Tale of the Tape

Howdy folks. Markets closed up for a second straight day. 📈

Nifty and Sensex staged a late pullback to end with minor gains again. Strength in select large cap heavyweights (particularly RIL) and positive global cues restricting any downside. Midcaps (+0.5%) and Smallcaps (+0.6%) fared much better. Over 3 stocks rose for 2 losers. 💪

Most sectors ended in the red but the losses were restricted. On the other hand, Energy (+1.3%) and Autos (+1%) witnessed healthy gains. 🔥

Polycab sank over 22% intraday amidst concerns over serious financial irregularities and corporate governance issues. Read our top story below. 🚨

Chemical stocks have failed to participate in the recent rally. What’s hurting the sector and what are the expectations from 2024? More details below. 🔍

Zomato (+2.5%) was in focus. Global brokerage firm HSBC upgraded their target price to Rs 150 p/sh; +9% from current levels. 💰

Axiscades Technologies hit a new all-time high. The company will raise Rs 500 cr via QIP; The floor price is set at Rs 697 p/sh. 🤑

Ease My Trip jumped +17% after announcing its entry into the insurance business. 👍

HDFC AMC hit a new 52-week high on strong Q3 results. 📊

Kalyani Steels will buy Kamineni Steel and Power India Private Ltd for Rs 450 crore. The stock rallied +15%. 🏭

SpiceJet will raise Rs 2,250 cr growth capital. Additionally, the airline announced plans to launch new flights to Ayodhya and Lakshadweep. ✈️

Jyoti CNC Automation IPO got oversubscribed 40x on the final day. 🤯

Here are the closing prints:

| Nifty | 21,647 | +0.1% |

| Sensex | 71,721 | +0.1% |

| Bank Nifty | 47,438 | +0.2% |

Rs 1,000 cr Fraud

Polycab India CRASHED over 22% intraday. Reports indicated tax officials allegedly found a HUGE number of violations. Here’s all the important information that you need to know: 🕵️

1) Unaccounted cash sales: Reports say the I-T dept found cash sales of about Rs 1,000 cr that were unaccounted for. This means that the firm was allegedly just not reporting sales, likely to evade tax. Earlier reports said that tax authorities had slapped a Rs 200 cr tax evasion notice, so if true, this is a significant bump up. 🚨

2) Unaccounted cash payments: The I-T department’s statement also said that there was evidence of payments of more than Rs 400 cr. This was allegedly made by a distributor on behalf of the flagship company. What was this payment for? We don’t know yet and will have to wait for more details. ❌

3) Non-genuine transactions: Finally, reports say there are allegedly fraudulent expenses (approx Rs 100 cr). This includes bills for sub-contracting & transport expenses. Also, alleged inflation of purchase accounts through distributors to the tune of Rs 500 cr. 🙊

Overall, rough stuff. That said, the company has denied all rumours of tax evasion and said it fully cooperated in the income tax department’s search operations. 😪

For the unaware: Polycab has been a ten-bagger stock since it listed in April 2019. This has been a dream market run by any account. We’ll have to wait and watch how this space develops now. 👀

Stocktwits Specials

As a F&O trader, how do you spend your capital? Check out the results of a recent survey conducted by Kantar India in partnership with Sharekhan.

What’s Up With Chemical Stocks?

The chemical sector has been going through a ROUGH time. In the last few quarters, several companies have been downgraded. These include: Deepak Nitrite, Vinati Organics, Aarti Industries, Navin Fluorine and SRF. Brokerage firm Jefferies recently noted that it DOES NOT expect a pick-up for specialty chemicals until H2FY25! 😣

The sector’s problems are complex. They also vary depending on different industries within the larger sector. But we break them down here for you. 🔍

1) Rough weather: The monsoon season was erratic this time. Agrochemical companies depend on crop production. So when output slows down, it affects the sales of chemical companies. FYI – in Q1FY24, PI Industries saw a 13% YoY drop in crop protection chemical sales. UPL saw an even bigger 20% drop. 🌾

2) Global factors: Another key problem is that Chinese exports of crop protection products are through the roof. They were up 40% YoY in Oct-Nov 2023 alone. Why is this happening? It’s because domestic demand is low in China, which forces their companies to export more. Naturally, their margins are lower, which squeezes the bottom line of Indian companies. 📊

On top of this, demand in textiles & dyes is still weak. This means customer spending on pigments and polymers is low. EU markets are also going through their own problems due to inventory destocking + slowdown in discretionary spending. Covid years saw clients overstocked in fears of a supply chain crash. But now that it’s over, there’s an inventory glut. 👎

