Tale of the Tape

Hey, guys. Markets were back in the green after yesterday’s ugly cut. 🟢

Nifty and Sensex pulled back +0.7% each tracking the overnight gain in US stocks. Midcaps (+0.6%) and Smallcaps (+0.7%) also moved in sync. 📈

Most sectors ended higher. Banking and NBFC stocks led the list of gainers; +1.5% each. On the other hand, IT (-1%) stocks continued to fall. 🤕

Reliance Industries (+3%) snapped its 8-day losing streak. CLSA sees a +30% upside from current levels. More details below. 💰

Tax filing season is back! We take a close look at the top 3 equity-linked savings schemes (ELSS) in our special section below. 🤓

Phoenix Mills closed up for a third straight day. Domestic brokerage firm Motilal Oswal sees a +30% upside from current levels. ✌️

HDFC AMC rallied +5% after SBI MF bought a 2% stake. Separately, UTI AMC bounced 4% after Parag Parikh Mutual Fund bought 11.2 lakh shares (0.9% equity). 👀

Sterling & Wilson Solar (+7%) won a Rs 2,100 cr from NTPC. 💸

Sobha closed down for a third time in the past four days after the Income Tax Department raided its offices. 🚨

Here are the closing prints:

| Nifty | 17,107 | +0.7% |

| Sensex | 58,074 | +0.8% |

| Bank Nifty | 39,894 | +1.5% |

Deep F*#&ing Value!

Shares of Mukesh Ambani-led Reliance Industries have been under serious pressure. PS – the stock hit a new 52-week low on Monday vs a minor cut for the Nifty 50 Index during the same period. WTF!!! 😢

One of the major reasons behind this underperformance was the sudden change in GOI policy on fuel exports. Expensive valuations plus weak investor sentiment amidst fears of a global recession only made matters worse. ⛔

But, CLSA believes the recent correction makes RIL a “bargain buy” at current levels, according to its latest report. RIL’s current valuations ascribe no value to its new energy business and do not factor any progress made by its telecom and retail arm in the last 3 years, said CLSA. 🔍

According to the latest TRAI data, Jio continues to grow faster than the industry average. This has not only helped Jio retain its leadership but also solidify it by gaining market share. Reliance also successfully launched its FMCG business under the “Independence” brand. They continue to acquire top brands (Campa Cola, Metro Cash & Carry) and drive the e-commerce business. 💯

A slew of growth initiatives like the launch of an affordable 5G smartphone, ramp up of its FMCG business and the possible IPO of Jio/retail are key rerating triggers, said CLSA. Based on this, they have a 12-month target of Rs 2,970 per share; +30% from current levels. Watch out for this one! 🔥

Tax Season!

It’s that time of the year when everybody is scampering to save tax and equity-linked savings schemes (ELSS) are a popular option. 💸

ELSS mutual funds help investors save tax under Section 80C of the Indian Income Tax Act with a three-year lock-in period. Deductions under this section are fully exempt from tax up to Rs 1.5 lakh a year. ✅

ELSS mutual funds are structured like any other equity mutual funds. This means that they not only provide tax-saving benefits but also aim to generate consistent long-term returns!!! Here’s a roundup of the top 3 ELSS mutual funds based on their 3-year returns. PS – we’ve only considered direct schemes for the purpose of this analysis: 🤓

- Quant Tax Plan Growth:

Minimum initial investment: Rs 500

AUM: Rs 2,780 cr

Expense Ratio: 0.57%

Quant Tax Plan Growth is the best-performing scheme in the ELSS category with a +50% return in the past 3 years. Rs 10,000 monthly SIP for 3 years would’ve become Rs 5.28 lakh after the expiry of the lock-in period. A majority of its assets are invested in blue-chip stocks. Their top 5 holdings include ITC, Reliance Industries, HDFC Bank, SBI and L&T.

- Bandhan Tax Advantage (ELSS) Fund:

Minimum initial investment: Rs 500

AUM: Rs 4,020 cr

Expense Ratio: 0.75%

Bandhan Tax Advantage (ELSS) Fund has generated a 37% return in the past 3 years. PS – It was earlier known as IDFC Tax Advantage (ELSS) Fund before it was acquired by the Bandhan Group. Daylnn Pinto will continue to remain as the fund manager. 47% of the scheme’s funds are invested in large caps. 3 out of their top 5 holdings are banking stocks – ICICI Bank, SBI and HDFC Bank.

