Tale of the Tape

Good evening ladies and gentlemen. Markets were down AGAIN! 😢

Nifty and Sensex cracked over 1% intraday as fears of more bank failures wrecked global equity markets. Midcaps (-1%) and Smallcaps (-1%) continued to struggle. The advance-decline ratio (1:3) ratio remained firmly in favour of the bears. 🐻

Except for FMCG (+0.8%), all the other sectors ended lower. Metals (-2.4%) and PSU Banks (-1.7%) were punished the most. IT and Real Estate stocks also witnessed heavy losses; down -1% each. 📉

Gold prices hit a new all-time high of Rs 60,000 per 10 grams on soaring demand for safe assets. 💰

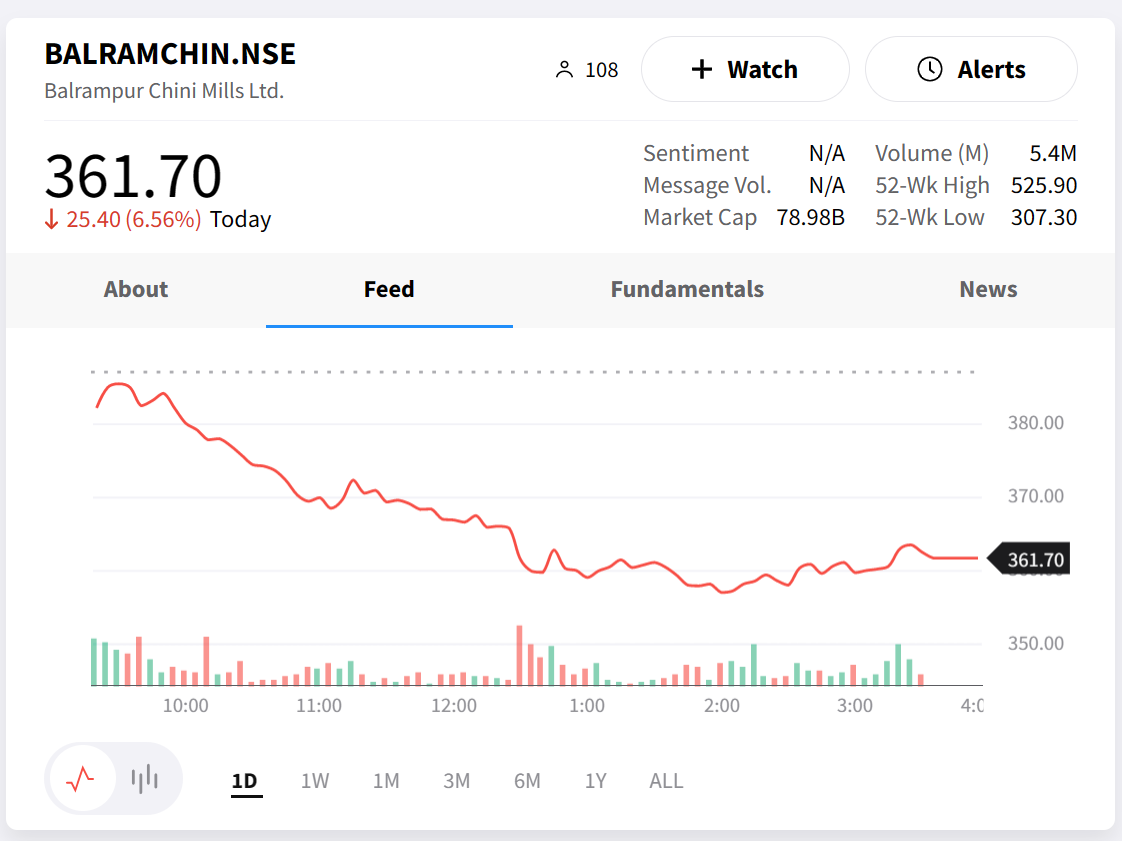

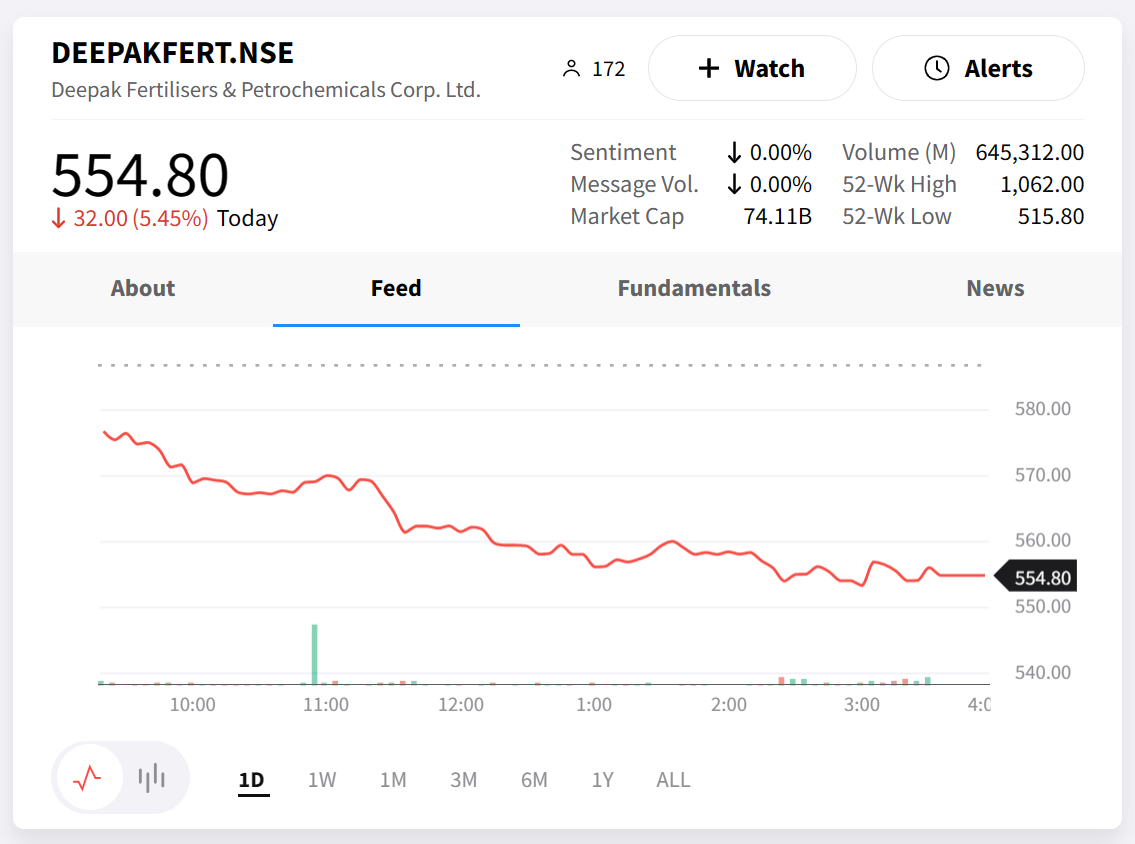

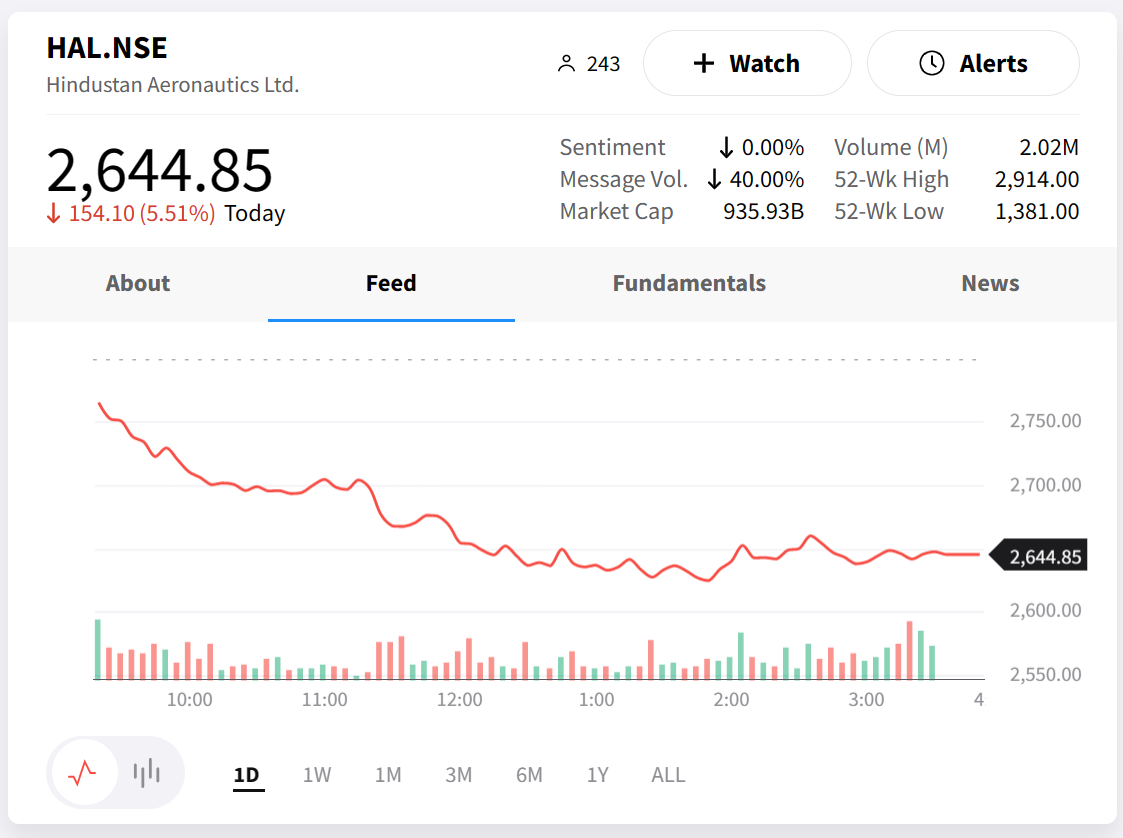

Midcaps and smallcaps got thrashed as investors prefer safer assets like gold. Many investor favourite stocks like Balrampur Chini (-6%), Deepak Fertilizer (-5.5%) and Hindustan Aeronautics (-5.5%) saw deep cuts. Check out their (horrifying) charts below. 📉

Adani Enterprises dropped nearly 4%. Adani Group stopped work on its Rs 35,000 cr petrochemical project in Gujarat. 👎

