Tale of the Tape

Happy Tuesday everyone. Markets were up for a fourth straight day. 📈

Investors bought the morning dip. Nifty and Sensex rebounded off the lows. Muted global cues and weakness in heavyweight large caps restricted the gains. Midcaps (+0.6%) and Smallcaps (+0.8%) saw decent gains. 💪

Most sectors ended in the green. State-owned banks (+3%) stood head and shoulders above the rest. Metals and FMCG stocks advanced +1%. Meanwhile, TCS’s earnings hangover continues to hurt IT (-0.8%) stocks. 🥴

Delta Corp (+5%) hit a new all-time high despite posting a net loss of Rs 22 cr in Q2. Tata Metaliks slipped 7% on weak results. GM Breweries (+14%) net profit grew +100%. Read more below. 📊

National Aluminium soared +7% after ace investor Rakesh Jhunjhunwala bought a 1.4% stake.😎

Schaeffler India (+6%) will consider the proposal of a stock split on Oct 28. ✌

Movie Time! Cinema halls will be allowed to open with 50% capacity in Mumbai from Oct 22. PVR and Inox Leisure closed +2% near the day’s high. 🍿

Fertilizer stocks were in focus today. The Government may approve a Rs 28,600 cr fertilizer subsidy this week, as per media reports. GSFC, Zuari Agro, and Gujarat Narmada advanced between 3%-4%. 💸

Tata Power (+3%) received a new order worth Rs 538 cr. ⚡

Cryptos crept lower. Bitcoin was flat. Ethereum dropped 4%. Solana, Cardano, and Doge slipped ~7%. 😓

Here are the closing prints:

| Nifty | 17,992 | +0.3% |

| Sensex | 60,284 | +0.3% |

| Bank Nifty | 38,522 | +0.6% |

Earnings Roundup

Delta Corp (+5%) hit a fresh record high after the company’s net loss narrowed to Rs 22 cr in Q2. The casino and hospitality company is considered to be a “reopening play”. Investors are betting on easing restrictions and a travel boom to boost the company’s future earnings growth. 🎰 Here are the key stats:

- Revenue: Rs 74 cr; +2x YoY

- Net Loss: Rs 22 cr; down from a net loss of Rs 55 cr YoY

Delta Corp is +76% YTD. 🤑

Tata Metaliks slipped 7% on weak results. Higher raw material costs impacted the company’s profitability. Tata Metaliks is hopeful of doubling its production capacity by March-end. 🏭 Here are the key numbers:

- Revenue: Rs 645 cr; +25% YoY

- Net Profit: Rs 55 cr; -33% YoY

Sandeep Kumar, Managing Director, at Tata Metaliks told CNBC:

Margins have been impacted because input costs are going up… we have increased prices in the pig iron business, but the ductile iron pipe business takes a bit of a time; it’s more stable. We have an order book of +12-14 months.

Tata Metaliks is +73% YTD. 📈

GM Breweries rallied +6% on bumper results. Strong demand boosted the company’s topline. Margins expanded to 25.2% vs 20.9% the previous year aided by cost savings. 🥃 Here are more details:

- Revenue: Rs 116 cr; +60% YoY

- Net Profit: Rs 22 cr; +96% YoY

GM Breweries is up ~2x YTD. 💰

Ready To Fly

Rakesh Jhunjhunwala backed Akasa Air is all set to take off next summer! Fasten your seat belts cuz it’s going to be one hell of a ride. ✈

SNV Aviation, which operates Akasa Air, has received a No Objection Certificate (NOC) from the Ministry of Civil Aviation. Ex-Jet Airways CEO Vinay Dube will be the pilot in charge of the new airline. 👨✈️

Akasa Air plans to follow an ultra-low-cost carrier (ULCC) model. Typically, these airlines are famous for low fare rates. But how do they pay the bills? A ULCC airline makes money from advertisements, food and beverages (except water), and limited baggage allowances. 80% of the Indian aviation market is dominated by low-cost carriers. 📊

But, it is by no means the gold standard. Take the case of Kingfisher or Jet Airways. Airlines in India have been struggling for years due to competition, weak pricing power, and high fixed costs. 🔒

Back in July, we discussed Jhunjhunwala’s awesome timing of foraying into the aviation space. But, a lot has changed since then. Jet Airways is back with a fresh lease of life. The troubled airline is ready to spread its wings from Q1 2022. Air India’s return to Tata Sons after 68 years is sure to increase competition. 🤼♂️

The new airline will have its task cut out from day 1. We just want to wish them All The Best! 👍

Overheard on Stocktwits

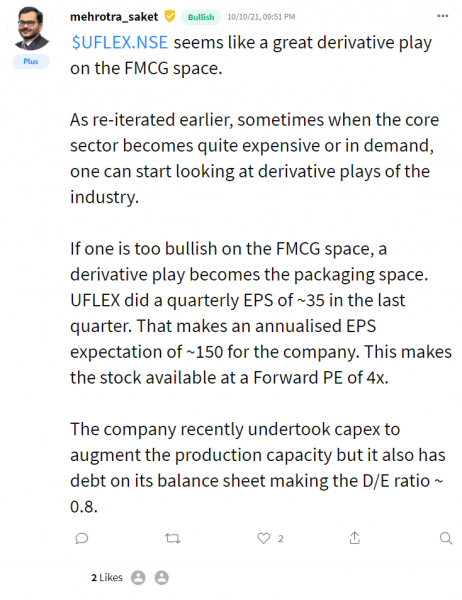

Here’s an interesting fundamental take on Uflex Ltd by Saket Mehrotra on Stocktwits. Add $UFLEX.NSE to your watchlist and track its performance.

Big Plans

CRED is reportedly in talks with investors to raise more money. The latest fundraise is expected to value the startup at $5.5 billion, according to TechCrunch. 💰

Details are scarce at the moment. Early reports indicate that CRED will use these funds to pursue overseas expansion and acquisitions. The Bangalore-based startup raised $215 million in a Series D funding round back in April. 📊

CRED rewards customers for paying their credit card bills on time. It does so by giving them points that can be redeemed for cash back and discounts on high-end brands. It claims to serve 6+ million customers making up +20% of all credit card bill payments in India. Tiger Global, DST Global, and Falcon Edge, are large investors in the company. 💳

There’s a lot going on at CRED. The company recently invested $5 million in CredAvenue. It is also in talks to back fintech startup Uni. CRED recently launched peer-to-peer (P2P) lending and is also busy scaling up other revenue channels. 🤑

Links That Don’t Suck

💸 More Global Biggies Line Up For Paytm’s $2.2-Billion IPO

📱Apple’s iOS 15 Is Here—These Are All The Top New Features

❣ Man Builds Rotating House So His Wife Has Better Views

🏍This Startup Can Convert Your Petrol 2-Wheeler To Electric In Just 4 Hours

🤣 Kim Kardashian Roasts Entire Family Including Estranged Husband Kanye West In Her ‘SNL Monologue

🏏 KL Rahul Likely To Part Ways With Punjab Kings In IPL 2022

🦸♂️ DC’s New Superman, Jon Kent, Comes Out As Bisexual In Upcoming Comic