Tale of the Tape

Good evening everyone! 👋

Nifty (+0.3%) and Sensex (+0.4%) pulled back sharply in the last hour of trade to end with minor gains. Midcaps performed the same (+0.3%), while Smallcaps (-0.1%) saw limited cuts. 📉

It was a mixed bag kinda day for sectors. Metals (+1%) was the top winner while IT (+0.5%) and Energy (+0.3%) saw minor gains. FMCG (-0.4%) and PSU Banks (-0.3%) saw some selling pressure. 💸

What stocks were in focus as Vibrant Gujarat kicked off today? Read our top story below. 🚀

Delta Corp slumped after a poor Q3 showing. Meanwhile, UBS is bearish on Indraprastha Gas. More details below. 📊

Network 18 Media & Investments was locked in a 20% upper circuit after 1.3% equity changed hands in a mega block deal. The buyer and seller were not immediately known.🤝

Bharti Airtel hit a 52-week-high before paring gains after Bofa Securities upgraded the stock; the brokerage sees a further 7% upside. 😎

Spice Jet was up 4%. The airline will seek shareholder approval tomorrow to raise Rs 2,250 cr. 💰

Cochin Shipyard was locked in a 20% upper circuit. Its stock split came into effect today, where shareholders got 2 shares for every one they held. ✌️

Manappuram Finance cracked 5% after SEBI put its microfinance arm’s IPO on hold. 🚨

Here are the closing prints:

| Nifty | 21,618 | +0.3% |

| Sensex | 71,657 | +0.4% |

| Bank Nifty | 47,360 | +0.2% |

Vibrant Gujarat Summit – Top Takeaways

The Vibrant Gujarat Summit kicked off today! For the unaware, this HUGE investment fair takes place every year and brings in billions of dollars. Major announcements usually take place, with big implications for various sectors. FYI – in the run-up to the summit nearly 58 MoUs with Rs 7 lakh cr proposed investment were signed. 💯

Here’s what’s in focus this time around:

1) Adani + Ambani stocks: Adani said the conglomerate would invest Rs 2 lakh cr over the next five years in Gujarat. FYI – a lot of this will go into the new green energy park in Kutch. Little wonder that Adani Green Energy was up +3%. As for RIL, chairman Mukesh Ambani announced that its green energy giga factory in Jamnagar will be up by H2FY24. ♻️

2) Auto + Ancillary: Cars are a BIG theme Vibrant Gujarat and this year was no exception. The biggest deal here was Maruti Suzuki announcing it would set up a second plant in the state for Rs 38,200 cr! ⚙️

3) EV Theme: More than 50 percent of MoUs signed in Vibrant Gujarat are green, which is INSANE. Reports also indicate that Elon Musk’s Tesla may show up to announce its first new plant, but we’ll have to wait for that. Beyond this, the Tata Group announced that its new lithium ion cell manufacturing plant will start construction in the next few months. And ICYMI: Vietnam’s VinFast announced a few days ago it would build a $2 billion EV plant in Tamil Nadu as part of its global expansion. Experts say the green energy theme isn’t going away any time soon. ⚡️

Stocktwits Specials

We’ve curated a list of top stock picks by brokerages like Axis Securities, Sharekhan, Motilal Oswal and more. In less than 5 minutes, we’ll walk you through their top picks for 2024, with a timeframe of ~12 months and cover key fundamental, technical and news events surrounding these.

Bullets for the Day

📊 Delta Corp (-2%) slumped after reporting awful Q3 results. Muted consumer demand + regulatory troubles took a toll on the topline, which declined 16% YoY to Rs 234 cr. Higher expenses took a whopping 59% YoY chunk out of the bottom line, which fell to Rs 34 cr.

CFO Anil Malani said: “The company faced a downturn in the Oct-Nov quarter due to the impact of a higher GST regime. Revenue slumped as customers were required to pay a 28 percent GST upfront on chips.”

ICYMI – Delta Corp has been battling the GOI on two fronts. Firstly, it’s been asked to pay over Rs 22,000 cr from the GST department. And secondly, the GOI clarified that all online casinos & gaming were required to pay 28% GST on the full bet value. This has upset their basic biz model. Overall, not a pretty picture.

Delta Corp is down -29% over the last year.

👎 Indraprastha Gas (IGL) cracked 3% after brokerage firm UBS downgraded the stock to ‘sell’ and slashed its target price to Rs 400 p/sh (vs Rs 630 p/sh earlier). Rough stuff. Why is UBS so bearish? It believes IGL’s FY23-26 volume growth will lag (at a muted 6% CAGR). This is because the risk of fleet electrification weighs on its valuations.

ICYMI – the Delhi govt’s shift to EVs (announced back in Oct 2023) was a big negative trigger for IGL’s long-term CNG prospects. The company has tried to expand into new areas, lower gas pricing, but UBS says none of this will help.

