It’s Sunday Funday! Welcome back to The Daily Rip!

The end of daylight savings last week means two things: 1) we’re all “getting an extra hour of sleep” and 2) that the sun will practically be setting at the end of every trading day. I mean, come on… the sun sets at 4:39pm in New York! We’re going to be trading stocks and crypto in the dark, soon! Why is this still a thing?

Complaints aside, all four of the indexes we painstakingly watch tracked in the red this week… it’s the first time that that has happened in quite awhile. The Russell 2000 led the losers, down 1.09%. The S&P 500 was down 0.4%.

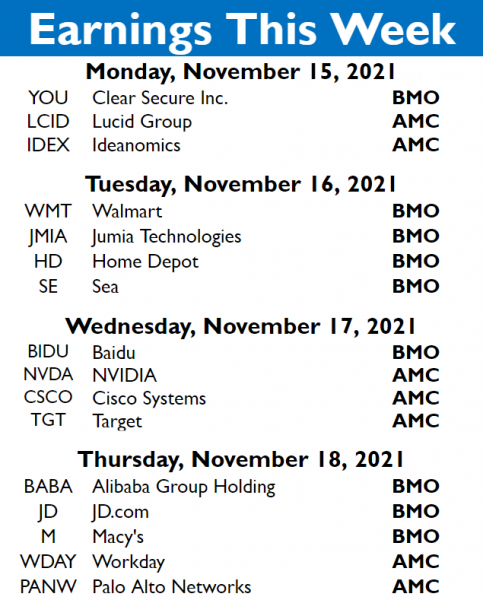

Earnings season will continue this week… and our eyes will be on Chinese tech stocks, which are hoping to mount a rally. We’ve also got our eyes on some other domestic names. More on that in our China story & earnings section below. 👀

In the top 100 cryptos: $LRC.X continued its big rise, up 136% on news that GameStop will be using it for its NFT platform. It was joined by $IOTX.X (+113%) and $LPT.X (+79%).

Oh, and Bitcoin got its first big update in Taproot, a quaint upgrade which rolled out this weekend. We touch on its biggest changes below. 👇

Here’s what went down last week:

| S&P 500 | 4,682 | -0.40% |

| Nasdaq | 15,860 | -0.84% |

| Russell 2000 | 2,411 | -1.09% |

| Dow Jones | 36,100 | -0.87% |

Crypto

Bitcoin’s New Update

Bitcoin‘s new update, Taproot, launched yesterday. It was the blockchain’s first upgrade in four years.

Taproot added a number of security and privacy features to the world’s largest cryptocurrency. However, the blockchain’s newest big feature is arguably smart contract support.

Smart contracts are already a staple of many next-gen blockchains like Ethereum, Solana, and Binance Smart Chain. Taproot added smart contract functionality on Bitcoin’s core layer and the Lightning Network.

Alongside smart contract functionality, the blockchain has beefed up the security and efficiency. Taproot features a few unique features, including the MAST, which helps make smart contracts be more efficient and private. The network also has made complex transactions “indistinguishable” from simpler transactions, which means that it will be hard to censor or stop smart contracts or complex transactions from taking place.

Overall, Taproot doesn’t really feel like a substantial development for the Bitcoin network. However, it’s nice to know that the world’s first and most-valuable crypto is still forging its own path. $BTC.X rose just 2% this week.

Sponsored

Portfolio Analytics For Your Crypto Holdings

Consolidate your crypto holdings and evaluate your performance with BTCS Analytics. BTCS’s Analytics allows you to securely evaluate the performance of your crypto across multiple exchanges. It supports 7 exchanges and over 800 digital assets which can be securely synced to your personal dashboard.

Earnings

Return of the China Stocks

U.S-listed Chinese tech stocks, which were battered earlier this year amid a regulatory crackdown, look ready to mount their comeback.

The KraneShares CSI China Internet ETF has fallen 32.4% this year, but signs of improvement are showing. $KWEB rose 8% this week and looks increasingly poised for a breakout as it rolls into the thick of earnings season.

Rideshare company $DIDI inspired confidence among investors when it reported earnings last week. The stock rose 16% on optimism that the company would relaunch its apps in China and beyond.

Some investors are banking on that optimism snowballing after we see reports from $BIDU, $JD, and $BABA this week. All three rose last week on the positive report from DiDi.

However, investors will also have to grapple with turbulence in China’s property sector. That’s one reason why Chinese tech stocks might bounce before the broader market.

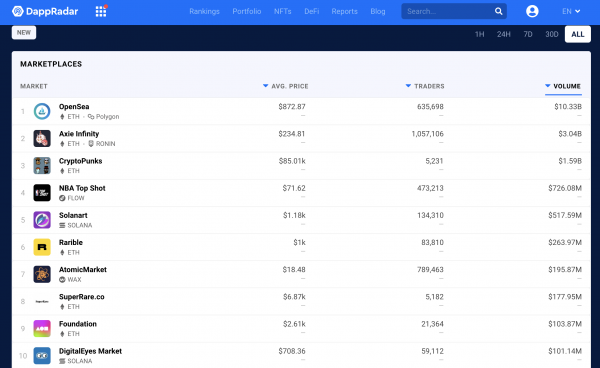

NFT platform OpenSea has officially mediated $10 billion worth of NFT sales on its marketplace. It underscores the explosive growth of NFTs and OpenSea, its flagship marketplace on Ethereum.

It’s an important milestone for NFTs (non-fungible tokens) — a type of asset in the crypto world that can be bought or sold like any other piece of property but doesn’t have a physical form. You can think of these digital tokens as certificates of ownership for virtual or physical assets.

Dappradar reports that 629,867 traders have contributed to the $10 billion in sales and the average sale price per NFT since OpenSea’s launch is $872.

Axie Infinity and CryptoPunks, both giants in their own rite, are the next biggest players by volume in the world of NFTs. Axie Infinity posted a total trading volume of $3 billion and a customer base of over one million. The Punks, arguably the origin of all NFTs, had a volume of $1.6 billion on its 10,000 pieces of algorithmically-generated artwork.

Rarible and SuperRare fall far behind the rest, with$263 million and $177 million in volume, respectively. In contrast, the average sale prices on Rarible and SuperRare are higher than on OpenSea, suggesting that the latter two platforms are more popular for higher-ticket items.

The Brief

Here’s a brief for the week of Monday, November 14, 2021:

Economic Calendar:

11/16 Retail Sales (8:30 AM ET)

11/16 Industrial Production & Capacity Utilization (9:15 AM ET)

11/17 Housing Starts & Building Permits (8:30 AM ET)

11/17 EIA Crude Oil Inventories (10:30 AM ET)

11/18 Initial & Continuing Claims (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

Here’s what to expect from earnings this week:

For more information on stocks that are reporting (and what our community is watching), check out the Stocktwits earnings calendar.

Links

Links That Don’t Suck:

💻 Semiconductor Giant TSMC Has A $100 Billion Plan To Fix the Chip Shortage

🌋 The Lava Lamps That Help Keep The Internet Secure

📅 Want To Host Events With Other Stocktwits Users? We’ve Designed a Program Just For You.

🛰️ Jeff Bezos’ Blue Origin Announces New Space Station In Low Earth Orbit

🌀 Hurricane Season Is Coming To A Close: Tropical Storm Wanda Might Be The Last Storm of the Season

*this is a sponsored post