Is there going to be a recession?

It seems to be the only thing that financial media is talking about right now.

Nearly a month ago, 28% of forecasters were feeling a recession was just around the corner — or less than 12 months away. That figure appeared to be on the rise, too.

Meanwhile, regular Americans are feeling even more nervy. In a recent survey, 60% of polled Americans were concerned about a “major recession.” A factor looming heavy in that decision? Inflation, the stock market’s backslide, and economic activity shrinking in the first quarter of the year.

Of course, one big factor confounding these concerns is the country’s latest jobs and quits numbers. For the last six months, the number of available jobs has stayed above 10 million, while unemployment fell to near pre-pandemic levels.

Another huge factor? People leaving their jobs. More than 6 million people quit their jobs in April.

We covered both factors at length in the top story of our Friday Rip.

A strong economy now doesn’t = a strong economy in 12 months, though. Nor does it mean a strong economy in 18, 24, or 36 months. To quote Ellie Goulding, “anything could happen.”

One thing is for sure, though: the markets are absolutely not hot right now. And while the markets are a reflection of sentiment and some portions of the economy, it’s by no means the best indicator to measure the economic success of a nation…

The S&P 500 fell -0.18% this week, the Nasdaq Composite fell -1.52%, and the large-cap Dow Jones Industrial Average fell -0.24%. These losses are preferable, though, to what we saw last week. (iykyk.)

It’s probably a given by now, but crypto had its own standout week of disaster: Bitcoin (-8.8%) and Ethereum (-7.7%) went lower this week. My friends who don’t understand crypto messaged me to tell me that “the fad is over.” We’ll have to see about that…

An honorary mention should go out to orange juice, which was the best-performing commodity of the week. It traded up nearly +10%. The worst-off commodity was UK Gas, which fell more than -20%. It’s now down -43% MoM.

Before we talk shop, peep the week’s moves:

| S&P 500 | 4,123 | -0.18% |

| Nasdaq | 12,144 | -1.52% |

| Russell 2000 | 1,839 | -1.29% |

| Dow Jones | 32,899 | -0.24% |

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s a summary of important earnings and economic data for the trading week ahead.

Economic Calendar

5/11 CPI & Core CPI (8:30 AM ET)

5/11 EIA Crude Oil Inventories (10:30 AM ET)

5/12 Initial & Continuing Claims (8:30 AM ET)

5/12 PPI & Core PPI (8:30 AM ET)

5/13 Import & Export Price Index (8:30 AM ET)

5/13 Univ. of Michigan Consumer Sentiment (10:00 AM ET)

Looking for everything else? Here’s the whole breakdown from briefing.com.

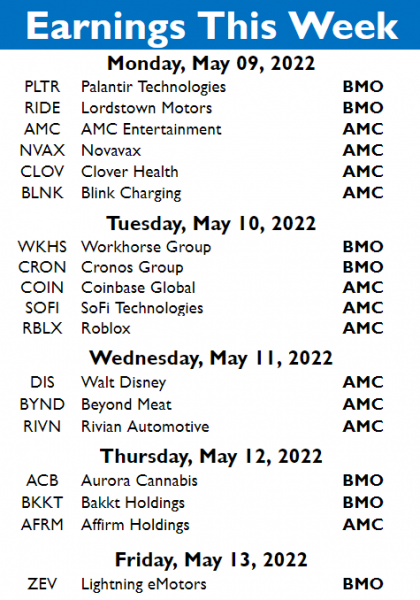

Earnings This Week

Now that Big Tech earnings behind us, what lies ahead? We’re glad you asked…

Turns out, there’s 926 tickers that the Stocktwits community will be tracking as they report this week, with the majority reporting on Tuesday and Thursday.

That’s only our shortlist, by the way. Check out the full Stocktwits earnings calendar to see the other names reporting this week.