Good evening, everyone. Happy hump day & happy green day. 🤑

The market of stocks was a sea of green. All four indexes closed in positive territory. The Russell 2000 rose 2.5% as today’s leader. The S&P 500 shot up 1.86% and the Dow increased 1.79%.

Arlo Technologies ascended 29% to three-year highs after reporting a surprise profit in the fourth quarter. $ARLO is now up 6.7% in 2022. Here’s the daily chart:

Each sector registered gains. Financials flew 2.59% and energy erupted 2.29%. Tech turned 2.17% higher.

Wheat futures rampaged 7.62% for the third consecutive gain. The commodity is already up 23% this week… We’ll see where it closes.

For the next few days, we’ll also lean into our role as the market’s funny guy by asking “Are the Russian Markets Open Yet?” Today, the answer is: still no. They’ve been closed for the longest period of time since 1998 (you can do the math on what happened in that year…)

$JWN jumped 37.82%, $RCKY ripped 26.6%, and $BTU blasted 10.93%.

Here are the closing prices:

| S&P 500 | 4,386 | +1.86% |

| Nasdaq | 13,752 | +1.62% |

| Russell 2000 | 2,058 | +2.51% |

| Dow Jones | 33,891 | +1.79% |

Earnings

$SNOW Melted

Snowflake reported earnings today. The earnings were so bad that IR websites everywhere basically went offline in sympathy (joking, but as far as we’re concerned, pretty much every IR site that we tried to access to write this newsletter wasn’t working so it might as well be true.)

Here’s the sig figs:

Revenue: $383.8 million, +101% YoY (compared to estimates of $372.7 million)

Loss per share: ($0.43), compared to estimates of $0.02

Guidance: $383-388 million, compared to estimates of $410 million

As it seems to be these days, revenue beats are plentiful; losses are bountiful; and guidance estimates from Wall Street’s finest are too aggro. On the bright side, the company shared that it had nearly 6,000 customers and that its margins were fat, coming in at 70%.

The company also announced it would be acquiring Streamlit, an “open-source app framework for Machine Learning and Data Science teams” which helps companies build web apps. Terms were not provided.

However, things went sideways when the company talked about its forthcoming fiscal year product revenue growth. Management said that it expected growth between +65-67% YoY, which was in-line with what analysts expected. However, that’s a pretty steep deceleration in revenue growth.

That’s most of what Snowflake can credit for its steep drop today. $SNOW fell 23% in afterhours. It’s now in the red YTD.

As the case for growth has fallen apart, it feels as though the star of one of its most forefront figures has also fallen — Chamath Palihapitiya was once seen as a hero of the retail investor, but now he’s seen almost universally as a villain. (Don’t believe us? Go read the streams.)

The 45-year-old is credited with popularizing SPACs, a novel way by which corporations could go public and avoid the arduous IPO process — filings and all. However, in retrospect, maybe there’s a reason why the IPO process is intentionally difficult. As growth stocks have fallen out of fervor, so too have the highly-speculative SPACs, which have posted “weak” returns.

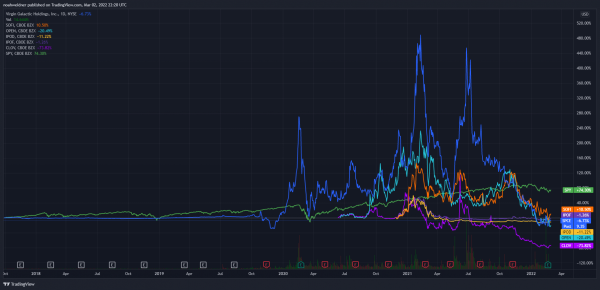

That weakness has offered little exception, including for Palihapitiya. The early entrants of his alphabet worth of SPACs — IPOA (now Virgin Galactic), IPOB (now Opendoor), IPOC (now Clover Health), and IPOE (now SoFi) — have radically underperformed the market. To make matters worse, Chamath has still not closed mergers for two funds — $IPOD and $IPOF — frequently trade below their NAV value (barring the times that people drum up delusions that the SPACs will acquire SpaceX or Stripe, which probably would be better off going it alone in their IPO process.)