HDFC AMC hit a new 52-week low after 51 lakh shares (2.4 equity) changed hands in multiple block deals. 🔍

Navin Fluorine will invest Rs 450 cr to set up a new manufacturing unit in Gujarat. 🏭

Tata Consumer Products withdraws plans to buy Bisleri. 🚫

Godawari Power will buy back 50 lakh shares at Rs 500 apiece; +30% from current levels. 🤑

Cochin Shipyard (+3%) won a Rs 550 cr order from Norway-based Samskip Group. 💸

Cryptos continued to climb higher. Bitcoin hit a 9-month high. Ethereum traded flat. Solana jumped +8%. 🚀

Here are the closing prints:

| Nifty | 16,988 | -0.7% |

| Sensex | 57,628 | -0.6% |

| Bank Nifty | 39,361 | -0.6% |

What’s Happening To Banks?

The 2023 banking crisis took a new turn after Credit Suisse was sold to its biggest rival UBS Group for $3.2 billion. This mega-deal between the two Swiss banks comes days after Silicon Valley Bank and Signature Bank announced bankruptcy! 👀

This is a pretty big deal. For those who don’t know, Credit Suisse has been marred by numerous scandals, high-level exits and massive treasury losses in recent years. In fact, fears of Switzerland’s 2nd largest bank going bust have been floating around since last year! Credit Suisse’s failure to turnaround operations coupled with negative global news caused a bank run. 🏃

Financial term of the day: Bank Run

A bank run happens when a large number of people withdraw their money from a bank at the same time. They do so because they are worried that the bank might not be able to give them their money back. This can cause serious problems for the bank including a collapse.

The Swiss government is hopeful that the deal will restore confidence in its economy and banking system. Separately, reports indicate that Warren Buffett is in talks with the US government to discuss potential investment in regional US Banks. Experts say the move will help restore confidence in the struggling banking sector. Watch out for this! 🧐

Bottomline: Trust is the foundation upon which the banking system is built. Without trust, the entire financial system could collapse, which would have disastrous consequences for individuals and the economy as a whole. 🚨

Broader Markets Crash!

