Tale of the Tape

Good evening ladies and gentlemen. Markets extended their record winning streak. 🔥

Nifty and Sensex rebounded from the lows to end with minor gains. Midcaps and Smallcaps also moved in tandem, up 0.2% each. 📈

Sectoral gainers and losers were split equally. The Nifty Realty Index (+1.6%) closed up for a fifth straight day. IT (-0.8%) and Auto (-0.5%) stocks witnessed profit booking. 💸

SBI Cards & Payments dropped over 5% intraday after the RBI proposed changes to payment norms. More details below. 🤯

Sona BLW fell 4% after 10.2 cr (17% equity) changed hands in multiple block deals. 🤝

Spicejet (+2%) and Credit Suisse agreed to explore an out-of-court settlement of their long and messy legal battle. ⚖️

IRCTC (+6%) has invited bids to sell rail ticketing data, according to media reports. 💰

Indo Amines was locked in a 20% upper circuit after receiving the thumbs up from the Environmental Ministry to set up a new plant. ✅

Power Mech Projects (+3%) won new orders worth Rs 6,100 cr from Adani Group. 🤑

Syrma SGS Technologies IPO was oversubscribed 33x on the final day. Prem Watsa-backed Digit Insurance filed IPO papers with SEBI. Read more below. ✌️

Cryptos traded lower. Bitcoin and Ethereum slipped ~2%. Meme coins Doge and Shiba Inu fell up to 6%. 📉

Here are the closing prints:

| Nifty | 17,956 | +0.1% |

| Sensex | 60,298 | +0.1% |

| Bank Nifty | 39,656 | +0.5% |

Party Pooper

The Reserve Bank of India (RBI) proposed changes to the fees levied by credit card companies. 💸

The new guidelines involve either a reduction in Merchant Discount Rate (MDR) – a fee paid by merchants to acquiring banks, or imposing a tier-based structure. This is a huge negative for India’s second-largest credit player, SBI Cards & Payments. “Charges for payment services should be reasonable and competitively determined for users while also providing an optimal revenue stream for the intermediaries,” RBI said in its discussion paper. 👎

Credit cards are the most profitable business for banks. To date, the RBI did not regulate MDR charges on credit card transactions. MDR-related fees make up 1/4th of the total income for SBI Cards. Any change to the fee structure would have a direct impact on the company’s profitability. PS. Goldman Sachs estimates that a 0.1% cut in MDR may result in a 7% drop in its FY23 profits. Yikes! 🤕

The RBI will continue discussions with all stakeholders before taking a final decision. Even so, the proposal has caused panic among investors. But, if the RBI chooses not to tweak the fee structure then it will lift a major overhang from the stock. Watch out for this space! 👀

Raining IPOs

Canadian billionaire Prem Watsa-backed Digit Insurance filed its IPO papers with market regulator SEBI. The unicorn startup aims to raise Rs 5,000 cr from the markets! 💰

The public offer will be a mix of fresh issue and sale by existing promoters. Pricing details are not yet available but reports indicate that the company is targeting a $4.5-$5 billion valuation. 😎

Founded in 2017, Digit provides motor, health, travel, and other small-ticket insurance. They aim to capitalize on India’s under-penetrated general insurance market by delivering best-in-class customer experience like easier claim settlements. Digit founder Kamesh Goyal is an insurance sector veteran having previously worked with Germany’s Allianz and headed its Indian joint venture. Digit hit Unicorn status after raising $200 million in a funding round led by Faering Capital in July last year. Fun fact: King Kohli is one of the investors in the startup. 💯

Financial Snapshot: (FY22)

- Revenue: Rs 3,841 cr; +71% YoY

- Net Loss: Rs 296 cr; vs Net Loss of Rs 123 cr YoY

- Assets Under Management: Rs 9,394 cr; +68% YoY

Speaking of IPOs, it is expected to be a busy second half for the primary markets. A whopping 71 companies have received SEBI clearance to launch their public offer. Aadhar Housing Finance, BoAt, and PharmEasy are some of the marquee names. Let’s go! 🕺

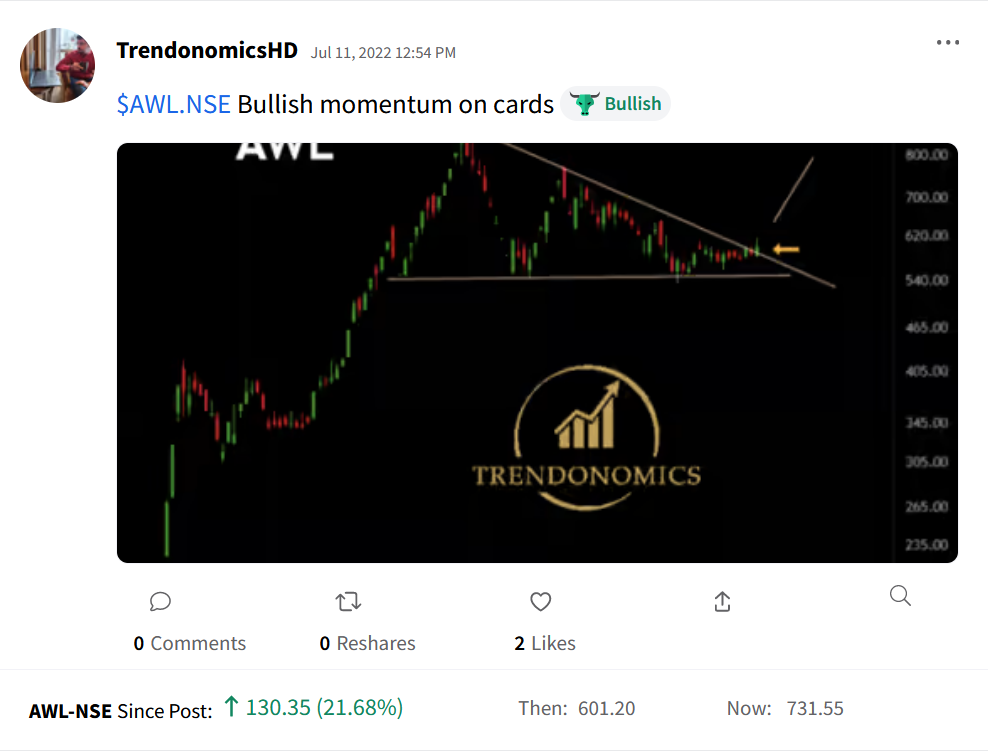

Stocktwits Spotlight

Adani Wilmar is up +21% since Harsh Dixit aka TrendonomicsHD shared his view on Stocktwits. Follow him for more amazing trade ideas and add $AWL.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3QBD1te.

Links That Don’t Suck

🧐 Investing In The Times Of Uncertainty (Business Insider India)

🚨 Coinbase Has A Serious Insider Trading Problem, Study Claims

🙏 ‘Found My Kids Playing With Plastic Trash At A Beach So I Cleaned Up 650 Tonnes Of It’

🤣 Mark Zuckerberg Launches Meta’s ‘Horizon Worlds’ & Immediately Gets Trolled For Its Bad Graphics