Welcome to the Stocktwits Top 25 Newsletter for Week 26 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 26:

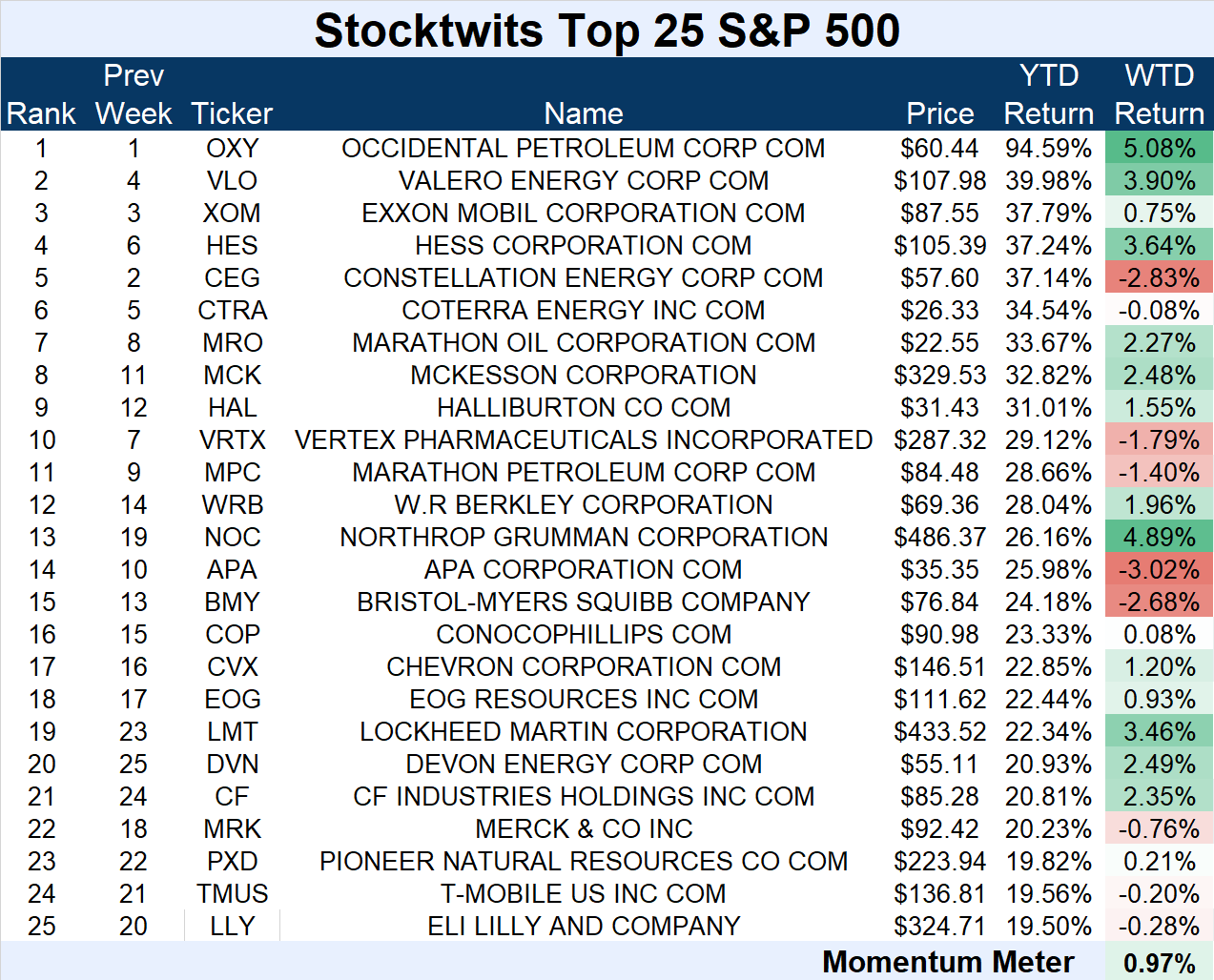

S&P 500

ST Top 25 S&P 500

The S&P 500 Top 25 list was up 0.95% as energy stocks rebounded.

