Tale of the Tape

Good evening, folks. Welcome back to the market of stocks. 🎲

Nifty and Sensex continued to climb higher. Hopes of a rate hike pause by the Reserve Bank of India plus sustained FII buying boosted sentiment. Midcaps (+0.2%) and Smallcaps (+0.4%) also inched up. 📈

A majority of the sectors ended in the green. The Nifty Auto Index (+1.3%) hit a new all-time high! Oil and Gas (+0.5%) and Banks (+0.4%) also strengthened. 💪

Markets are less than 2% away from their peak. Where should you invest your hard-earned money? Check out Goldman Sachs’s top multi-bagger picks below. 💰

Tata Chemicals rallied +4% intraday. The company will invest Rs 13,000 cr to set up an EV battery plant in Gujarat. 🔋

Info Edge slipped -3% after a double downgrade by global brokerage firm Macquarie. PS – they see a 30% downside from current levels!!! 🚨

HBL Power Systems surged +8% while Kernex Microsystems was locked in a 5% upper circuit. Indian Railways aim to expedite the use of anti-collision systems after the Odisha train tragedy. 🚉

SBI Life (+1.3%) will take over the life insurance business of the defunct Sahara Group. 👍

IKIO Lighting IPO opens for subscription tom. Check out our detailed analysis below. 💸

Here are the closing prints:

| Nifty | 18,593 | +0.3% |

| Sensex | 62,787 | +0.4% |

| Bank Nifty | 44,101 | +0.4% |

Investment Opportunity

From March lows, Indian markets have been on a roll! As the Nifty & Sensex move towards all-time highs, the hunt for the next multi-bagger stocks is underway. 🔍

As you look for the next big thing, here are brokerage firm Goldman Sachs’s top midcap multi-bagger picks: 💯

1) Container Corp of India: Founded in 1988, the company is in the business of cargo transportation. It manages ~70% of all containerized cargo that is moved by rail in India. After two rough Covid years, its FY23 was decent, with an 8% YoY top-line growth. ICYMI – while the GOI wanted to privatise it, the plans have been put on hold for now. Why bet big? The company is expected to gain BIG TIME from the ‘dedicated freight corridor’ project + GOI’s massive infra-capex cycle. The stock is up 6% over the past year. 🚧

2) Gujarat Fluorochemicals: The firm is a leading advanced chemicals manufacturer & is part of the INOX group of companies. Its products are used in everything from semiconductors to construction. The stock had a FANTASTIC run before correcting in late 2022. What does the bull case look like? Its fluoropolymer biz is poised to cash in on new-age industries like EVs, solar panels and green hydrogen. The stock is +17% in the last year. ♻️

3) Aditya Birla Capital: The company is the holding firm for the group’s financial business (NBFC, insurance, AMC etc). Over the last 3 years, apart from its health insurance vertical, all other businesses have been firing on all cylinders. With its asset quality issues now firmly behind it, experts believe FY24-26 will see a nice uptick in growth + lower credit costs + better return ratios. FYI – the stock is up 65% over the past year. 💰

IPO Time

LED light manufacturer IKIO Lighting will kick off its IPO on June 6. The price band is fixed at Rs 270-285 per share. 🤑

IKIO Lighting is a B2B lighting solutions manufacturer. It caters to the premium segment of the market. The company produces refrigeration lights, fan regulator switches, ABS drainage pipes and recreational vehicle components. In 2022, the company’s top ten customers brought in 98.8% of its total revenue. Signify Innovations (formerly Philips Electronics), Western Refrigeration, and Panasonic Life are among IKIO’s customers. 📊

IKIO is looking to raise Rs 607 crore. Promoters are selling up to Rs 257 crore worth of shares. Fresh issue amounts to Rs. 350 crores. IPO funds will be used for debt payments, factory investment and general corporate purposes. 💪

Financial snapshot (FY22)

- Revenue: Rs 334 crore, up 56% YoY

- EBITDA: Rs 77 crore, up 62% YoY

- EBITDA margin: 23.3% vs 22.4% YoY

- Profit after tax: Rs 51 crore, up 75% YoY

IKIO has shown strong revenue and profit growth. The company’s heavy dependence on top clients is a key risk. Moreover, IKIO’s top client Signify cut its full-year sales guidance in January 2023 citing slow demand in China. Having said that, the market seems to be optimistic about IKIO’s prospects. Grey market data shows stock may list at a 31% premium. 📈

