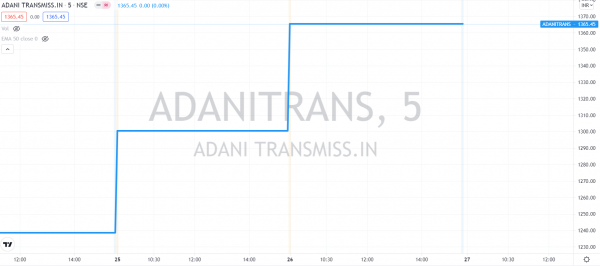

Adani Group stocks were on a roll. Four of the six Adani Group stocks were locked in a 5% upper circuit. Check out their charts below. 📈

Procter & Gamble Hygiene & Health Care rallied ~4%. The company announced a final dividend of Rs 80 p/sh. 🤑

Affle India (+5%) approved a 1:5 stock split. ✂

Cryptos recovered from the lows. Bitcoin was down 0.5%. Ethereum was flat. Ripple advanced ~1%. Cardano and Doge were down 2%. 😏

Here are the closing prints:

| Nifty | 16,637 | +0.01% |

| Sensex | 55,949 | +0.01% |

| Nifty Bank | 35,618 | +0.09% |

All I Do Is Win

Indian equities have topped the Emerging Markets list in 2021. 🥇The benchmark Nifty 50 index is +17% YTD. The Taiwanese market comes in at #2 with a 16% gain. South Korea (+2%) and Thailand (1%) were the only other gainers on the list.

Despite a deadly 2nd wave, India has managed to get back on its feet quickly. Pickup in spending and corporate investment has helped the economy rebound sharply. 🔥 Improving growth outlook and a series of new-age IPOs revived the animal spirit. But, this would not have been possible without the support of retail bros.

Millions of Indians have entered the equity markets in the last 12-18 months. Rising financial awareness, low cost brokers, and meme stock culture has fueled interest. Retail investors now account for 45% of market share. 💪 Mutual funds, too, have found favor among retail investors. In July, inflows into equity schemes hit a two-year high. Take a bow. 🙏

On the other hand, Foreign Institutional Investors (FIIs) haven’t been able to make the most of this rally. Data shows that FIIs have been net sellers in three out of the last four months. However, experts believe this trend may reverse as economic growth further accelerates. If FII’s get FOMO, markets could propel markets higher. 🤞

Long time no see

It’s been a while since we’ve covered Adani Group stocks. Reports of SEBI and the Directorate of Revenue Intelligence (DRI) investigating multiple group companies triggered a sharp sell-off last month. 👎

Since then, most stocks have been stuck in a sideways trend. However, it’s only now that we’re starting to see some signs of life. Four out of the six Adani Group stocks were locked in a 5% upper circuit today. 📈 Check out their charts below:

Taking A Break?

We don’t usually deep dive on individual stocks, but this one’s an exception. The stock in question doubled on listing day back in September and has only moved in one direction. In 2021 alone it has given +4x return. For those who got it wrong, it’s Happiest Minds Technologies. 😇

Happiest Minds is a fast-growing, highly modern IT digital services company. The Company offers Big Data, Analytics, Cloud Computing, Networking, Security, Blockchain, and IoT services. As all IT companies, they’ve benefited from digital adoption. Their Q1 revenue rose 10% (QoQ) and 41% (YoY). They particularly benefit from strong exposure to hot sectors like OTT, Edtech, and more. 👨💻 Strong demand, favorable currency, and lower costs have boosted earnings.

Going forward, the company aims to grow twice as fast as the industry, led by strong growth in cloud (41% of revenue) and SaaS (22% of revenue) verticals. FYI – some of its marquee clients include Amazon, Netflix, and Microsoft. And finally, their Executive Chairman Ashok Soota is a well-known industry veteran who previously held senior positions at Mindtree and Wipro. 😎

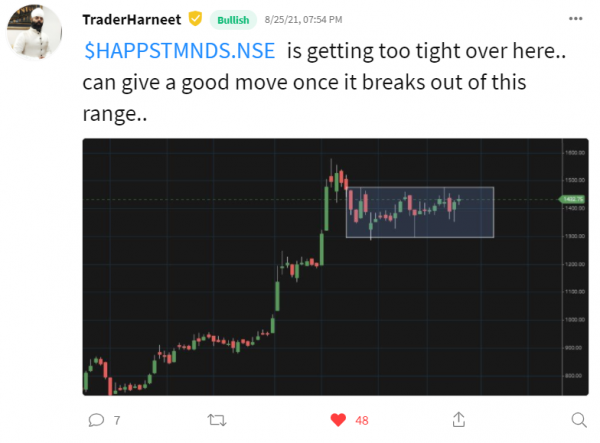

Happiest Minds’ record-breaking run has turned quite a few heads. However, its last 1-month performance (-9%) does throw some caution. 🚨 Here’s what technical guru Harneet Singh is spotting on the charts on Stocktwits:

Meanwhile, fundamental investors remain unfazed by its recent weakness. Most analysts continue to remain bullish on the stock and advise buying on dips. 💸

Links That Don’t Suck

✅ Sebi Okays Blockchain Tech For NCDs

💰 Barclays Bets On India Again With $400 Mln Infusion For Banking, Wealth Businesses

📱 The iPhone 13 Might Launch Sept. 17

🖌 Paintbrushes Are Used To Create Art, But Making The Brushes Is An Art In Itself

🐕 This Golden Retriever Is Melting Hearts Online

🎬 ‘Shang-chi’ Reviews Are In: Here’s What Critics Think Of Marvel’s Latest Movie