There were no changes to the list, just intra-list moves. A relatively muted week overall.

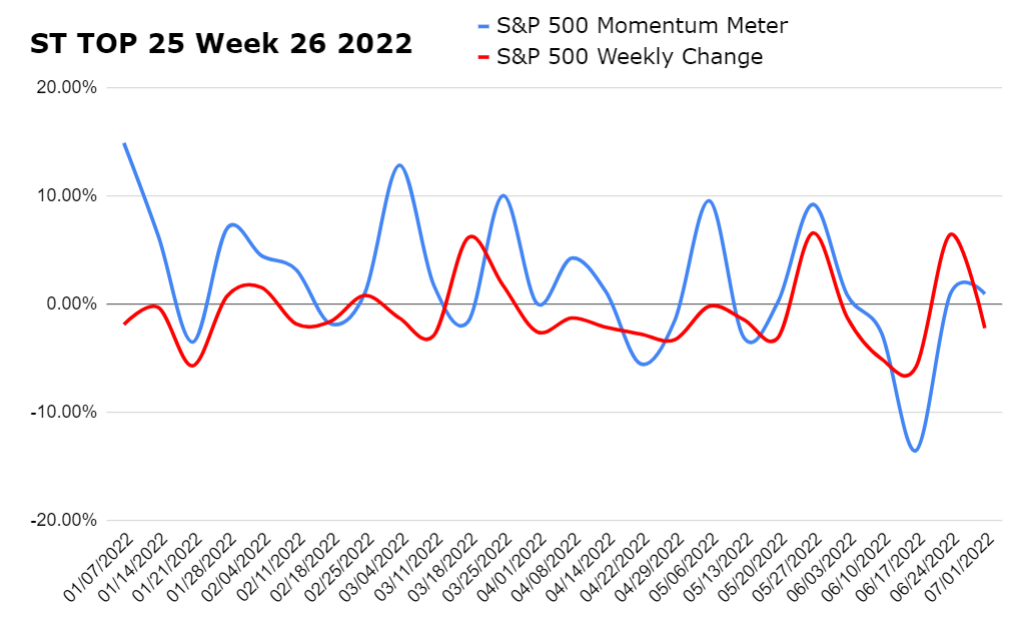

Members of the Top 25 list outperformed — +0.97% vs. the S&P 500, -2.21%. Check out how the momentum meter has looked against the actual index so far this year:

