Tale of the Tape

Hola Amigos! Markets were down big! 📉

A heavy sell-off left the Sensex (-1%) and Nifty (-1.1%) deeply in the red. SEBI’s moves to contain risk also prompted a bloodbath in Midcaps (-2%) and Smallcaps (-1.9%). The advance-decline ratio was firmly in favour of the bears (4:1). 🤕

It was a wave of red across sectors. PSU Banks (-2.3%), Real Estate (-2.1%), Oil & Gas (-2.1%) and Auto (-2%) were the top losers. 👎

Will 2024 be Vedanta’s time to shine? Read our top story below to find out more. 😎

Mukka Proteins Rs 224 cr IPO opens for subscription tomorrow. Read our analysis below to find out if you should invest. 🔍

Vodafone Idea (-14%) was the top NSE 500 loser after its Rs 45,000 cr fundraising plans failed to excite the market. 🚨

Shriram Finance was in focus after reports said it may enter the Nifty 50 by March 2024. The stock closed -2% tracking the weakness in broader markets. 💯

Dreamfolks Services was up 5% after Motilal Oswal initiated coverage on the stock; it sees a 34% upside. 🚀

Listing gains. Juniper Hotels closed at Rs 402 p/sh, +12% from its issue price. 💰

Patanjali Foods (-3%) fell after the Supreme Court pulled it up over misleading advertisements. 🧑⚖️

Capital Small Finance Bank slumped 5% after posting weak Q3 results. 📊

Zee Entertainment cracked 7%. The firm set up an independent panel to probe SEBI’s allegations, but investors appear unimpressed. 😣

Here are the closing prints:

| Nifty | 21,951 | -1.1% |

| Sensex | 72,304 | -1.1% |

| Bank Nifty | 45,963 | -1.3% |

Vedanta’s Big Plans For FY25 & Beyond

After a weak 2023, are the tides slowly turning for Vedanta? The stock is down -2% over the last year due to its debt woes. But, after its recent analyst call experts believe that things might get better for the conglomerate hereon: 😇

1) Debt burden: ICYMI, Vedanta has restructured bonds with $3.2 billion and pushed their ‘maturity’ to FY26. Debt at the parent level is currently at $6.2 billion (down from $9 billion a couple of years ago) and the management says they will bring it down to $3 billion by FY27. A key trigger here to watch out for is the sale of its iron & steel businesses. Vedanta’s Anil Agarwal said this would be completed by March 2024, but we’ll have to see if that happens. 🤞

2) Future triggers: The re-opening of the firm’s copper smelter in Tuticorin will be a HUGE W if and when it happens. The Supreme Court has given off some positive signals lately. Beyond this, its copper expansion in Zambia and Saudi Arabia has also gone off well and should start showing some benefits in the next year or two. 💸

3) Core cash cows: The firm is upping its aluminum capacity to ~3 mtpa from 2.4 mtpa. More importantly, this will raise value-added volumes (higher margins) and also help backward integration. FYI – some experts say this will help the vertical’s EBITDA to grow by 40% over FY24-FY26. 📊

Finally, its mega demerger, which will see it split into 6 listed entities, should unlock MAJOR value. Analysts say the power vertical is specifically the one to watch out for. ✅

TL;DR: Vedanta has made some headway in clearing its debt, although this needs to be closely monitored. Beyond that, its key aluminum & copper verticals are set for growth. FYI – brokerage Nuvama Institutional Equities has a target price of Rs 394 p/sh; +49% from current levels! 🔥

Stocktwits Specials

In this week’s video, we will walk through the Top 3 stocks to buy under Rs 300 recommended SEBI RAs on Stocktwits.

In the video, we’ll break down the recommendations by SEBI RAs, covering both fundamental and technical analysis.

Mukka Proteins IPO Review

Mukka Proteins IPO opens for subscription tomorrow! The price band is fixed at Rs 26-28 p/sh. The company aims to raise Rs 228 cr from the markets. 💰

Founded in 2003, the company has been a leading player in the fish protein business for +5 decades. They make & supply fish meals to companies that manufacture aqua feed, poultry feed and pet food. FYI – while fish meal makes up 80%+ of its top line, it also supplies fish oil to the pharma industry and recently entered the insect protein biz as well. Mukka currently has six manufacturing units, 4 in India and two in Oman. Roughly 50% of its top line comes from domestic sales, while the rest is exports to over 10 countries. 🌎

FYI – the IPO is a 100% fresh issue of shares, which means all the money raised will come into the money, which is a BIG positive. The proceeds will be used to fund its working capital requirements. 🏭

FY23 snapshot:

