Tale of the Tape

Good evening everyone! ☕

Markets were super boring. Nifty (+0.1%) and Sensex (+0.2%) barely moved. Midcaps (+0.5%) and Smallcaps (+0.6%) staged a last-hour recovery to end in the green. The advance-decline ratio was evenly split. 🥱

Except for IT (-0.1%) all the other sectors ended in the green. PSU Banks (+1.3%) and Metals (+0.9%) saw the most buying. 📈

The $8.5 billion RIL-Disney merger is here. What does it mean for the market and competitors? Read our top story below. 💯

SEBI has raised red flags over midcap & smallcap MF schemes. Read more below to find out what it means for their bull runs. 👀

Hospital stocks took a hit after the Supreme Court asked the GOI to look into overcharging issues. Max Healthcare (-7%) was the top NSE 500 loser, Fortis Healthcare and Apollo Hospitals fell between 3%-4%. 🧑⚖️

JB Chemicals and Pharmaceuticals (-2%) fell after reports said promoter KKR was planning a stake sale. 💸

Shriram Finance (+3%) will be added to the Nifty, while UPL (-1%) will be removed from the index. 🎉

Venus Pipes and Tubes (+5%) gained after announcing an entry into the fittings business. 🔩

JSW Infrastructure was up 4% after Motil Oswal initiated coverage on the stock; the brokerage sees a +17% upside from current levels. 🔥

Bajaj Auto slipped -3% after it turned ex-date for the Rs 4,000-cr share buyback plan. 🤑

Market debut. GPT Healthcare closed at Rs 201 p/sh on the NSE; +8% from its issue price. 👍

Here are the closing prints:

| Nifty | 21,982 | +0.1% |

| Sensex | 72,500 | +0.3% |

| Bank Nifty | 46,120 | +0.3% |

Danger In Midcaps & Smallcaps?

Midcaps and smallcaps are being SMOKED this week. The big trigger is SEBI warning mutual fund houses that there is too much “froth” building up in the two segments. What does this mean? Put simply: the regulator thinks there’s too much risk with a potential of blowing up in the future. 🚨

Some quick context first. In 2023, midcap MF schemes got Rs 22,913 cr in inflows, while smallcap schemes pulled in an INSANE Rs 41,035 cr. The AUM (assets under management) of smallcap schemes hit a whopping Rs 2.48 lakh cr in January 2024. In comparison, the AUM of largecap schemes was Rs 2.99 lakh cr. To top it off, the top active fund by AUM is now a midcap fund and the fifth-largest fund by AUM is a smallcap fund! Holy f*ck. 🤯

What’s going to happen next? Most experts say mutual funds will limit inflows into midcap & smallcap schemes. ICYMI – this has slowly started. Nippon & Tata stopped taking lumpsum investments in their smallcap funds last year. But with SEBI’s warning, this will pick up now. Nuvama Research says ICICI Prudential and Birla are already encouraging MF distributors to consider largecap funds over mid and small. 💸

Most importantly: how does this affect you? The midcap and smallcap bull run last year was boosted by mutual fund inflows. Less mutual fund inflows = less liquidity = less overall gains. There’s also what experts call a ‘self-fulfilling prophecy’. That is, by waving a huge red flag over midcaps and smallcaps, you end up triggering a meltdown in both segments. Disclaimer: nobody knows if this will happen, but that’s what’s at stake. 🤷

On the flip side, there’s always an opportunity in every crisis. Most experts say mutual funds should start warming up to largecaps this year. If FIIs return after elections, 2024 could go down as a good year for blue chip stocks! 📈

Stocktwits Specials

In this week’s video, we will walk through the Top 3 stocks to buy under Rs 300 recommended SEBI RAs on Stocktwits.

In the video, we’ll break down the recommendations by SEBI RAs, covering both fundamental and technical analysis.

Tag Team Champions

Reliance Industries has FINALLY announced its mega-merger with Walt Disney’s Indian media business. After months of speculation, a $8.5 billion entertainment giant will be born. FYI – this will completely SHAKE UP India’s multi-billion-dollar media & entertainment sector. 🎬

First, some quick deets: RIL & Disney together will own 120+ television channels and TWO streaming platforms. The new entity will have a 40%-45% market share in the traditional broadcasting business AND the streaming space. FYI – Mukesh Ambani will invest $1.4 billion into the new venture. RIL will own 63% and Disney 37%, with Nita Ambani becoming the chairperson of the JV. 💯

There are two big losers and one big winner here.

