Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 40 in 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 40:

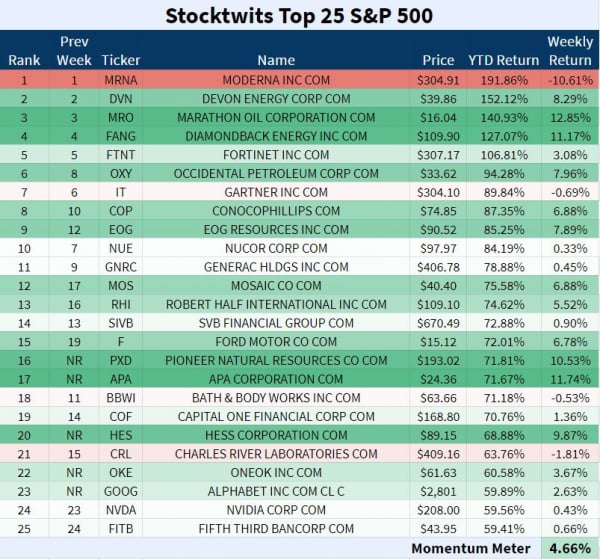

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 was smoking hot in Week 40.

21 of 25 names traded positive.

Marathon Oil Corp climbed 12.85% and was the list’s biggest gainer. It’s the Top Dawg below.

Moderna hindered the list again by losing 10.6%. $MRNA is a Sinner below.

$PXD, $APA, $HES, $OKE, and $GOOG are the list’s Freshmen.

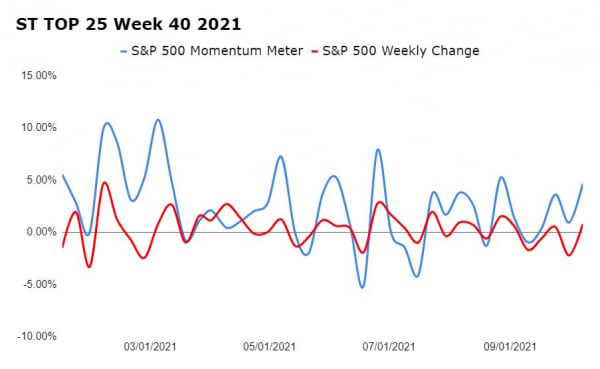

The Stocktwits Top 25 S&P 500 Momentum Meter ripped 4.66% while the S&P 500 added 0.79%. The 3.87% differential proves the top-stocks continue to outperform the full index.

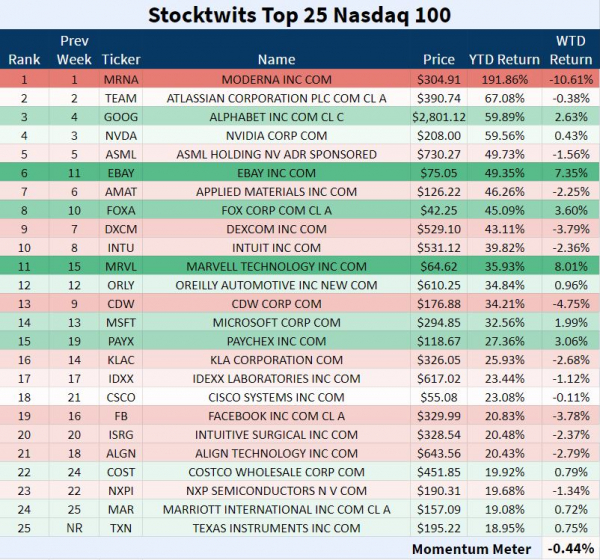

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List was this week’s weakling.

14 names closed negative.

Marvell Technology was a standout performer on this week’s mostly red list. Check out $MRVL on the Winners list below.

eBay added 7.35% and improved five spots to #6.

Texas Instruments was the list’s only Freshman.

The ST Top 25 Nasdaq 100 Momentum Meter dipped 0.44%, while the full Nasdaq 100 rose 0.20%. The 0.64% difference shows the top-stocks fell behind the full index.

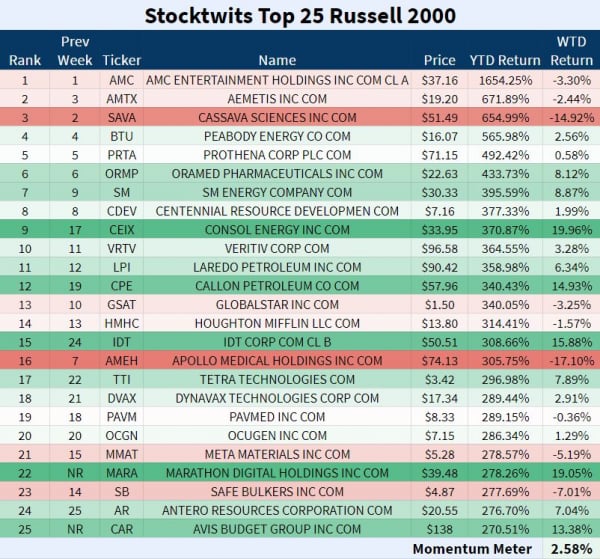

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List posted a respectable performance.

