Happy Halloween! It’s time for a very spooky Weekend Rip!

Indexes were four-for-four again this week. The Nasdaq Composite led the pack, up 2.3% this week.

The S&P 500 and Nasdaq-100 have pulled away from the Dow and Russell 2000 for YTD performance. The S&P 500 is up 21.5% this year and the Nasdaq isn’t far behind, up 20.6%. Which index will have the greatest gains before the year is up?

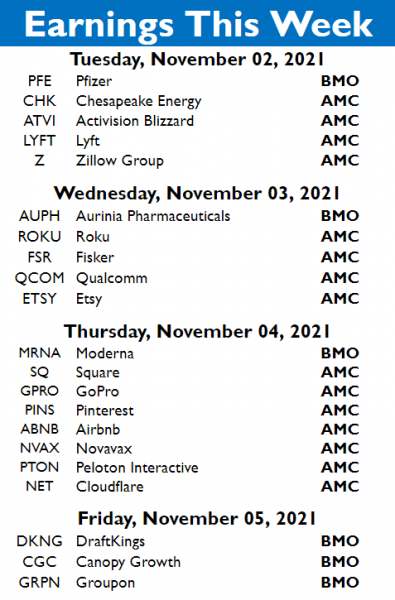

The middle of the week is going to be a busy time for earnings, with tons of tech players reporting. Keep an eye out for $SQ, $PINS, and $NET. 👀

Speaking of earnings, earnings szn has been going really well. According to Refinitiv’s “This Week In Earnings”, 82.1% of S&P 500 companies (which have reported so far) have reported above analyst estimates.

There wasn’t much action in large-cap crypto this week. $BNB.X was the biggest gainer in the top 10, up 9.6% this week. $ETH.X rose 5.58% this week, and $SOL.X rose 4%.

Metaverse-themed cryptos such as $MANA.X and $SAND.X appreciated a double after Facebook’s new “Meta” keynote. They were joined by memecoins $ELON.X (+320.9%) and $SHIB.X (+70.3%). 📈

That said, here’s how the week finished out:

| S&P 500 | 4,605 | +1.14% |

| Nasdaq | 15,498 | +2.35% |

| Russell 2000 | 2,297 | +0.24% |

| Dow Jones | 35,819 | +0.36% |

Company News

Roblox Is Down

After being down for over two days, sandbox building game Roblox is slowly coming back online.

Users have been quick to fault Chipotle, which announced a promotion offering Roblox users free burritos for visiting their virtual Roblox store, with having caused the outage. However, Chipotle’s million dollars worth of free burritos are supposedly not to fault.

The company cited an internal issue as the cause of the outage, which began on Friday morning. We imagine that it made for a spooky weekend for scores of engineers and IT junkies, which were called in to resolve the issues so that people could play virtual Halloween games and visit the Roblox Chipotle. 🎃

Rest assured, Roblox might have bigger fish to fry than this temporary outage — at least in the grand scheme of things. Facebook’s announcement of their own digital metaverse has prompted analysts to question what the future might hold for development platforms like Roblox. It’s untold what competition might await them in the world of Web3 and Big Tech. 😳

$RBLX was up 1.6% on Friday… unfortunately, it’s likely to take a dip tomorrow because of this weekend’s outage. 😩

Sponsored

Unlock Impressive Tax Perks on Gains (Even on Crypto)

Yes, taxes should be factored into your investing strategy, and now there are remarkable ways to keep more of your gains.

If you are facing significant tax payments on gains from the sale of a business, stock, BTC, real estate, or other investments, investing in a Qualified Opportunity Zone Fund (QOF) can unlock these perks:

- Defer taxes on cap gains until the end of 2026.

- Exclude 10% of the original gain from taxation (expiring soon).

- Permanently escape taxation on post-investment gains.

Learn how –> Grab “The Accredited Investor’s Guide To Opportunity Zone Investing”

Earnings

Meme Currencies Fail Robinhood In Q3

Robinhood’s latest quarterly earnings, reported on Monday, were disappointing at best: the brokerage reported a massive revenue miss for the third quarter.

