Tale of the Tape

Hey folks. One more day to go for the weekend. 😇

Nifty and Sensex recovered from the lows to end with minor gains. Midcaps (+0.2%) and Smallcaps (+0.6%) fared better. The advance-decline ratio was split evenly. ✌️

Most sectors closed higher but the gains were muted. FMCG (+2.3%) and IT (+1.8%) were the key sources of strength. Metals (-4%) hit a 3-month low. 📉

Adani Enterprises tanked 25% after they called off their Rs 20,000 cr FPO. Adani Green and Adani Transmission were locked in a 10% lower circuit. 🚨

Britannia was the top gainer on Nifty after blockbuster Q3 results. More details below. 💯

ITC rallied +5% intraday to hit a new all-time high. 🚀

Insurance stocks were under pressure for a second straight day. Max Financial dropped 7%, and HDFC Life (-6%) hit a new 52-week low. 🤕

IDFC First Bank jumped +3%. Promoters IDFC Ltd will invest Rs 2,200 cr in the lender. 💸

Hero MotoCorp’s Jan sales were down 6% over the previous year.

Earnings Reaction. Ashok Leyland gained +3% intraday. Dr Lal Path Labs hit a 6-month low. 📊

Cryptos were up big post the US Fed comments. Bitcoin (+4%) hit the highest level since August and Ethereum rallied by +6%. 😇

Here are the closing prints:

| Nifty | 17,610 | -0.1% |

| Sensex | 59,932 | +0.4% |

| Bank Nifty | 40,669 | +0.4% |

Earnings Roundup

Britannia (+5%) legit killed it in Q3. The company beat Street estimates on all counts. Britannia continued to gain market share even as most FMCG players witnessed a slowdown. PS – they’ve consistently gained market share over the past 39 quarters!!! 💯

Their scale and value-for-money offerings give it an edge over its competitors, said experts. They have an army of 2.6 million pan-India distributors with a robust presence in rural areas. EBITDA Margins hit a 10-quarter high aided by price hikes and operational efficiency. This in turn boosted overall profitability. Here are its key stats: 📊

- Revenue: Rs 4,197 cr; +17% YoY (vs Est: Rs 4,125 cr)

- EBITDA: Rs 818 cr; +52% YoY (vs Est: Rs 675 cr)

- EBITDA Margin: 19.5% (vs Est: 16.4%)

- Net Profit: Rs 932 cr; +29% YoY (vs Est: Rs 465 cr)

Britannia will host its Q3 analyst call later today. Management commentary on demand trends, outlook on price hikes and future growth initiatives will be critical. Let’s see how this goes. 🔥

Britannia is +26% in the past year. 📈

Budget: Thumbs Up

Finance Minister Nirmala Sitharaman’s last full budget ahead of the 2024 General elections focused not just on economic growth but also on careful financial management. The Budget provided tax stimulus largely via direct tax proposals and a few indirect tax proposals which should be positive for consumption, and may boost manufacturing and exports, said experts. ✅

- The Govt will spend Rs 10 lakh crore on infrastructure projects; +33% over the previous year. This will boost credit growth which is positive for banks like SBI, Axis, HDFC and Kotak, according to ICICI Securities. 🏦

- The defence sector received Rs 5.94 lakh crore; +15% YoY. Of this, Rs 1.62 lakh cr will be used to buy new weapons, aircraft and warships. This is positive for companies like Bharat Dynamics, Bharat Electronics, Hindustan Aeronautics, Mazagon Dock Shipbuilders and Garden Reach Shipbuilders, as per HDFC Securities. 👍

- Proceeds from life insurance policies with over Rs 5 lakh premium will be taxed from FY24. This will not only have a negative impact on business but also deter insurance penetration, said Motilal Oswal Securities. 🚫

- To boost EV manufacturing and its penetration the Govt increased the subsidy under the FAME policy by 78% to Rs 5,172 cr. Custom duty on lithium-ion batteries used in electric vehicles was also reduced to 13% (vs 21% earlier). Tata Motors, TVS Motors, Sona BLW, and Exide Industries would gain big time from this. ⚡

The GOI has set aside Rs 35,000 cr to boost investments in the renewable energy sector. Additionally, they have allocated nearly Rs 20,000 cr to achieve 5 MT per annum of green hydrogen production. NTPC, PowerGrid, JSW Energy and Tata Power stand to benefit from this, according to JM Financial. ♻️

Winner Winner Chicken Dinner

Congratulations Naivedh Shah for winning the Community Star of the Month! ⭐

Naivedh’s top idea, Indiabulls Housing Finance, is down ~20% in the past month! Here are a few investment & trading ideas shared by him on Stocktwits that you must check out: 😎

- $AUTOAXLES.NSE: https://stocktwits.com/naivedhshah/message/505407633

- $RAJESHEXPO.NSE: https://stocktwits.com/naivedhshah/message/504208369

Bio: Naivedh has been actively trading for 3 years and specializes in catching breakouts in cash stocks. Follow him for more awesome trading insights like these. Here’s the link: http://www.stocktwits.com/naivedhshah

Disclaimer: All ideas shared by Naivedh Shah are for educational purposes. Naivedh Shah is neither SEBI registered nor an investment advisor.

