Tale of the Tape

Heya, guys. Markets were quiet today. 🥱

Nifty and Sensex pulled back sharply from the lows to end with minor gains. Midcaps (+0.1%) and Smallcaps (+0.5%) fared slightly better. The advance-decline ratio was split evenly. 🤷🏻

Most sectors ended lower but the losses were limited. IT stocks were the biggest casualty; -1.9% today. On the other hand, Autos and Real Estate added +1% each. 📈

FIIs are back shopping Indian stocks. Find out which companies have seen a jump in foreign holding in Q4 below. 🛒

This smallcap chemical stock can give up to +16% returns from current levels. Find out below. 🧪

Bajaj Finserv launched its mutual fund business today. Fun fact: they became India’s 43rd Asset Management Company (AMC). 💰

BHEL slipped over -3% intraday after a double downgrade by global brokerage firm Nomura. FYI – they see a -27% downside from current levels! 🚨

Aditya Birla Group forayed into branded jewelry retail business. Will invest Rs 5,000 cr to scale up operations. 👑

Bharat Dynamics (+4%) closed up for a 6th straight day. 4 lakh shares (0.2% equity) changed hands in a block deal. 🤝

IKIO Lighting IPO got fully subscribed on day 1. 🔥

| Nifty | 18,599 | +0.1% |

| Sensex | 62,792 | +0.1% |

| Bank Nifty | 44,164 | +0.1% |

Who’s Buying What?

Foreign institutional investors (FIIs) are nibbling at the Indian market again. So, which stocks benefited the most in Q4? We take a look for you here. FYI – these are companies that have over Rs 1,000 cr market cap: 💯

1) Cigniti Technologies: FII holding in the stock went up from 1.59% (Q3 FY23) to 5.13% (Q4 FY23). The company is a leading software testing firm that focuses on BFSI, transportation and life sciences verticals. It had an OUTSTANDING FY23, with a 33% YoY jump in top line & 83% boost in bottom line growth. The stock is up 67% YTD. 📈

2) Data Patterns (India): FII holding in the stock was at 5.08% in Q4, vs 2.3% in the previous quarter. Founded in 1985, the company makes defence and aerospace electronics products. Like many of its peers, the business has been booming with GOI’s push to buy locally-made defence products. The stock is up 59% YTD. 🚊

3) Roto Pumps: FII holding went up from 4.7% in Q3 to 7.4% in Q4! For the unaware, the company is a leading manufacturer of industrial pumps. After a rough Covid year, Roto has fired on all cylinders for FY22 (39% YoY jump in the top line) and FY23 (28% YoY bump in the top line). FYI – the stock is +52% YTD. 💪

Chemistry For Success

Aether Industries seems to be doing well compared to other companies that listed in recent years. While the likes of Delhivery and Paytm have lost 27% and 63% respectively, Aether has surged 43% since its market listing in June 2022. 📈

Aether Industries is one of the few specialty chemical companies in India with three separate business models – large-scale manufacturing, contract manufacturing, and contract research and manufacturing services (CRAMS). The company’s R&D-focused approach has allowed it to develop new products, serve high-end product markets and capture market share from China. 📊

The chemical manufacturer’s strong R&D capability has become its moat. Some of Aether’s products are the first to be made in India. Domestic firms are substituting exports for Aether’s products. 🌎

Demand from overseas is also growing. In March 2023, Japan’s Otsuka Chemical signed a 10-year supply deal with the company. Saudi Aramco Technologies penned an agreement with Aether to make and sell sustainable polyols. It’s no surprise that Aether posted double-digit percentage growth in both revenue (+12%) and profit (+20%) for FY23. 💰

In terms of the risks, investors need to watch out for rising raw material costs, a slowdown in the pharma and agrochemical industries, and Aether’s expensive market valuations (PE of 88). 👀

Having said that, JM Financials expects the stock to rise even higher due to its high growth potential. The brokerage firm set a one-year price target of Rs 1080, +16% from current levels. Keep an eye on this one. ✅