The controversy has also cast a shadow of doubt on the Social Capital CEO, who is being sued by shareholders over a number of disputes. Most namely, lawyers claim he “insider sold” Virgin Galactic and misled investors about Clover Health’s business fundamentals. Their cases might have some strength, given Chamath’s court grilling in December (he was fighting an appeal suggesting the sale of dating app Tinder was deceitful in form.) Independent of these scraps with investors, Chamath dug an even deeper hole in January when he said that “nobody cares” about the “Uyghur genocide” in China during a podcast episode. In recent weeks, he stepped down as Chairman of the Virgin Galactic board.

Chamath still has an ardent digital fanbase, which follows him even in spite of these fairly objective shortcomings (the chart) and hot takes (namely, that opinion about China.) However, what we feel confident to say is that his fanfare has shrank because he has not proven to be a Buffett-tier investor. In fairness to him, nor has Cathie Wood or Bill Ackman. Don’t think of this as FUD on his remaining SPACs, but consider this a documentarian’s glimpse into the King of SPACs; it’s not a postmortem, but a reflection of times which have proven difficult for both SPACs, SPACs sponsors, and most famously — its King.

Earnings

Trending Earnings

ChargePoint Holdings charged 7.2% in extended trading after reporting impressive revenue figures which grew 90% year-over-year to $80.7 million. $CHPT expects $450 – 500 million in annual revenue for 2023.

$CHPT | EPS: $3.19 (vs. $2.86 expected) | Revenue: $80.7 million (vs. $76.55 million expected) | Link to Report

Okta faltered 5.6% in extended trading despite posting earnings and sales exceeding analysts’ expectations. Total revenue accelerated 63% YoY.

$OKTA | EPS: ($0.18) (vs. ($0.24) expected) | Revenue: $383 million (vs. $360 million expected) | Link to Report

Splunk reported a surprise profit and grew revenue by 20% in the fourth quarter. $SPLK also appointed Gary Steele as the company’s new CEO, replacing Graham Smith who served since Nov 2021.

$SPLK | EPS: $0.66 (vs. ($0.32) expected) | Revenue: $901 million (vs. $784 million expected) | Link to Report

C3.ai dove 3% after-hours despite beating earnings and sales forecasts. The software provider raised the fiscal year 2022 revenue guidance to $252 million, a 38% jump over the prior year. $AI is down 27.45% in 2022.

$AI | EPS: ($0.07) (vs. ($0.27) expected) | Revenue: $69.8 million (vs. $66.8 million expected) | Link to Report

Bullets

What’s Making Headlines?

🛢️ Oil reserves do little to dampen oil’s run. Oil jumped to its highest since 2011 after OPEC+ decided to hold output steady in spite of Russia’s war on Ukraine. In short, they’re running up the tab against predominately Western nations. For that reason, they’re likely to guarantee this is the last era of “peak oil” before countries catch on and turn into renewables and energy independence. Here’s CNBC with some more broad coverage of the matter.

💰 Epic Games buys Bandcamp. The company behind Fortnite and Unreal Engine is now acquiring indie music platform Bandcamp. Details of the deal were not released. The acquisition is expected to play a role in Epic’s growing creator marketplace ecosystem. Read more in Axios.

🏴 Biden’s State of the Union address coincided with Texas primaries. The state of Texas scheduled its primary elections for a most unique night: the night of Joe Biden’s State of the Union Address. While Biden spoke on Ukraine, Russia, and issues afflicting Americans, the state parties in Texas chose who they’d like to play ball in the general later this year. Read the liveblog on ABC’s FiveThirtyEight.

Links

Links That Don’t Suck

⛓️ Tom Scott Takes The Elie Chainwalk, Which He Insists Is Safe If You Follow the Signs

⚖️ State AGs Launch Investigation into TikTok

🔭 Why Are There Holes in the James Webb Sunshield?

⚔️ Vox Explains Putin’s War on Ukraine (With Sources)

📚 Amazon To Shut Some Bookstores and Other Physical Shops In Pivot

🇺🇦 Updates on the War: Russia Forces Claim Control Over First Major City in Ukraine