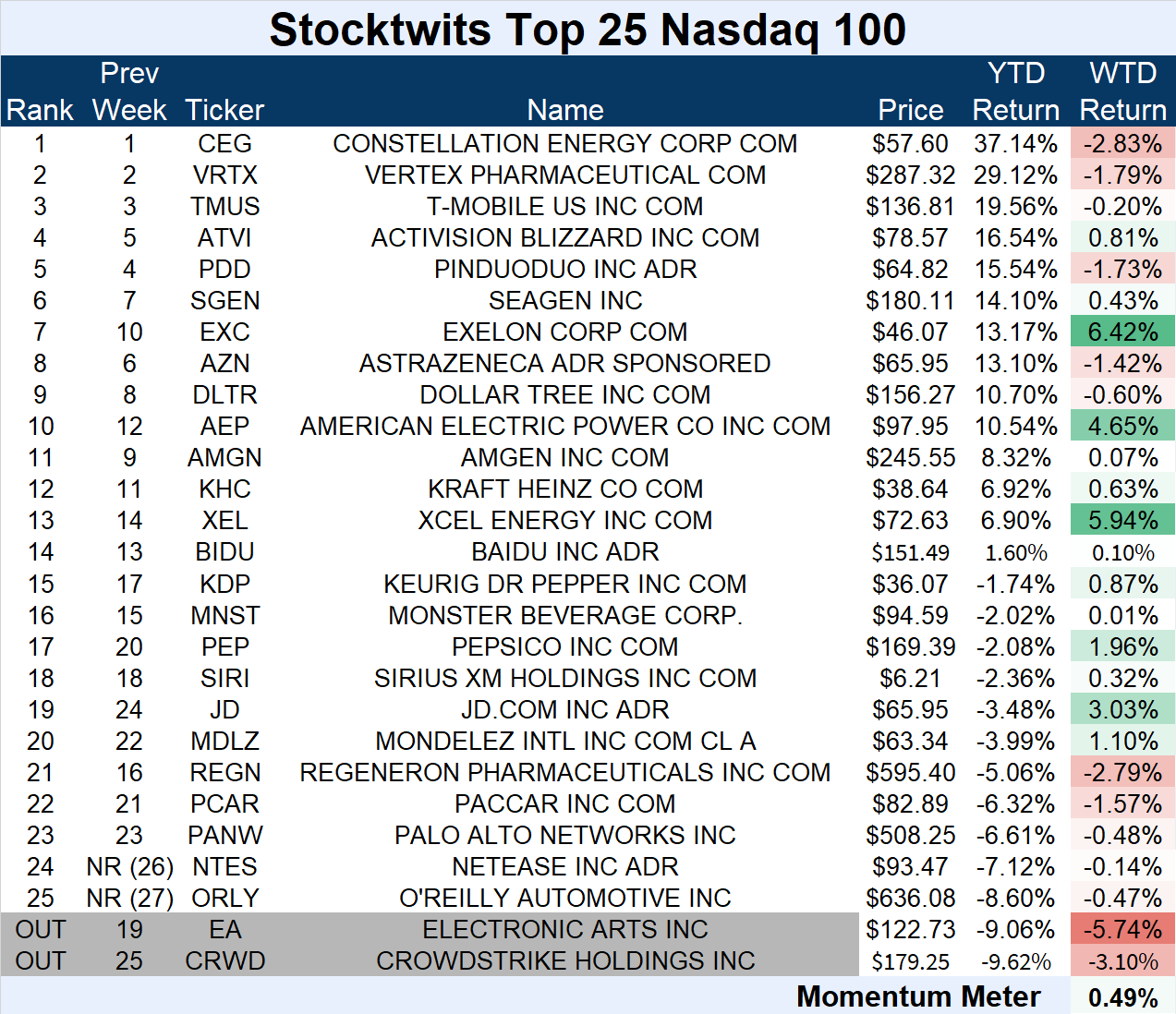

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100’s Top 25 leaders outperformed with a 0.49% average gain.

Utilities Exelon Corp (+6.42%), American Electric Power (+4.65%), and XCEL Energy (+5.94%) were the top gainers.

Netease Inc. (-0.14%) and O’Reilly Automotive (-0.47%) joined the list.

They replaced Electronic Arts (-5.74%) and Crowdstrike Holdings (-3.10%).

The Top 25’s momentum meter was up 0.49%, outperforming the index’s 4.30% loss.

