Tale of the Tape

Hey, ya’ll! Happy hump day! 😇

Nifty and Sensex jumped over 1% following a sharp crack in oil prices overnight. PS – India is the world’s third-largest oil importer. Midcaps (+1.9%) and Smallcaps (0.5%) traded mixed. 📈

Except for Energy (-0.6%), all the sectors ended in the green. FMCG and Auto topped the list of gainers, +2.6% each. 💯

Q1 earnings. Bajaj Finance (+4%) and Godrej Consumer Products (+5%) solid business updates boosted investor sentiment. More detail below. 📊

Paint stocks were red hot. Asian Paints, Berger Paints and Kansai Nerolac rallied between 3%-7% each. Check out their charts below. 🔥

Maruti (+3%) will launch a new car on July 20. Reports indicate it could be the Jimny 4×4 SUV. 🚘

Kotak Mahindra Bank gained +2% after Goldman Sachs upgraded the stock to a “buy” rating. Also, they see a +26% upside from current levels. 💰

Titan (+2%) will expand its Tanishq brand of jewelry stores in North America. 💎

Havells India (+3%) will invest Rs 400 cr to set up a new manufacturing unit in Andhra Pradesh. 🏭

Container Corporation of India bounced +5% intraday. The GOI may consider a proposal to cut land licensing fees (LLF), according to media reports. ✅

J Kumar Infraprojects (+1%) won a Rs 571 cr order from Brihanmumbai Municipal Corporation (BMC). 🚧

Cryptos traded mixed. Bitcoin was up half a percent. Ethereum was flat. Solana rose 3%. ✌🏻

Here are the closing prints:

| Nifty | 15,989 | +1.1% |

| Sensex | 53,750 | +1.2% |

| Bank Nifty | 34,324 | +1.5% |

More Business Updates

Bajaj Finance (+4%) was the top gainer after posting a blockbuster Q1 business update. The company gave out fresh loans to 74 lakh customers, up 61% over the previous year. Assets Under Management (AUM) jumped 31% YoY to over Rs 2 lakh cr vs estimate of 25%-27% growth. That’s not all. Bajaj Finance added an all-time 27 lakh new customers in Q1. That’s insane! 🚀

Godrej Consumer Products (+6%) hit a five-month high on upbeat management commentary. The company forecasted double-digit sales growth in Q1 despite concerns over soaring inflation and muted rural growth. Higher exports plus continued traction in the core Personal and Home care segment turbocharged growth. Margins may take a hit owing to higher costs but experts believe it is on expected lines. Interestingly, the company is confident of higher sales and margins from Q2 onwards following a sharp drop in key raw material prices in recent weeks. 💰

Color Me Green

Paint stocks were in high demand as international oil prices crashed over 10% on recession fears. This is a huge positive for paint companies. Here’s why: oil is a crucial raw material and accounts for +50% of their total expenses. Hence, lower oil prices would reduce total costs and boost operating income. 📊

Most paint companies had taken multiple price hikes in the past year to tackle higher oil costs. Hence, the recent cool-off gives them ample room to protect against any future volatility, which is a big W, said experts. ✅

Asian Paints, Berger Paints and Kansai Nerolac rallied between 3%-7% each. Check out their charts below:

Stocktwits Spotlight

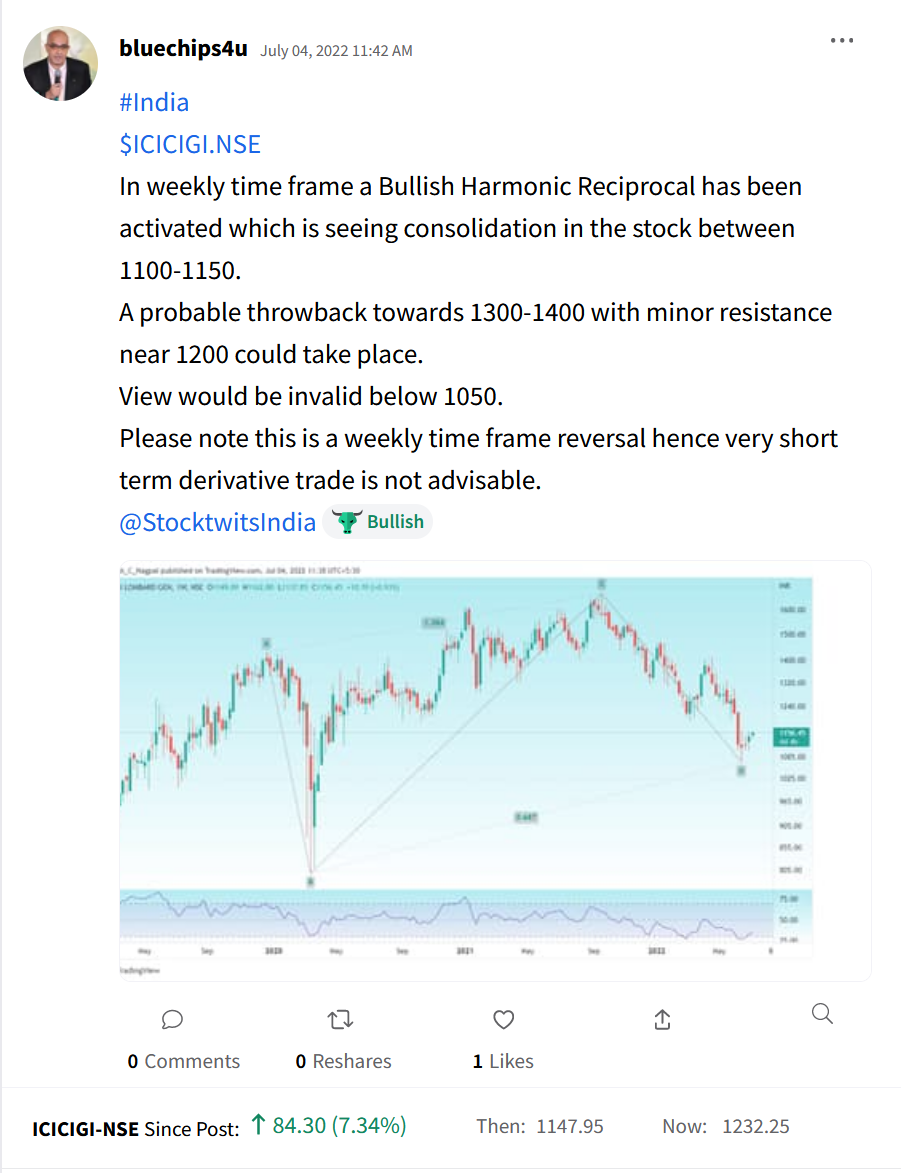

ICICI Lombard General Insurance is up +7% in just 2 days! Huge shoutout to Dinesh Nagpal for spotting the trade. Follow him for more awesome trade ideas and add $ICICIGI.NSE to your watchlist and track its performance. Here’s the link: https://bit.ly/3AvwHOS.

Links That Don’t Suck

💰 Celsius Repays $183m On Defi Exchange Maker, Gets Back Collateral, Blockchain Data Shows

🙏 20 Year Indian Student’s Machine Learning Software To Be Sent To Space

🔥 ‘Stranger Things 4’ Crosses 1 Billion Hours Viewed On Netflix; Inches Closer To ‘Squid Game’

💼 If You Thought Techies Got The Biggest Hikes Last Year, Think Again…

🧳 Thailand Ends Almost All Travel Restrictions — But One Key Rule Remains