Tale of the Tape

Hello, everyone. The stock market had a bad day.

Nifty and Sensex fell the most in over 7 months. Concerns over steep valuations and fresh spurt in Covid cases across Europe hurt sentiment. Midcaps (-3%) and Smallcaps (-2.8%) also saw deep cuts. 🔻

Not a single sector closed higher. PSU Banks (-4.5%) were beaten down the most. Real Estate (-4%) and Autos (-3%) added further weakness. 👎

Reliance Industries called off its deal with global oil giant Saudi Aramco. The stock fell ~5%. Read more below. 🚫

Bad to worse. Paytm extended its poor run on Dalal Street with another -13% cut. The company’s market cap is down over Rs 50,000 cr since listing. 😓

Bharti Airtel (+4%) hit a new all-time high. The company will increase monthly tariffs by 20%-25% from Nov 26. More details are below. 📱

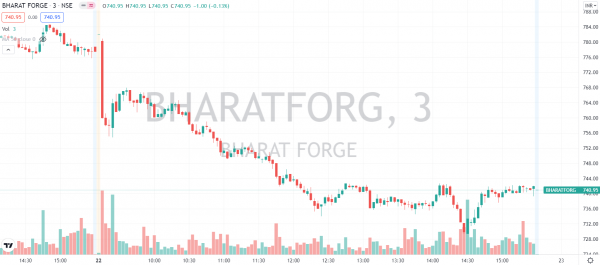

Companies with high exports to Europe came under pressure amidst fears of fresh lockdown. Tata Motors, Motherson Sumi and Bharat Forge slipped between 4%-5% each. Check out their charts below. 📉

JBM Auto (+3%) will consider the proposal of a share split on Dec 8. ✌

IRCON International (+1%) won new orders worth Rs 140 cr. 💰

Go Fashion IPO got oversubscribed 128x on final day. 🤯

Cryptos edged lower. Bitcoin and Ethereum were down 3%. Solana (+2%) bucked the trend. 😎

Here are the closing prints:

| Nifty | 17,417 | -2.0% |

| Sensex | 58,466 | -2.0% |

| Bank Nifty | 37,129 | -2.2% |

No Longer Friends?

Reliance Industries and Saudi Aramco have pulled the plugs on a major deal. The two companies have been sitting on an investment proposal estimated to be about $15 billion.😮

As part of the deal, the global oil giant was set to acquire a 20% stake in Reliance’s oil-to-chemicals (O2C) business. However, volatility in oil prices and COVID pushed the timelines for the deal closure. For now, the two companies have decided to re-evaluate the proposal. 👀

So what changed? Reliance is betting big on its renewable energy business. The company will invest Rs 75,000 cr over the next 3 years to transition itself into a full-fledged green company. It also acquired 100% stake in the world’s largest solar equipment maker, REC for $771 million. 💰

What happens now? A massive push towards green energy while burning more fossil fuels didn’t seem right for Reliance. The Aramco deal would have been a key re-rating trigger for the stock. Experts say the company’s failure to crack the deal has come as a negative surprise. No wonder the stock was hammered -4%. 📉

Show Me The Money

Bharti Airtel will increase the price of monthly prepaid plans by 20%-25% from Nov 26. 📈

Airtel said the price hikes will help the company scale up its network infrastructure. It will also provide a much needed boost to its financials ahead of the 5G spectrum auction. 💸

Big Picture: For some background, the telecom sector has long struggled with low ARPU (average revenue per user). Stiff competition, huge debt, and the average gross revenue (AGR) dispute have significantly impacted the industry dynamics. 💔 Weaker players have either gone bankrupt or merged with others.

Fun fact: The latest move comes soon after Airtel raised prices of entry-level plans by 60% back in July. This may indicate the return of pricing power for telecom operators. 💪

Sunil Bharti Mittal, chairman at Bharti Airtel said:

We need to get to Rs.200 ARPU very quickly and I do not have a crystal ball in front of me, but if this industry needs to thrive, we need to get to Rs.200 ARPU within this financial year. Eventually, this industry needs to be at Rs.300 per customer per month.

Chartbusters

There has been a sharp rebound in Covid-19 cases across Europe. Reports of harsh lockdown-like restrictions being imposed created panic among investors. 😬 Exports to these countries make up for a bulk of the total revenue for companies like Tata Motors, Motherson Sumi and Bharat Forge. Check out their charts below: 📉

Add To Cart

Flipkart will acquire online pharmacy startup SastaSundar Marketplace. Details about the deal are not available but the startup was last valued at $125 million in 2019. 🤑

The deal will help Flipkart enter the fast-growing digital healthcare segment. The Walmart-backed company will initially offer e-pharmacy services to its customers. Going forward, it plans to expand into diagnostics and consultation. 🩺

The e-health sector is estimated to grow 10x to $15 billion by 2025, according to RedSeer Consulting. The Covid-19 pandemic turbocharged the sector’s growth potential. Besides that, rising internet penetration and aggressive pricing have also attracted more users. 📊

While the market opportunity is huge, Flipkart will have its task cut out from day 1. Both Reliance and Tata Group have acquired established players in this space. Then there is the IPO-bound PharmEasy. Let’s see how this goes. 🔥

Links That Don’t Suck

✅ El Salvador Plans First Tax-Free ‘Bitcoin City’, Backed By Bitcoin Bonds

💰 Hedge Fund CEO Who Bailed Out Gamestop Short Seller Bought The Constitution

👎 Most Twitter Users Are Simply Talking To Themselves, Finds Study

💯 I’m Still Young’: With A Thriving Biz At 90, Kiran Mazumdar-Shaw’s Mom Is An Inspiration

🥇 Suriya’s ‘Jai Bhim’ Overtakes ‘the Godfather’ To Claim The Top Spot On IMDb

🎮 League Of Legends’ 2022 World Championship Will Be A Multi-City Affair