The first loser is clearly Disney. The deal values the Star India media business at a little over $3 billion for its 37% stake. This is a BIG drop from the $14-$15 billion that it commanded pre-Covid. This is mainly due to the loss of its IPL rights & HBO content (RIL has both of those now). This merger finds a safe home for its assets, allows it to stop bleeding money and bets on Ambani to make them money in the future. 📊

The second loser is the competition. Regional players like Sun TV will hurt the most, but Zee Entertainment and Sony will be affected too. Margins will be squeezed and most experts believe they can forget about trying to gain market share in the near future. ⚔️

Finally, the big winner of course is Mukesh bhai. Yes, media & entertainment are a small chunk of the RIL empire. But, it’s a key piece of the broader Jio puzzle. Jio Cinema, while pulling numbers due to cricket, has no biz model or original content at all. This will help it stop losing money — content costs will come down as the scale of the merged entity goes up — while being able to use valuable Disney content. 🍿

Stocktwits Spotlight

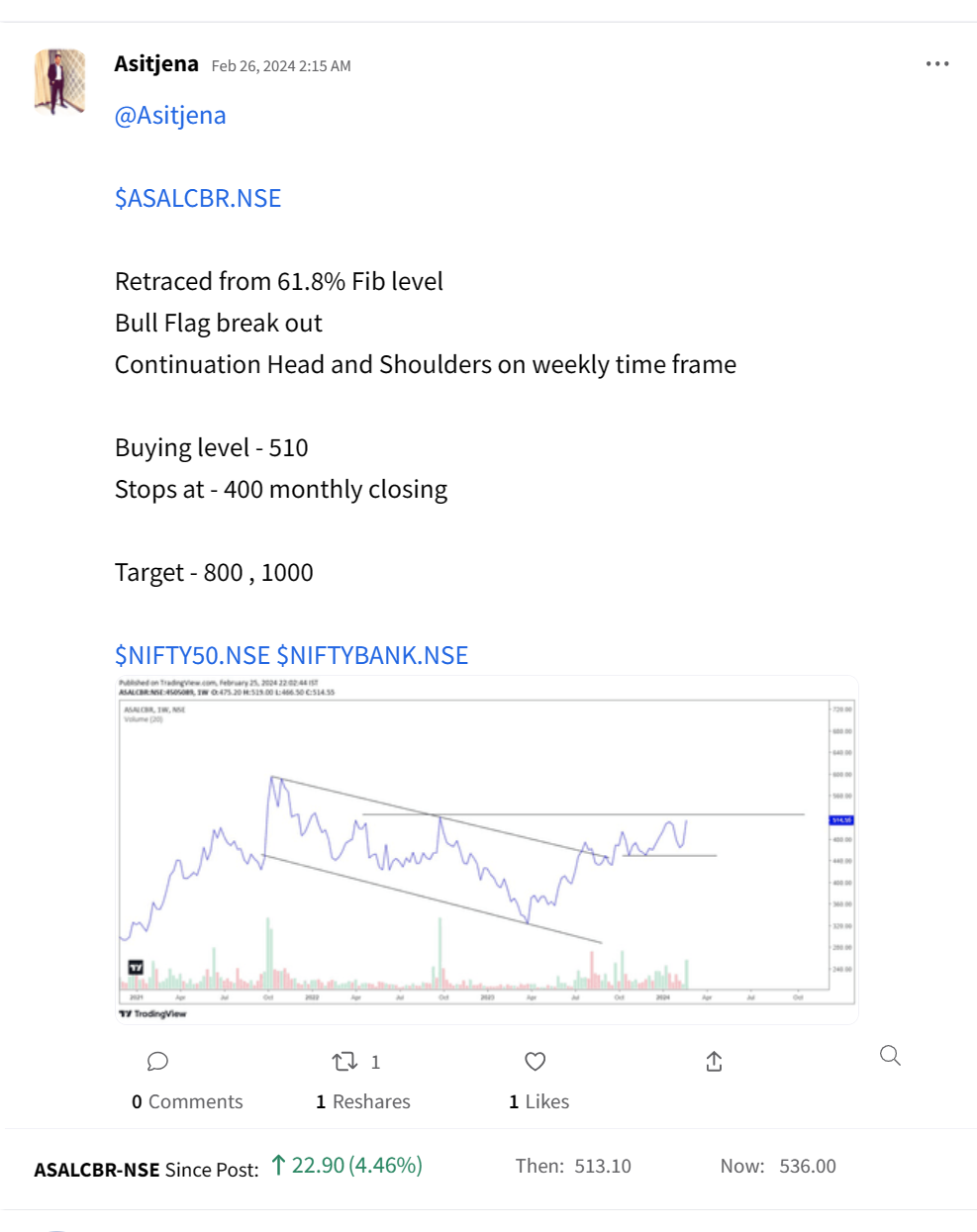

Here’s a bullish chart setup by Asit Jena on Associated Alcohols & Breweries. Follow him for more amazing insights and add $ASALCBR.NSE to your watchlist and track the latest from the community.

Disclaimer: Asit Jena is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.

Links That Don’t Suck

😎 Top 3 Stocks under 300 Recommended by SEBI RAs

💬 Stocktwits is hosting a free AMA with Shubham aka Curious Community. Click to Ask

🚀 Morgan Stanley Evaluating Spot Bitcoin ETFs for Its Giant Brokerage Platform: Sources

👶 Deepika Padukone and Ranveer Singh announce pregnancy; Baby expected in September