Robinhood reported a net loss of $1.32 billion, or $2.06 per share, on $365 million in total net revenues. The majority of their revenue came from options trading, which was worth $164 million (44.9% of revenue). Crypto trading represented $51 million (14% of revenue) and was up 860% YoY. Equities trading, formerly the bulk of Robinhood’s business, saw $50 million (13.7% of revenue). However, equities revenue was down 27% YoY.

Equities and options aside, Robinhood has been leaning into its future in crypto. The company plans to offer crypto wallets, a tool that allows investors to send and receive digital currencies. More than one million people have joined the crypto wallets waitlist to date. There’s just one problem: the app has seen much better quarters for crypto transaction revenue.

Last quarter, they did $233 million in crypto revenue, boosted in-part by memecoin $DOGE.X, which represented a significant portion of the company’s revenue. Investors have moved on to new, shiny things… so maybe it’s fair to say that having a brokerage business that relies on memecoins isn’t the most sustainable one?

“Looking back at Q2, we saw a huge interest in crypto, especially Doge, leading to large numbers of new customers joining the platform and record revenues,” said Robinhood chief executive officer Vlad Tenev.

$HOOD slumped 12% on the news, trading down to $34.20 intraweek. On Friday, it closed at $34.97, which was still well below its $38 IPO price.

Company News

“Dune” Sweeps Up Box Office

Warner Bros. might have a new franchise on their hands in “Dune”, which has swept up the competition at the box office and on streaming. 🎬

According to estimates from Comscore Inc., “Dune” generated $40.1 million in North American ticket sales in its debut weekend. This weekend, it made another $15.5 million — which might sound paltry, but it’s still above all other films in theatres by a meaningful margin.

“Dune” has made $58 million domestically, making it one of the biggest premieres of the pandemic-era. It’s nearing $300 million in worldwide gross.

What makes these figures even more impressive is that “Dune” launched simultaneously for free on streaming platform HBO Max. Day-and-date premieres are hard, because they tend to sap box office revenues.

Samba TV, a selected smart TV content recognition tech, said that 1.9 million households watched “Dune” (out of the 28 million it tracks) on HBO Max during its opening weekend. According to Reelgood, a streaming guide, the film had the highest engagement of any day-and-date movie premiere in 2021.

An analysis by Observer further substantiates the success of Warner Bros latest and greatest film, directed by Denis Villeneuve (Arrival, Blade Runner 2049.) However, an even more upbeat indicator is that “Dune: Part 2” has been greenlit by the studio. It’s definitely not going to be a day-and-date premiere, though. 😊

WarnerMedia is in the process of merging with Discovery Inc. (and spun off into a separate entity.) Until then, WarnerMedia lives under $T, which is down 14.2% YTD.

The Brief

Here’s a brief for the week of Monday, November 1, 2021:

Economic Calendar:

11/1 ISM Manufacturing Index (10:00 AM ET)

11/3 ISM Non-Manufacturing Index (10:00 AM ET)

11/3 EIA Crude Oil Inventories (10:30 AM ET)

11/3 FOMC Rate Decision (2:00 PM ET)

11/4 Initial & Continuing Claims (8:30 AM ET)

11/5 Payrolls & Unemployment Rates (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

Here’s what to expect from earnings this week:

For more information on stocks that are reporting (and what our community is watching), check out the Stocktwits earnings calendar.

Links

Links That Don’t Suck:

📈 Consider including crypto assets in your broader investment strategy. Learn the basics.*

☕ Tasting The Lost Species of Coffee That Might Save It

☢️ Going Inside the Chernobyl Nuclear Plant

📈 Slowing Down A Stock Exchange With 38 Miles of Cable

🚚 The Rivian R1T Review, By Marques Brownlee

🌎 COP26 Climate Change Summit Begins, Little Is Expected to Change

🏢 Architect Resigns After UCSB’s New Windowless Dorm Proposed

✈️ American Airlines Cancels More Than 600 Flights

*this is a sponsored post