3) Red Sea attacks: Another more recent issue is that commercial carriers are being attacked on the Red Sea by pirates. Longer routes, higher insurance costs and the threat of losing cargo are also taking a toll on the supply chain. 🚢

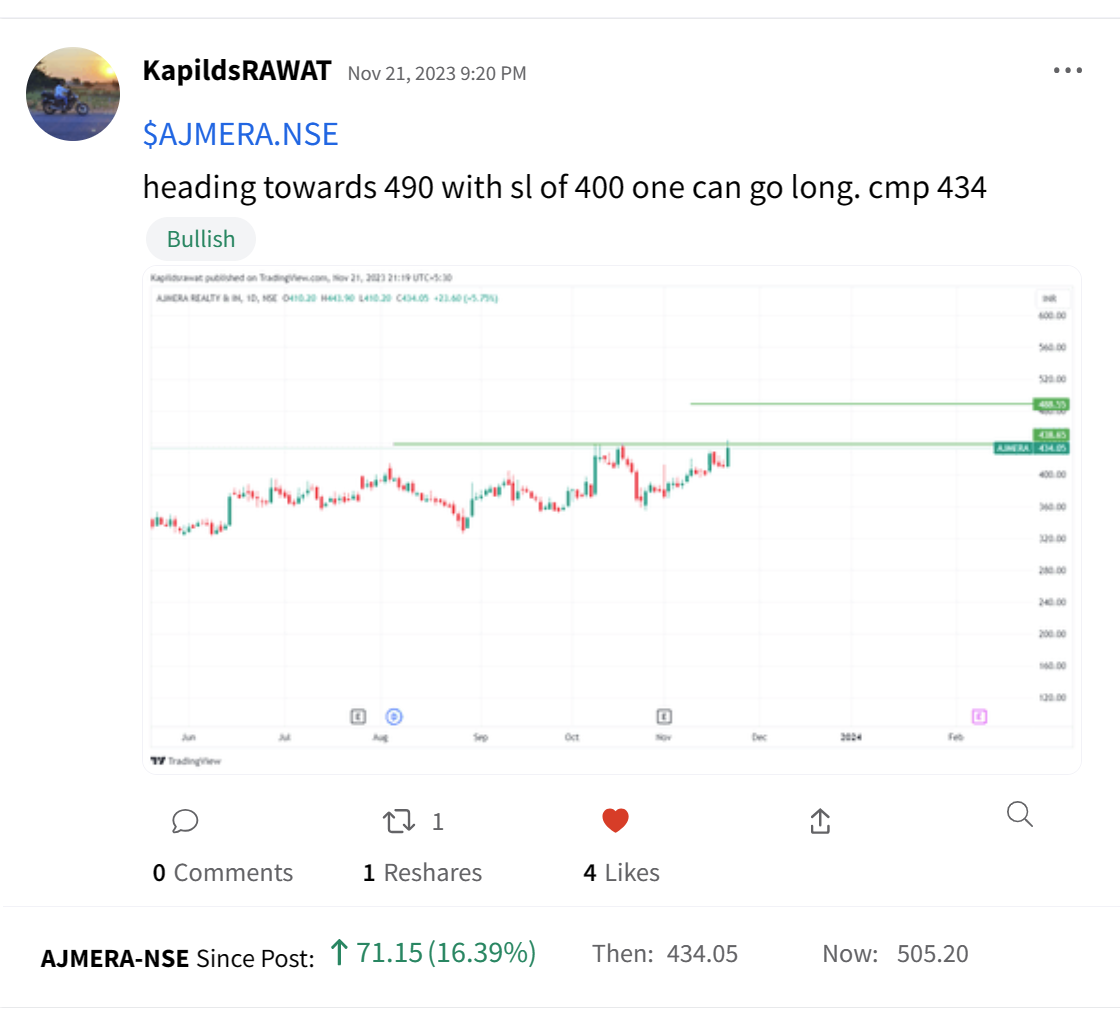

Stocktwits Spotlight

Target hit alert! Kapil Rawat’s buy call on Ajmera Realty is +16%. Follow him for more amazing trade ideas and add $AJMERA.NSE to your watchlist to track its performance. Here’s the link:

Disclaimer: Kapil Rawat is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.

Links That Don’t Suck

📈 How do F&O traders decide on spending their capital?

🔥Top stock ideas by brokerages for 2024

💯 Nothing can stop India from becoming $35 trillion economy, says Mukesh Ambani

🪙 SEC Authorizes Bitcoin-Spot ETFs in Crypto’s Breakthrough

👃 What Does Space Smell Like? Here’s What Astronauts Say

⚽ Sancho finalising Dortmund loan; Spurs agree Dragusin transfer, Spence loan exit