Tale of the Tape

Good evening everyone. Today was pretty volatile. 😕

Nifty and Sensex closed barely down on monthly Futures & Options expiry. Midcaps (-0.3%) and Smallcaps (+0.3%) traded mixed. The advance-decline ratio was evenly split. 🤝

Most sectors ended in the red. Metals and Energy stocks fell the most, down 1.3% each. IT (+1.1%) stocks extended their record-breaking run. 📈

HDFC Bank is up only 2% in 2021, its worst yearly performance since 2013. What’s gone wrong for the banking giant and what can you expect in 2022. More detail below. 👇

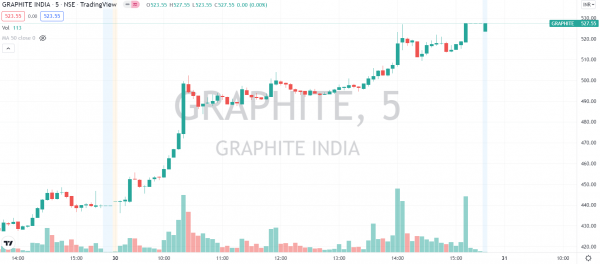

Graphite electrode makers were in high demand. Graphite India was locked in a 20% upper circuit. HEG rallied +13%. Check out their charts below. 📊

Delta Corp tanked 5% after the Goa government ordered all casinos to run at 50% capacity. 🚨

RBL Bank received the RBI approval to appoint Rajeev Ahuja as interim MD & CEO. Yet, the stock closed down 9%. 📉

Shares of recently listed companies saw healthy gains despite overall market weakness. Supriya Lifesciences surged 9%. HP Adhesives was locked in a 5% upper circuit for a third straight day. 🚀

NTPC (+3%) is in talks with investors for its renewable energy business, as per media reports. 🎤

Kalpataru Power (+5%) won new orders worth Rs 1,560 cr. 💰

Cryptos extended their post-Christmas rout. Bitcoin and Ethereum slipped ~3%. Cardano crashed 5%. Solana, Doge, and Shiba Inu dropped between 2%-4%. 😔

Here are the closing prints:

| Nifty | 17,203 | -0.1% |

| Sensex | 57,794 | -0.1% |

| Bank Nifty | 35,063 | +0.1% |

DOA: Dead or Alive

HDFC Bank has been the darling of Dalal Street for several years. However, something changed in 2021. The stock (+2%) has barely moved, its worst performance since 2013. Heck, even ITC beat the banking giant with a 3% gain. 😧

What’s the deal bro? The Reserve Bank of India (RBI) banned the private lender from issuing new credit cards following several complaints of tech glitches. ⛔ Peers SBI and ICICI Bank took advantage of the ban and shored up things. Covid issues didn’t help and consistent selling from foreign investors added further pressure. 😟

What’s next? Experts say hopes of improved earnings plus attractive valuations increase its appeal. Some much-needed love from foreign investors in 2022 may come in handy. But, fears of a third wave may postpone this recovery, they warned. 😰

Off The Chart

Graphite India and HEG were in high demand. Graphite electrode prices are set to increase by Rs 20,000 per ton from Jan, as per SteelMint. Pickup in steel production has also boosted the demand for graphite electrodes, used in steel making. 😎

Graphite India posted its highest single-day gain since Sept 2019. HEG bumped up 13%. Check out their charts below:

Under The Tax Scanner?

Zomato and Swiggy may come under the Income Tax Department’s radar. ⚠️

What’s the matter? Starting Jan 1, all online food delivery companies will be treated like restaurants and pay 5% GST. The tax code mandates these companies to pay GST on the total cost of food. But, here’s the catch. 📝

Unlike traditional restaurants, Swiggy and Zomato have partnerships with various banks that allow them to offer higher discounts. Tie-ups with large restaurant chains can further increase the discounts. The definition of the total cost of food does not distinguish between the gross price and net of discount, causing a headache for both parties. 😞

Swiggy and Zomato have consistently recorded losses and GST rules will only add more pain. Reports suggest the delivery apps may hike the GST charge to 18% in order to claim tax credits. That means your food bill could rise in 2022. Can we skip to the good part? 🥺

Where’s My Money?

Fintech sector bad loans jumped 2.5x YoY to 4.6% in the September quarter, as per the latest RBI data. 😮 This is significantly higher compared to private banks (2.2%) and NBFCs (3.8%). 🚫

Digital lending has seen a sharp uptick post-Covid. Rising smartphone penetration, hassle-free process, and attractive schemes like Buy Now Pay Later (BNPL) have boosted their popularity. Paytm, Mobikwik, Simpl, and LazyPay have been the winners in the overcrowded space. ✅

But, this growth has come at a cost. Most of these startups lend to high-risk first-time borrowers. Aggressive sales tactics to hit lofty targets is another industry-wide evil. Beating the banks at their own game is tougher than one imagined. 🙈

Links That Don’t Suck

🎮 Fortnite Servers Were Down For Five Hours, But Now The Game Is Back Online

🤑 Here Are The Startups That Raised Big Money In First Round Of Funding

📺 October Registered Highest Cryptocurrency Ad Volumes On Television During July-Nov 21

🤔 What Happens When An AI Knows How You Feel?

💔 Why You Feel Like Breaking Up With Your Partner Around The New Year

🏏 Relentless Shami, Bumrah help India go 1-0 up with first win in Centurion