16/25 stocks finished green.

$MARA marched 19% and claimed the 22nd spot as a Freshman. Marathon Digital Holdings is a Winner below.

$AMEH sank to the Sinners list after falling 17%. The biotech is still up 305.75% YTD.

The list’s Freshmen are Marathon Digital Holdings and Avis Budget Group.

The ST Top 25 R2K Momentum Meter gained 2.58%, while the Russell 2000 index decreased 0.38%. The 2.96% differential in favor of the top stocks indicates the full index still lags.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 40 of 2021 is #3 S&P 500 – Marathon Oil Corp.

If Marathon Oil ran, it’d be a sprinter, not a long-distance runner. $MRO bolted 12.85% in Week 40 as the ST Top 25 S&P 500 List’s biggest winner. The energy company remained ranked #3.

$MRO added 4.15% on Monday and an additional 4.60% on Friday. The name traded positive for four days as crude oil climbed to new 52-week highs.

Here’s the daily chart:

$MRO is up 141% YTD.

📈📈📈

The Winners 📈

△ #11 N100 – Marvell Technology marched four spots higher from #15 to #11 on the ST Top 25 N100 List in Week 40.

On Tuesday, Marvell announced the introduction of the industry’s first 5nm 50G PAM4 device for the carrier market, the Prestera® DX 7321 Ethernet switch, as part of its industry-leading 5nm data infrastructure platform.

Later that day, $MRVL completed its acquisition of Innovium, a leader in providing networking solutions for cloud and edge data centers. The purchase strengthens Marvell’s cloud leadership and enables the company to enter the fastest-growing switch market with a cloud-optimized solution.

$MRVL moved up 7.35% on Wednesday and closed at new weekly-highs. Here’s the weekly chart:

$MRVL is up 36% YTD.

△ #22 R2K – Marathon Digital Holdings hopped 19% and entered the ST Top 25 R2K List as a Freshman. The bitcoin mining company is now ranked 22nd.

On Monday, $MARA published unaudited bitcoin production and miner installation updates for Sept. 2021 and unveiled a new $100 million revolving line of credit with Silvergate Bank.

Here are a few highlights from the update:

- Produced 1,252.4 new minted bitcoins during Q3 2021, +91% QoQ

- Produced 340.6 new minted bitcoins in Sept. 2021, increasing bitcoin holdings to 7,035 with a value of $336.3 million

- Obtained a $100 million revolving line of credit, secured by bitcoin and USD, with Silvergate Bank

$MARA is up 278.25% YTD.

△ #20 S&P 500 – Hess made one helluva statement on the ST Top 25 S&P 500 List in Week 40. The energy company debuted as a Freshman ranked 20th.

Hess announced on Thursday an increase in the gross discovered recoverable resource estimate for the Stabroek Block offshore Guyana to approximately 10 billion barrels of oil, up from the prior estimate of more than nine billion barrels of oil.

The company also made a significant discovery on its Stabroek Block at the Cataback well, allowing them to upgrade their resource estimate for the block. 👏

$HES spiked 6.60% on Friday and is testing 52-week highs.

$HES is up 68.90% YTD.

📉📉📉

The Sinners 📉

▼ #16 R2K – Apollo Medical Holdings couldn’t hang in the top-10. The healthcare company dropped 17% and moved to #16 from #7 on the ST Top 25 R2K List.

Shares of Apollo Medical rolled over to the downside after trading in a range for the last four weeks.

Will buyers step in and support $AMEH at $68 or will it continue to falter? Place your bets…

Here’s the daily chart:

$AMEH is still up 305.75% YTD.

▼ #1 S&P 500 – Moderna Inc was the worst performing stock on the ST Top 25 S&P 500 List by a long shot. In fact, this is the biotech’s second week in a row on the Sinners list.

$MRNA gave up 10.6% and now leads Devon Energy Corp by a small margin. This could get interesting going into the end of the year.

Despite the poor performance, this week wasn’t all that bad for Moderna. The European Medicines Agency authorized a third dose of the Moderna COVID-19 vaccine on Tuesday.

On Thursday, Moderna released plans to construct a state-of-the-art mRNA plant in Africa with the objective of manufacturing up to 500 million vaccination doses per year. $MRNA will invest up to $500 million in the new facility, which will feature drug ingredient manufacturing as well as fill/finish and packaging capabilities.

$MRNA is up 192% YTD.

See Y’all Next Week 🤙