- Parag Parikh Tax Saver Fund:

Minimum initial investment: Rs 500

AUM: Rs 1,150 cr

Expense Ratio: 0.80%

Parag Parikh Tax Saver Fund is up 33% in the past 3 years. PS – the fund started in June 2019. According to Morningstar India, the fund has a “below average” risk and a 5-star rating, which is positive. A majority of its assets are invested in blue chip stocks with a high weightage to the banking & financial sector. HDFC Ltd, Bajaj Holding, ICICI Bank, Axis Bank and ITC are its top 5 stocks.

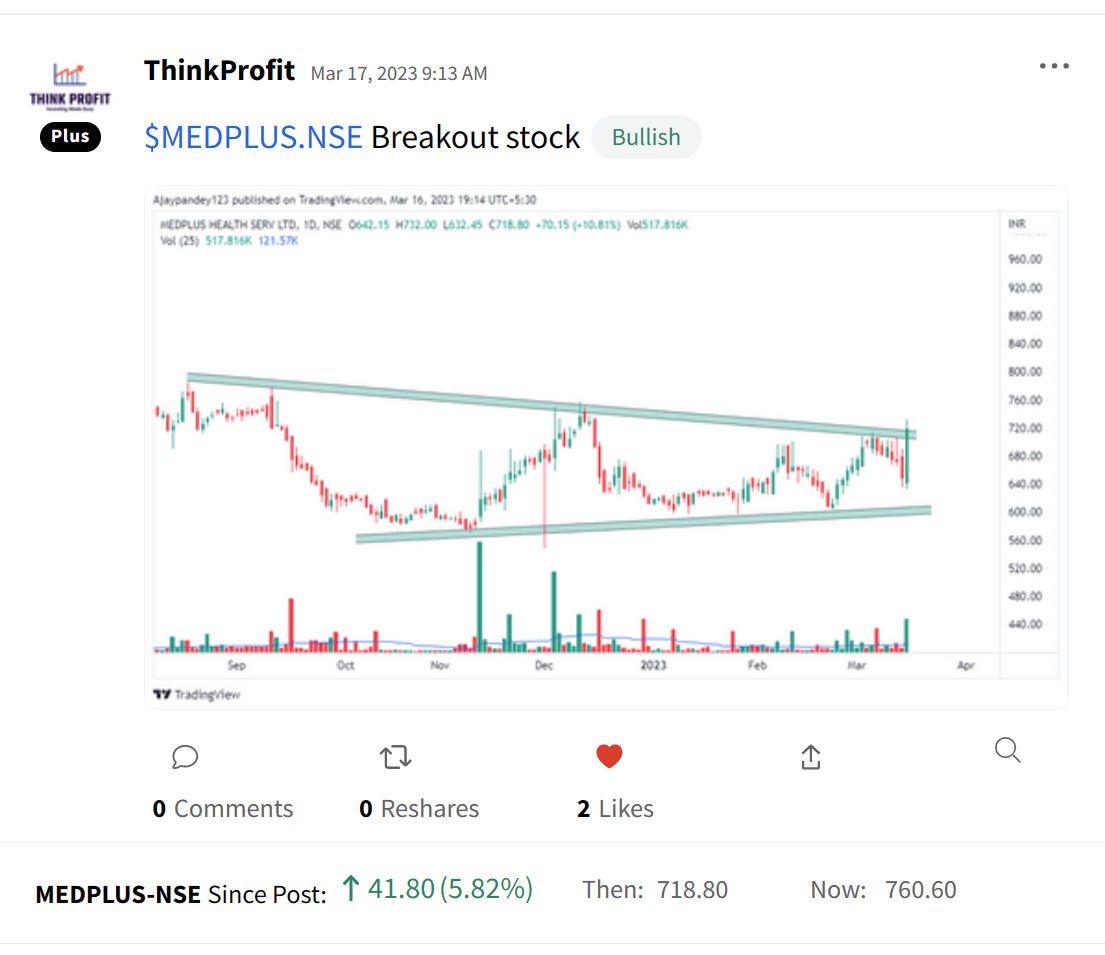

Stocktwits Spotlight

ThinkProfit is bullish on recently listed MedPlus Health. Follow them for more awesome trading insights and add $MEDPLUS.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3JAaEt2.

Links That Don’t Suck

😵💫 The 11 Days of Turmoil That Brought Down Four Banks And Left a Fifth Teetering

🎮 Netflix Games Is Still Happening. Just Don’t Hold Your Breath

😍 Text-to-video AI Inches Closer As Startup Runway Announces New Model

🚀 ISRO Plans To Start ‘Space Tourism’ At A Cost Of ₹6 Crore Per Passenger By 2030