- Revenue: Rs 1,117 cr +53% YoY

- EBITDA Margin: 8.01% vs 7.04% YoY

- PAT: Rs 47.5 cr; +81% YoY

Big Picture: The company had a GREAT FY23 mostly due to strong global demand + lower fish meal output from Peru, which is the world’s largest producer. As raw material issues continue to plague Peru, Mukka is projected to have a great FY24 & FY25 as well. Beyond that, the company’s China expansion + aggressive foray into insect protein should also pay dividends soon. FWIW – the IPO is reasonably priced and currently grey market data suggests it may list an insane 64% premium! 🤑

Stocktwits Spotlight

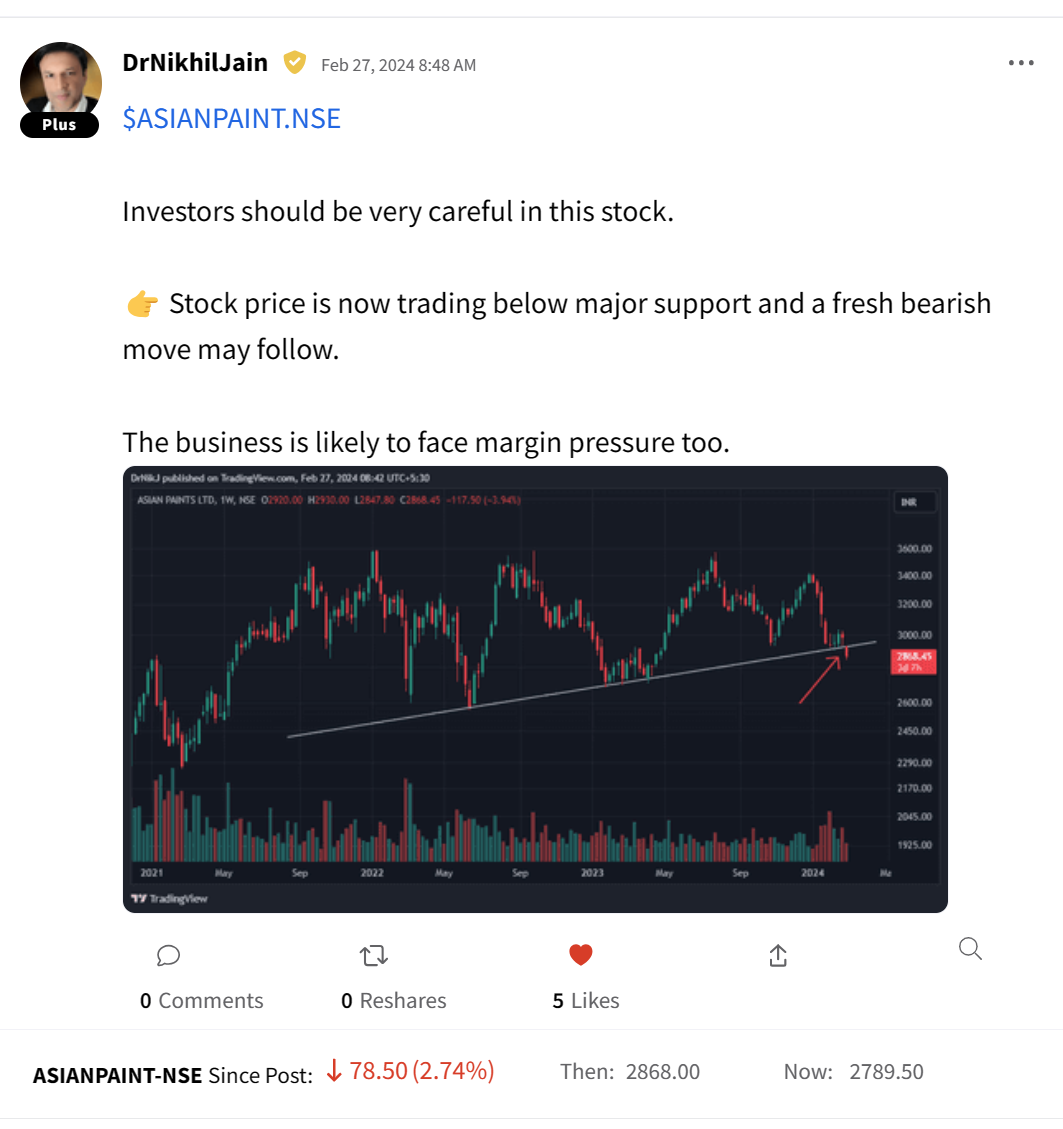

Paint stocks have been under pressure after the Birla Group’s entry. Nikhil Jain advises to be cautious in Asian Paints at current levels. Follow him for more amazing investing insights and add $ASIANPAINT.NSE to your watchlist and track its performance. Here’s the link:

Links That Don’t Suck

😎 Top 3 Stocks under 300 Recommended by SEBI RAs

💬 Stocktwits is hosting a free AMA with Shubham aka Curious Community. Click to Ask

⚡ Apple cancels plans to build an electric car

⚛️ National Science Day 2024: Why is it celebrated on February 28? History, theme and significance