Midcaps and Smallcaps saw a savage correction. PS – the Nifty Midcap100 Index hit the lowest level since July 29!! The banking crisis in the US and Europe plus constant FII selling pressure dampened sentiment. Many investor favourite stocks like Balrampur Chini (-6%), Deepak Fertilizer (-5.5%) and Hindustan Aeronautics (-5.5%) saw deep cuts. Check out their (horrifying) charts below. 📉

Stocktwits Spotlight

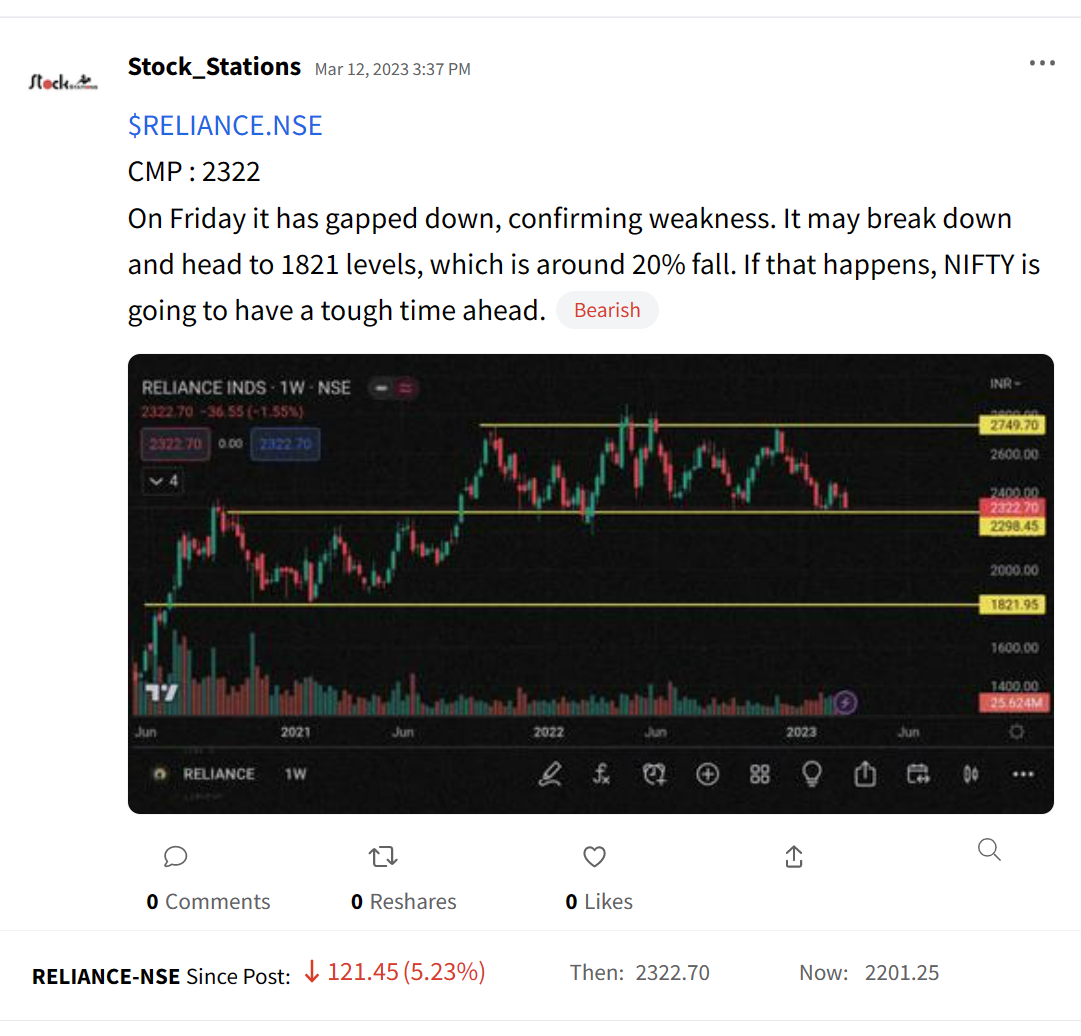

Reliance Industries closed down for an 8th straight day! Congratulations Stock Stations for timing the move to perfection. Follow them for awesome trade ideas and add $RELIANCE.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/40j2TOX.

Disclaimer: All ideas shared by Stock Stations are for educational purposes. Stock Stations is neither SEBI registered nor an investment advisor.

Links That Don’t Suck

👎 How Scandal and Mistrust Ended Credit Suisse’s 166-Year Run

😵💫 Former Coinbase CTO Places $2 Million Bet That Bitcoin Will Hit $1 Million In 90 Days

🌿 Banking Failures Are Hitting Weed Companies, Too

😇 A User Asked GPT-4 How Humans Can Get Along And The Answer Is Surprisingly Profound

💰 When Two Bengaluru Researchers Quit Their Jobs to Build Multi-Crore Samosa Empire

⚽ Barcelona 2-1 Real Madrid: Franck Kessie scores dramatic late winner as Barca win El Clasico