As the case for growth has fallen apart, it feels as though the star of one of its most forefront figures has also fallen — Chamath Palihapitiya was once seen as a hero of the retail investor, but now he’s seen almost universally as a villain. (Don’t believe us? Go read the streams.)

The 45-year-old is credited with popularizing SPACs, a novel way by which corporations could go public and avoid the arduous IPO process — filings and all. However, in retrospect, maybe there’s a reason why the IPO process is intentionally difficult. As growth stocks have fallen out of fervor, so too have the highly-speculative SPACs, which have posted “weak” returns.

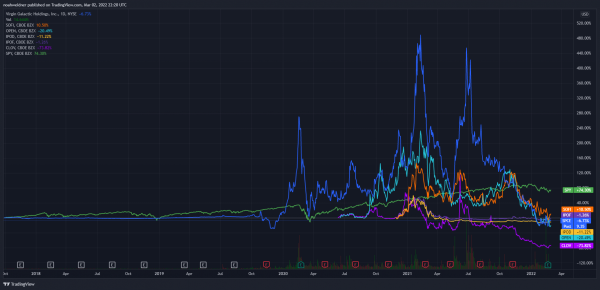

That weakness has offered little exception, including for Palihapitiya. The early entrants of his alphabet worth of SPACs — IPOA (now Virgin Galactic), IPOB (now Opendoor), IPOC (now Clover Health), and IPOE (now SoFi) — have radically underperformed the market. To make matters worse, Chamath has still not closed mergers for two funds — $IPOD and $IPOF — frequently trade below their NAV value (barring the times that people drum up delusions that the SPACs will acquire SpaceX or Stripe, which probably would be better off going it alone in their IPO process.)

The controversy has also cast a shadow of doubt on the Social Capital CEO, who is being sued by shareholders over a number of disputes. Most namely, lawyers claim he “insider sold” Virgin Galactic and misled investors about Clover Health’s business fundamentals. Their cases might have some strength, given Chamath’s court grilling in December (he was fighting an appeal suggesting the sale of dating app Tinder was deceitful in form.) Independent of these scraps with investors, Chamath dug an even deeper hole in January when he said that “nobody cares” about the “Uyghur genocide” in China during a podcast episode. In recent weeks, he stepped down as Chairman of the Virgin Galactic board.

Chamath still has an ardent digital fanbase, which follows him even in spite of these fairly objective shortcomings (the chart) and hot takes (namely, that opinion about China.) However, what we feel confident to say is that his fanfare has shrank because he has not proven to be a Buffett-tier investor. In fairness to him, nor has Cathie Wood or Bill Ackman. Don’t think of this as FUD on his remaining SPACs, but consider this a documentarian’s glimpse into the King of SPACs; it’s not a postmortem, but a reflection of times which have proven difficult for both SPACs, SPACs sponsors, and most famously — its King.