“IGL’s CNG volume growth lags its rapid infrastructure expansion. Despite a 24 percent increase in CNG volume from FY21-23 and a significant rise in stations/pipeline length, it falls short of expectations. Even with favourable gas policies, volume growth continuously misses projections,” UBS noted.

Stocktwits Spotlight

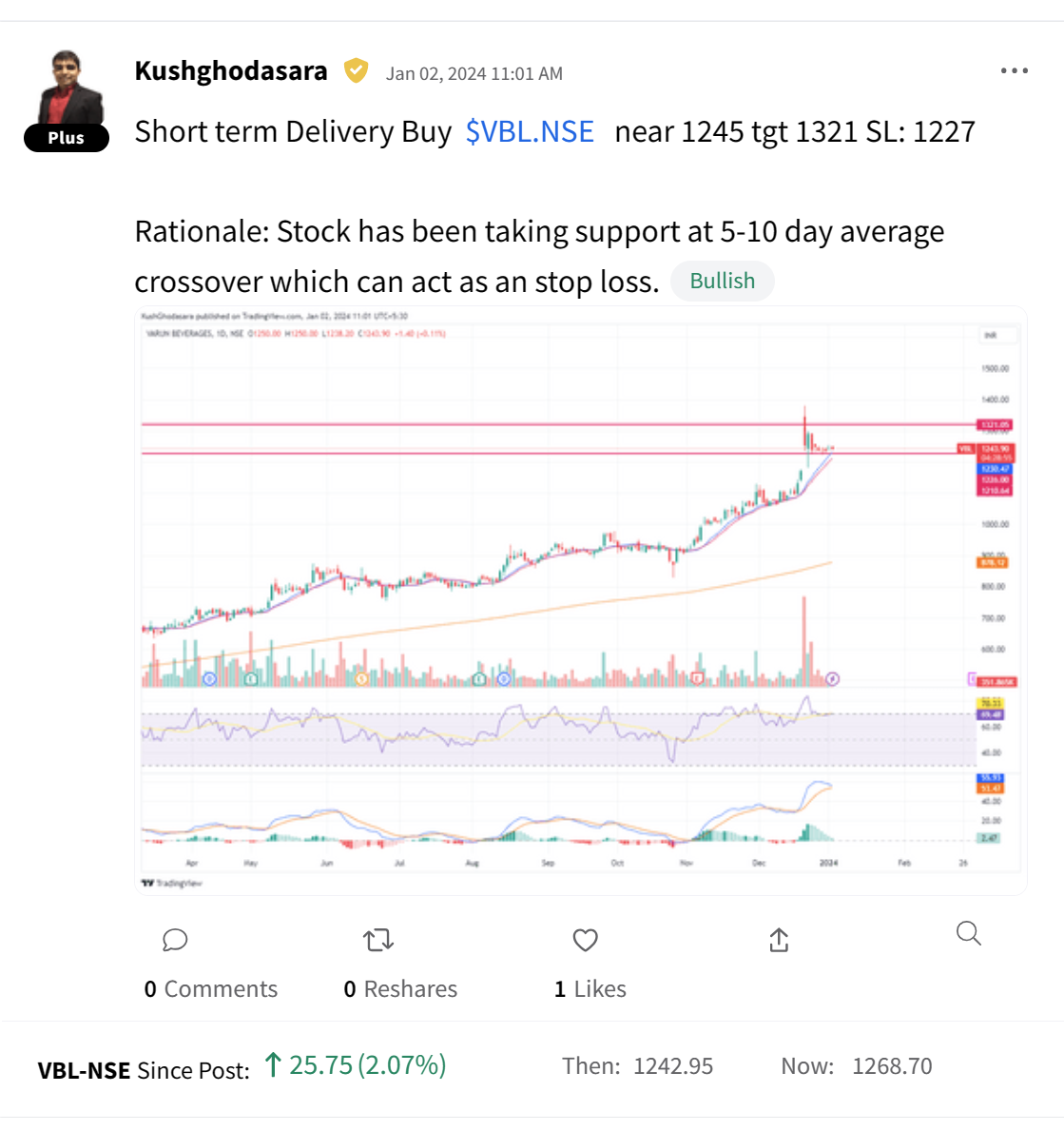

Here’s an interesting momentum pick on Varun Beverages by Kush Ghodasara. Follow him for more awesome trading insights and add $VBL.NSE to your watchlist and track the latest from the community. Here’s the link:

Links That Don’t Suck

🔥Top stock ideas by brokerages for 2024

📈 My Guarantee That India Will Be Among Top 3 Economies: PM Modi

🤣 Fake Bitcoin ETF Approval Tweet Causes $90M in Liquidations

💯 Sheetal Devi: The inspiring story of India’s armless archer who is an Asian champion

🏝️ Social media uproar may cost the Maldives millions, as feud with India intensifies

🤧 Been under the weather? Is It COVID, flu, or a common cold; recognize the symptoms