Winner Winner Chicken Dinner

Congratulations Peyush Kamal for winning the Community Star of the Month! ⭐

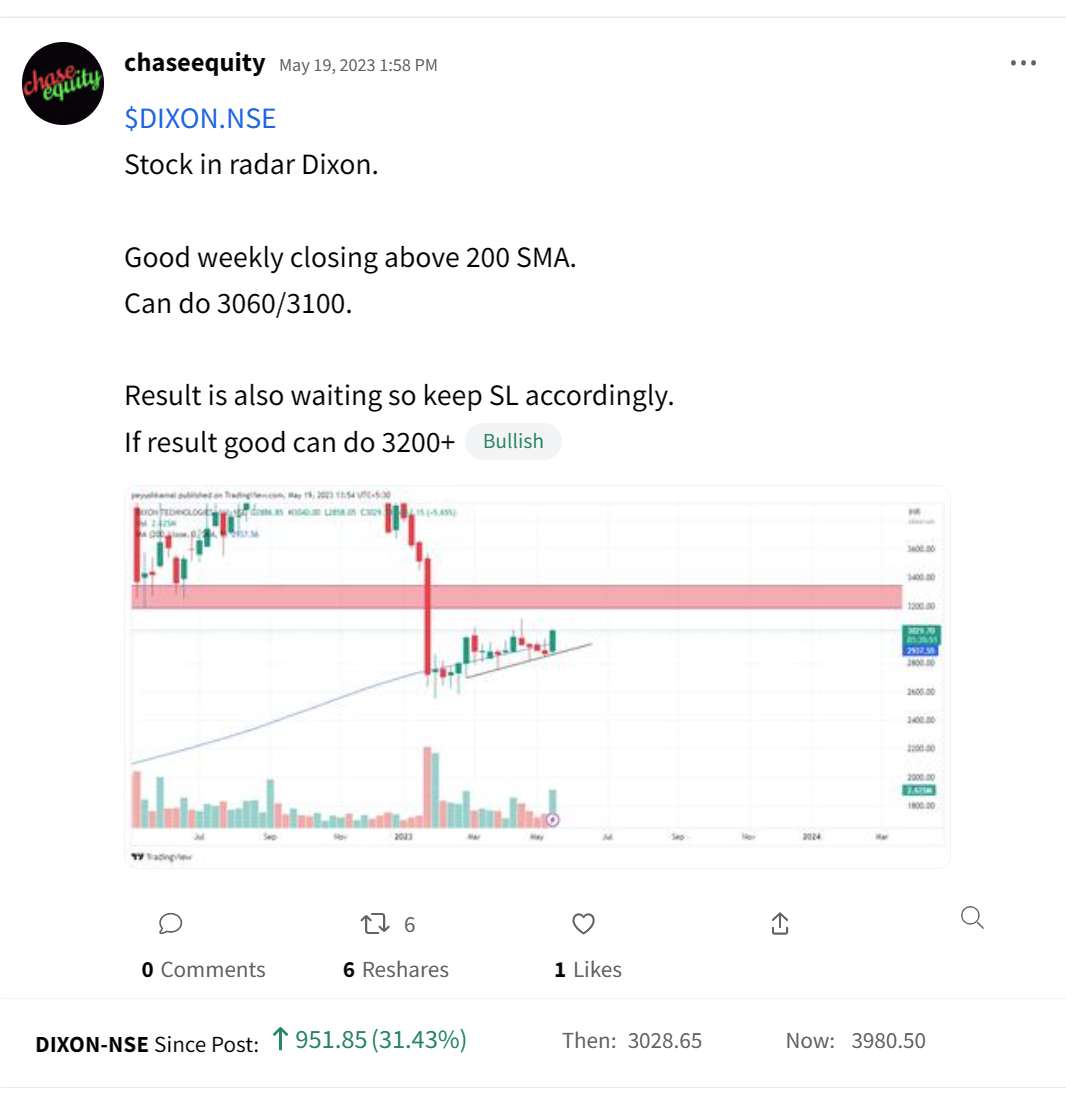

Peyush’s top idea, Dixon Technologies, rallied +32% in JUST 2 weeks! Here are a few investment & trading ideas shared by him on Stocktwits that you must check out: 😎

$CHEMBOND.NSE: https://stocktwits.com/chaseequity/message/527516647

$BECTORFOOD.NSE: https://stocktwits.com/chaseequity/message/528530198

Peyush is a part-time trader and specializes in momentum and breakout stocks for the short to medium term. He mostly trades cash stocks with a focus on sector leaders or $NIFTY50.NSE stocks for investment. Follow him for more awesome trading insights like these. Here’s the link: https://bit.ly/3NedA1N.

Disclaimer: All ideas shared by Peyush Kamal are for educational purposes. Peyush Kamal is neither SEBI registered nor an investment advisor.

Links That Don’t Suck

💻 What to Expect at Apple’s WWDC 2023

✅ Byju’s board sanctions Aakash IPO; launch by mid-2024

👀 Artificial Intelligence Took Over Around 4,000 Jobs In The Tech Industry In May Alone

🕷️ ‘Spider-Man: Across the Spider-Verse’ opens to $120.5 million, second-highest debut of 2023

❤️ A Woman Created An Instagram Account To Find Her LKG Friend & It’s The Most Wholesome Story Ever

😣 What It’s Like To Be the Punching Bag of Your Friend Group

🦁 Zlatan Ibrahimovic: AC Milan star retires from football aged 41