Tale of the Tape

Good evening everyone! Markets continue to march higher. 😇

Nifty and Sensex scaled new record peaks. US Fed’s comments on sticking with low interest rates boosted investor sentiment. Midcaps (1.9%) and Smallcaps (1.5%) fared slightly better. 3 stocks rose for every 1 loser. 💸

All sectors except for IT (-0.6%) closed in the green. Banks, Metals, Realty, and Pharma rallied +2%. 🤗

Bharti Airtel (+4%) was the top gainer on Nifty. The telecom operator surprised the Street with its mega Rs 21,000 cr rights issue announcement. 💰Read more below.

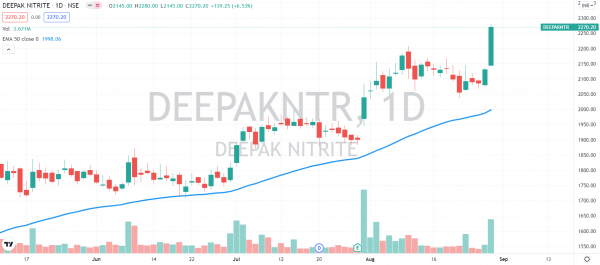

Chemical stocks were the star performers today. 🌟 Laxmi Organics (10%), Deepak Nitrite (+7%), and Balaji Amines (+5%) hit new all-time highs. Check out their charts below.

Nazara Technologies (+6%) acquired skill gaming platform OpenPlay for Rs 186 cr. 🎮

Maruti Suzuki (+3%) will increase prices across models from September 1. 🚘

Cryptos traded lower. Bitcoin and Ethereum were down 1%. Solana soared +9%. Ripple, Cardano, and Doge were flat. 😐

Here are the closing prints:

| Nifty | 16,931 | +1.4% |

| Sensex | 56,890 | +1.4% |

| Bank Nifty | 36,348 | +2.0% |

Dialing The Right Number

Bharti Airtel (+4%) is not screwing around. The telecom giant announced that it’s raising Rs 21,000 cr via a rights issue. 💰

The rights issue price is fixed at Rs 535 p/sh. That’s a discount of 14% from Monday’s closing price. Shareholders will receive one new share for every 14 shares held. Here’s ET with more numbers. 🧐

Big Picture – Airtel is preparing for war with Jio.

Firstly, Vodafone-Idea’s slow and painful death is seen benefitting Airtel the most. But, to service the new subscribers, it needs to update its network infrastructure for which it needs more money. Secondly, the fundraising will come in handy as the Government begins auctioning 5G airwaves later this year. Regulatory dues (AGR) and spectrum fees will also be taken care of without putting any additional burden on its balance sheet. ✅

Bharti raising money to finance future growth and not just pay off debt/regulatory dues got the Street excited. Management comments on price hikes, market share gains, and the 5G roadmap only added fuel to the fire. Lastly, Google is reportedly in talks to pick up a pretty big stake. 🔥

Sunil Bharti Mittal, Founder & Chairman of Bharti Airtel said:

This capital will help improve the leverage position for the company and simultaneously provide the fuel to accelerate investments across several parts of our portfolio to drive for competitive and profitable growth.

Bharti Airtel is up +20% YTD. 📈

Breakout Trades

Chemical stocks rallied in trade. Laxmi Organics (10%), Deepak Nitrite (+7%), and Balaji Amines (+5%) hit new all-time highs. 🤑 Here are their charts for your viewing pleasure:

Specialty chemicals is one of the hottest sectors without a doubt. 🥵 The Government’s Atma Nirbhar Bharat vision is a big positive for the sector. It should reduce our dependence on imports and turn India into a global hub for chemicals. 🧪

Strong demand from end-user industries like pharma, agri, and more along with rising prices has further boosted the bullish sentiment.

Mapping its way to glory

Digital map maker, MapmyIndia, is in talks to come out with an IPO, per media reports. The Delhi-based startup aims to raise Rs 1,200 cr from markets. 💸

MapmyIndia offers solutions in digital map data and APIs, GPS navigation, tracking, location apps, and others. 🗺 Its long list of clients includes names like Apple, Amazon, BMW, and more. The company raised Rs 1,600 cr capital from Flipkart way back in 2016. Qualcomm, Walmart-backed PhonePe, and Japanese mapmaker Zenrin Co. are also its early investors. 😎

Financial Snapshot:

- FY21 Revenue: Rs 149 cr; -8% YoY

- FY21 PAT: Rs 25 cr; -36% YoY

MapmyIndia is part of a small list of profitable startups aiming to go public. However, reports of the company’s IPO being a 100% Offer for Sale (OFS) may not sit well with most investors. 🤨

In an OFS, the company does not receive any money and its existing investors are cashing out. Let’s see how this one goes.

Links That Don’t Suck

💸 Freshworks Files For US IPO, CEO Cites Rajinikanth As ‘Mentor’

⚙ Tesla In Talks With Indian Component Suppliers Ahead Of Official Launch: Report

📡 The iPhone 13 Could Have Satellite Connectivity

🚀 SpaceX Sends Ants, Avocados, Lemon And Ice-Cream To Space