Stocktwits Spotlight

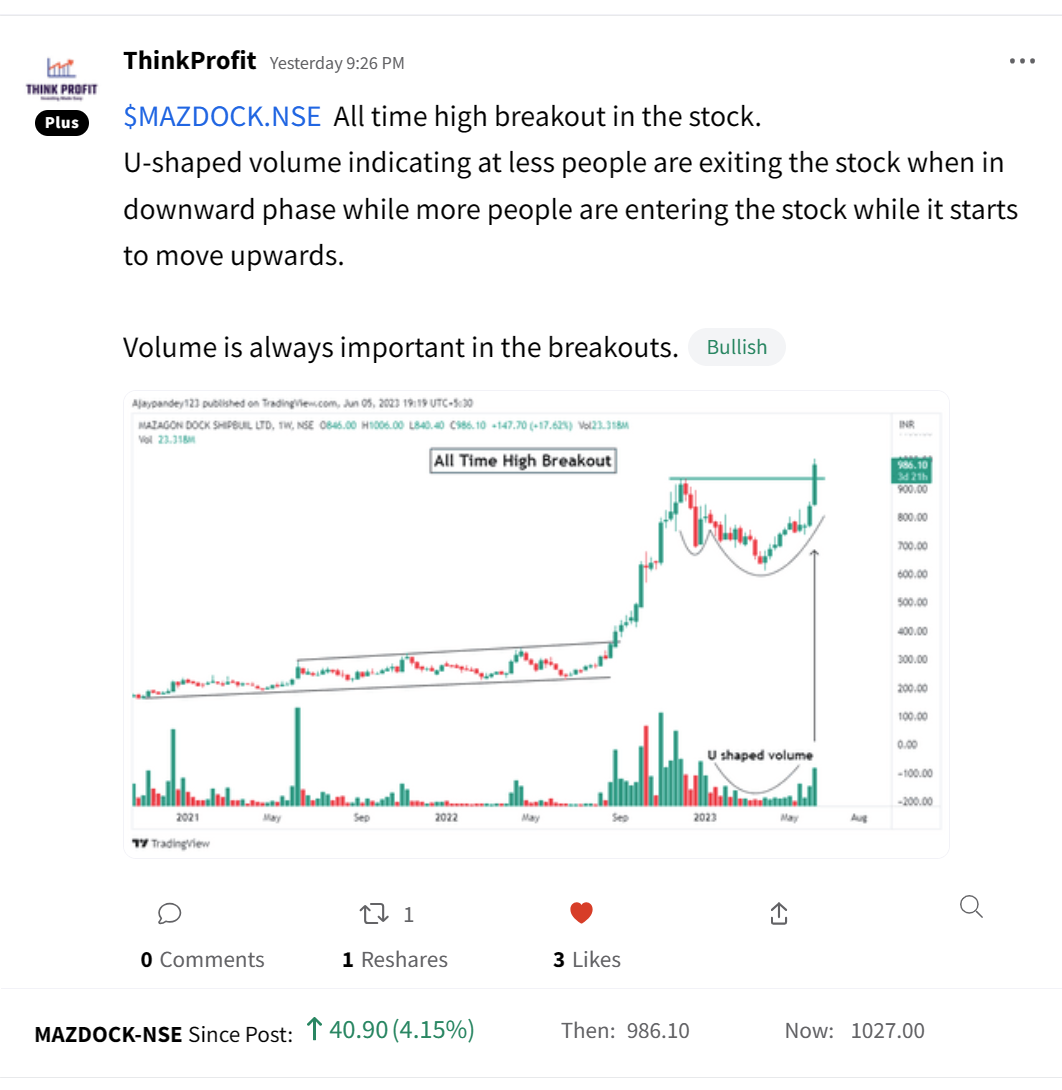

Here’s a bullish chart setup on Mazagon Dock Shipbuilders by ThinkProfit. Follow them for more awesome trading insights and add $MAZDOCK.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3oGqn3D

Disclaimer: All ideas shared by ThinkProfit are for educational purposes. ThinkProfit is neither SEBI registered nor an investment advisor.

Links That Don’t Suck

😅 Byju’s skips $40 million loan payment in dispute with lenders

👀 SEC sues Binance and CEO Changpeng Zhao for U.S. securities violations

🔥 I wore the Apple Vision Pro. It’s the best headset demo ever

🤦🏻♂️ A Woman From The US Married An AI-Powered Man & This Is ‘Modern Love’ For Real

👍 HDFC Bank suspends employee after video of him abusing co-workers goes viral