Tale of the Tape

Good evening and happy weekend everyone! 😊

Markets continue their hot streak. Nifty and Sensex clocked best weekly returns in seven months. 🤑 Midcaps and Smallcaps rose 0.5% each.

Most sectors ended higher. Energy (+2.3%) and Media (+1.5%) topped the list of gainers. 📈 Banks and NBFCs took a breather; were down -0.3% each.

HDFC Life Insurance (-3%) will buy Exide’s life insurance business for Rs 6,687 cr. 💰 Read more below.

Reliance Industries (+4%) hit a new all-time high. The company’s market cap crossed the Rs 15 lakh cr mark. 🥇

IRB Infra (+5%) received a highway order from the Government of Tamil Nadu. The Company’s total order book stands at Rs 14,189 cr. 👷♂️

More bad news for Maruti Suzuki. The company will recall +1.8 lakh defective cars. 🚫 The stock fell 3% from the day’s high.

SpiceJet’s (-0.1%) Delhi employees went on a strike over salary issues. 😓 The company immediately clarified that the issue was resolved.

L&T Technology Services (+7%) hit a new record high on positive management commentary. The Company guided for $1.5 billion in revenues by FY25 and steady 18% operating margins. Here’s Livemint with further details. 📊

Zomato popped up 9% out of nowhere to hit a new all-time high. The stock has ~2x from its issue price of Rs 76. Ye dil maange more. 😋

Ami Organics and Vijaya Diagnostics IPOs got oversubscribed 64.5x and 4.5x on the final day. 👍

Crypto’s traded mixed. Bitcoin was up 0.5%. Cardano and Doge were down 2%. Ethereum rallied +6%. Solana soared +23%. 😍

Here are the closing prints:

| Nifty | 17,324 | +0.5% |

| Sensex | 58,130 | +0.5% |

| Nifty Bank | 36,761 | -0.2% |

Assured Gains

HDFC Life Insurance is paying top dollar to buy Exide Life Insurance. The stock + cash deal will cost HDFC Life Rs 6,687 cr. 💰 That’s the biggest acquisition ever in the life insurance space. Back in 2016, the company had tried to acquire Max Life Insurance but the deal fell through due to regulatory obstacles.

So, what’s the scene? The proposed transaction will give customers access to a wider bouquet of products and service touchpoints. The deal will also add ~40% to its agency business and also expand its reach in South India, where Exide has a strong presence. 💪 HDFC’s size and business model will aid in optimizing cost and achieve higher margins, say experts.

Vibha Padalkar, MD & CEO at HDFC Life said:

We believe that this amalgamation can result in value creation for customers, employees, shareholders, and distribution partners. It gives us an opportunity to realize synergies arising out of complementary business models, and further bolster our proprietary distribution network.

Big Picture: The Indian insurance industry is going through somewhat of a rough patch. The surge in death claims during the 2nd wave and job losses due to lockdown hit demand for life insurance. 📊 Experts predict the move to set off a fresh round of consolidation in the overcrowded market. Let’s see how this goes.

HDFC Life is up 8% YTD.

Look Who’s Back

Snapdeal is eyeing a comeback! 🔙

The Softbank-backed company is reportedly in talks to raise $400 million from the markets. Post listing, the Company is expected to be valued at $2.5 billion. 💸 Snapdeal has not officially confirmed the news and reports indicate that discussions are still at early stages.

Snapdeal used to be one of India’s leading e-commerce firms. But then Amazon happened and things quickly began to go downhill. 📉 As per estimates, the company’s market share fell 20% between March 2015 and March 2016. By the end of 2016, the company was on the verge of bankruptcy. Add in a failed merger attempt with Flipkart, and the Company almost went poof! 👻

But, the Company’s founders Kunal Bahl and Rohit Bansal were not done yet. The company took some drastic steps like selling non-core assets (Freecharge), targeting smaller cities, and focusing on unit economics. 👍 The Covid-19 pandemic further boosted the company’s remarkable turnaround. Between 2018-2020, Snapdeal’s revenues grew 85% and traffic surged +100%. The company added +6 million new customers during the lockdown of which ~90% come from non-metro cities. 😎

Movers and Shakers

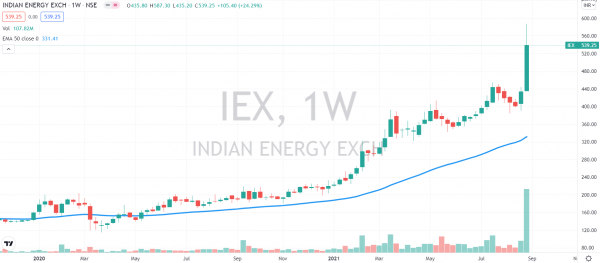

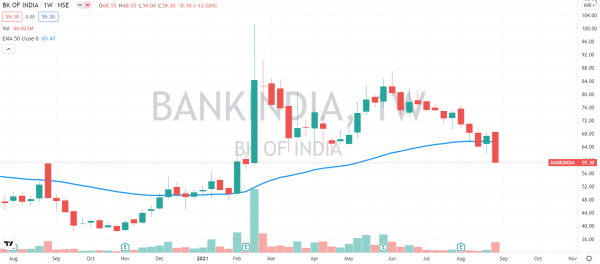

Here’s a look at this week’s top movers. Sobha Developers (+28%) took the pole position after gaining all five days of the week. 🥇 Indian Energy Exchange (+24%) posted its highest weekly gain of all time. Bank Of India (-12%) posted its worst weekly loss since March 2020. AU Small Finance Bank (-9%) remained under pressure for a thirds straight week. 🚨 Check out their charts below:

Links That Don’t Suck

😇 Govt Plans To Bring A Bill, Cryptocurrencies To Be Treated As Commodity

💸 PhonePe Mutual Fund May Come At ‘Some Point’: CEO Sameer Nigam

📺 Exclusive: Amazon Is Close To Launching Its Own TV In The US

👨 Humans Are Evolving: Science Finds Evidence Of An Extra Artery Growing In Our Arm

🍿 Money Heist To Black Widow, 11 Exciting New Shows & Films We Can’t Wait To Watch In September

🏏 Pope, Bairstow Lead England’s Counter

💑 You’re Not A Fish And Other Cardinal Truths Of Online Dating