Earnings Highlights

- Housing Development Finance Corporation: Net Interest Income: Rs 4,840 cr; (+29% YoY) | Net Profit: Rs 3,691 cr; (+13% YoY)

- Ashok Leyland: Revenue: Rs 10,400 cr; (+56% YoY) | Net Profit: Rs 319 cr;

- Godrej Properties: Revenue: Rs 405 cr; (-13% YoY) | Net Profit: Rs 59 cr; (+51% YoY)

- Dr. Lal PathLabs: Revenue: Rs 489 cr; (-2% YoY) | Net Profit: Rs 53 cr; (-8% YoY)

- Titan: Revenue: Rs 10,875 cr; (+14% YoY) | Net Profit: Rs 951 cr; (-4% YoY)

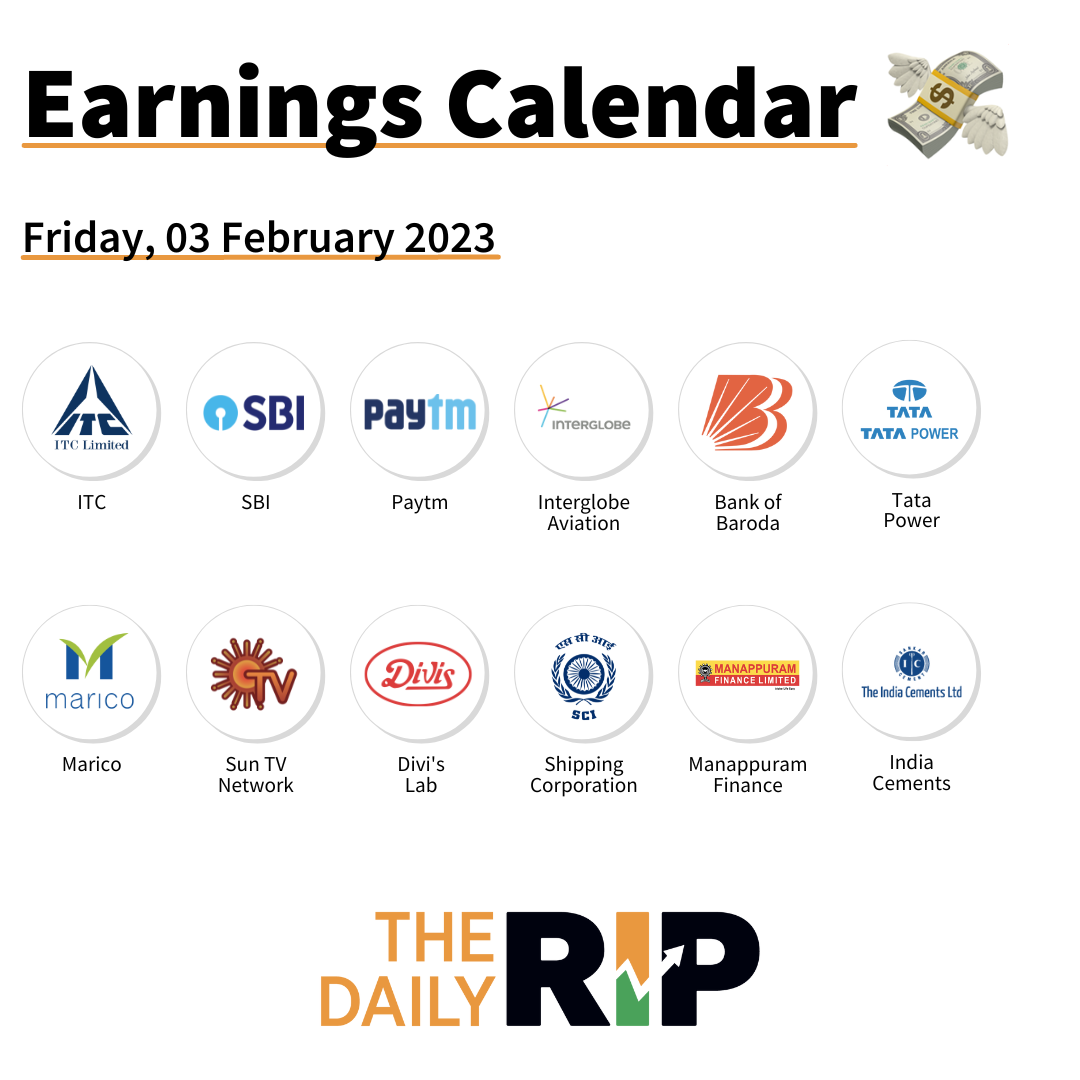

Calendar