Tale of the Tape

Happy Thursday everyone! One more day to go for the weekend. 😀

Markets continue to climb higher. Nifty and Sensex hit a new all-time high. Yes, again. Midcaps and Smallcaps gained +1%. The advance-decline ratio (2:1) ratio remained firmly in favor of the bulls. 🐂

Most sectoral indices closed in the green. IT (+1.7%) and FMCG (+1.6%) hit a record high. 📈 Meanwhile, PSU Banks (-0.4%) and Autos (-0.2%) saw minor cuts.

Vedanta gained ~3%. The company announced an interim dividend of Rs 18.50 p/sh. 🤑

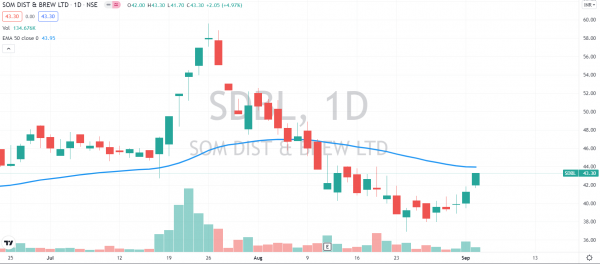

Liquor stocks were buzzing in trade. 🥃 GM Breweries rallied 7%. Globus Spirits and Som Distilleries were locked in a 5% upper circuit. Check out their charts below.

Mahindra & Mahindra (-2%) expects September production to fall 20%-25% due to the ongoing semiconductor shortage. 📉

Delta Corp rallied +11%. The Investment Promotion Board (IPB) approved the company’s “Entertainment City” project in Dhargal, North Goa. 🎰

Minda Corp (+6%) will acquire a 26% stake in charging solutions startup EVQPoint. 🔋

HDFC Life (+6%) hit a new all-time high. The company will consider raising funds at its Board meeting tomorrow. 💸

Vijaya Diagnostics and Ami Organics IPO see steady demand. Here are their Day 2 subscription figures. 😊

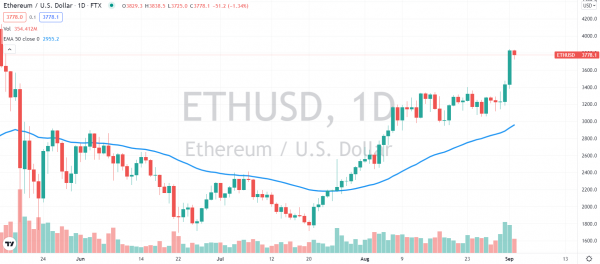

Cryptos keep surging higher. Bitcoin and Ethereum zoomed +5%. Ripple, Cardano, and Doge surge between 6%-8%. 🔥

Here are the closing prints:

| Nifty | 17,234 | +0.9% |

| Sensex | 57,853 | +0.9% |

| Nifty Bank | 36,831 | +0.7% |

Winner Winner Chicken Dinner

The Adani Group is the biggest wealth creator in 2021! 🥇

The Group’s market cap is up 104% YTD to Rs 8.7 lakh cr. Adani Total Gas, Adani Transmission, and Adani Enterprises are up +200% this year. But, it hasn’t been all smooth sailing for investors. 🌊

Reports of SEBI and the Directorate of Revenue Intelligence (DRI) investigating multiple group companies triggered a sharp sell-off. For instance, Adani Total Gas fell ~40% from its all-time high. Just like the fall, the recovery has been equally sharp. All stocks, except Adani Ports & SEZ have regained their lost mojo and are back near record highs. 😎

On the other hand, 2021 hasn’t been too kind for Mukesh Ambani-led Reliance Group. Not only, has Reliance underperformed the markets, but it also delivered the lowest returns across India’s top corporate houses. Heavy investments in its green energy business, delay in the Saudi Aramco deal, legal tussle with Amazon for Future Retail’s assets have been the key issues. 😓

Cheers To That

Liquor stocks were in high demand today. Investors cheered on hopes of strong demand as more States eased restrictions. 😇 The long-term industry outlook also remains positive. Low per capita alcohol consumption, a young aspiring population, and rising income levels are the key factors. 🥂

GM Breweries rallied 7%. Globus Spirits and Som Distilleries were locked in a 5% upper circuit. Check out their charts below:

Coming Through

Zerodha is all set to enter the mutual fund business. The company has received in-principle approval from SEBI. This enables Zerodha to offer its own funds to investors. Currently, you can invest in other firms’ mutual funds through its direct investing platform, Coin. 💸

Lately, there’s been a mad rush of companies entering the mutual fund business. Bajaj Finserv, Mobikwik, Navi Mutual Fund (run by Sachin Bansal), and most recently Groww, who acquired Indiabulls Mutual Fund for Rs 175 cr. Everyone wants a slice of the $444 billion Indian mutual fund industry. But, why? 🤔

In December, SEBI eased regulations allowing loss-making companies to set up mutual funds. Currently, there are some 40 asset management companies (AMCs) in India. But, the top 10 AMCs control +80% of the market share. This means there is ample room for growth, but would need serious disruption. 💯

Having already found a place on our smartphones, penetration will be less difficult for mobile-first startups. The new guys are going to launch new passive investing offerings. This week, Navi Mutual Fund filed scheme documents for 10 new funds with nearly all of them being index funds. Zerodha aims to follow a similar strategy. Innovative, low-cost products with superior returns – That’s music to our ears. 👍

Crypto 101

Hello and welcome to “Crypto 101”, our weekly feature where we explain complicated crypto terms in simple language. In today’s class, we’ll demystify smart contracts. 🤓

A smart contract is just like any other traditional contract. It has set rules, actions, and expectations between the two parties. The only difference is that it’s not on paper; but, it’s digital. These terms are written on codes that are automatically executed when certain conditions are met. Smart contracts are stored on a blockchain– a digital ledger consisting of records.

Let’s take an example. If Raj wants to buy chips from a vending machine, he’ll first select the type/flavor he wants to eat. He’ll press the code and insert a card or cash. The machine will then dispense the chips packet. In case he presses the wrong code or his card is out of balance, the machine will not dispense the chips packet.

A smart contract is like a vending machine. It replaces the need for intermediaries in many industries. No manual work or judging is needed with smart contracts.

Since smart contracts are stored on the blockchain, they can’t be altered, changed, or lost. A smart contract eliminates many operational expenses, saves time, and enhances efficiency.

The most popular smart contract platform is Ethereum. It allows developers to create smart contracts that can be integrated into blockchains using the programming language. More than 90% of all smart contracts currently run on the Ethereum blockchain network. Its competitors include Cardano, Solana, and many more.

Links That Don’t Suck

💰 Skit Raises $23m Series B Round Led By Westbridge Capital To Accelerate Its Growth

📈 Paypal Teases Consumer Stock Trading Offering

😢 Actor Sidharth Shukla Dies Of Heart Attack At The Age Of 40: Cooper Hospital

🏏 India Seek London Fillip In The Crucial Fourth Act

✅ Fancy A Four-Day Week? Scotland Is Urged To Expand Trials

🧳 6 Budget Workation Destinations In India With Postcard-perfect Surroundings