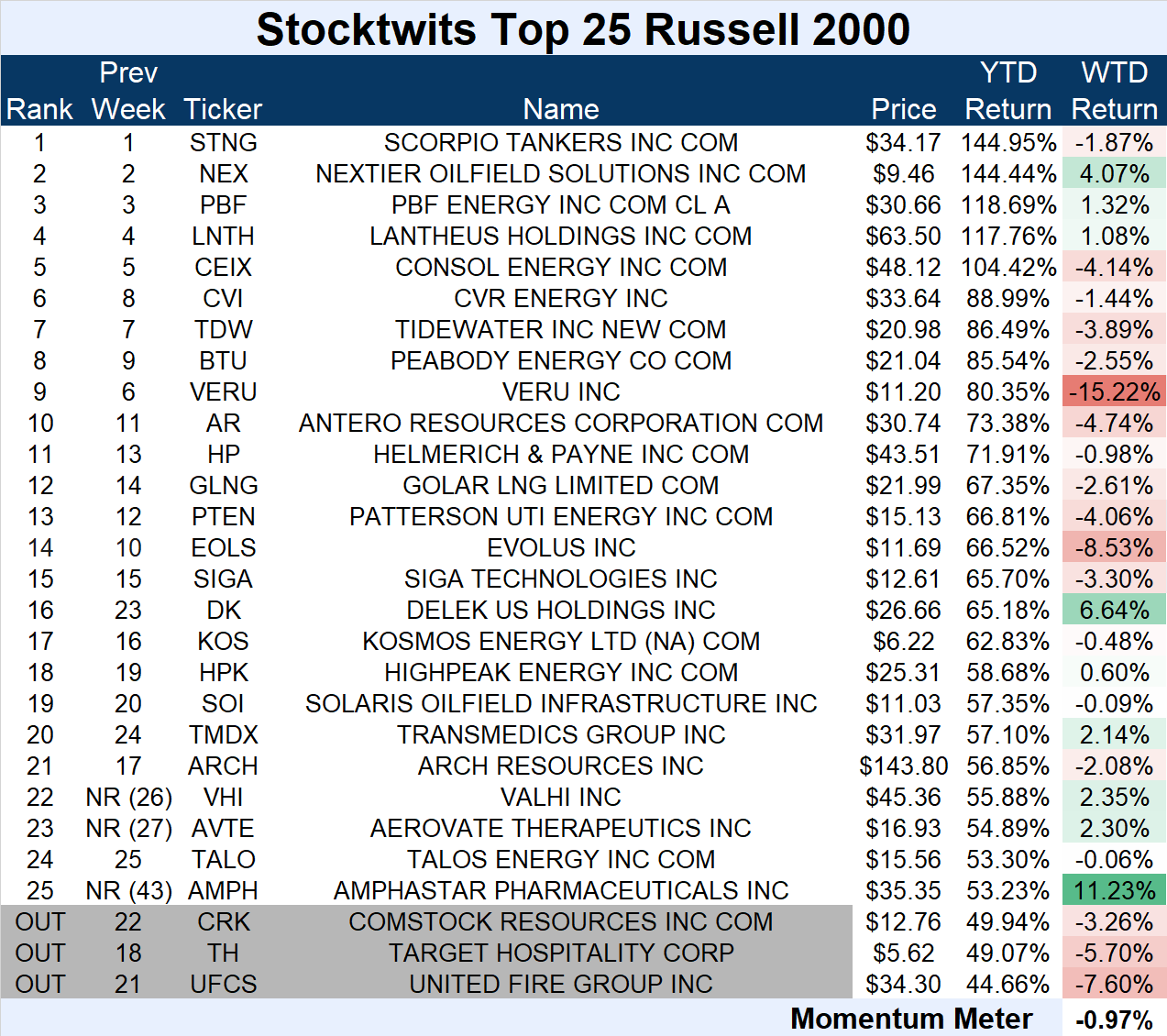

RUSSELL 2000

The Growth-Centric Russell 2000

The R2K Top 25 list fell along with the index, dropping an average of 0.97%.

Amphastar Pharmaceuticals (+11.23%) was the top gainer, and Veru Inc. (-15.22%) was the biggest loser.

There were three significant changes to the list.

Joining the list are Valhi Inc. (+2.35%), Aerovate Therapeutics (+2.30%), and Amphastar Pharmaceuticals (+11.23%).

They replaced Comstock Resources (-3.26%), Target Hospitality Corp. (-5.70%), and United Fire Group (-7.60%).

The Russell’s Top 25 companies outperformed the broader index. Its Momentum Meter was down 0.97% this week, while the broader index was down 2.15%.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

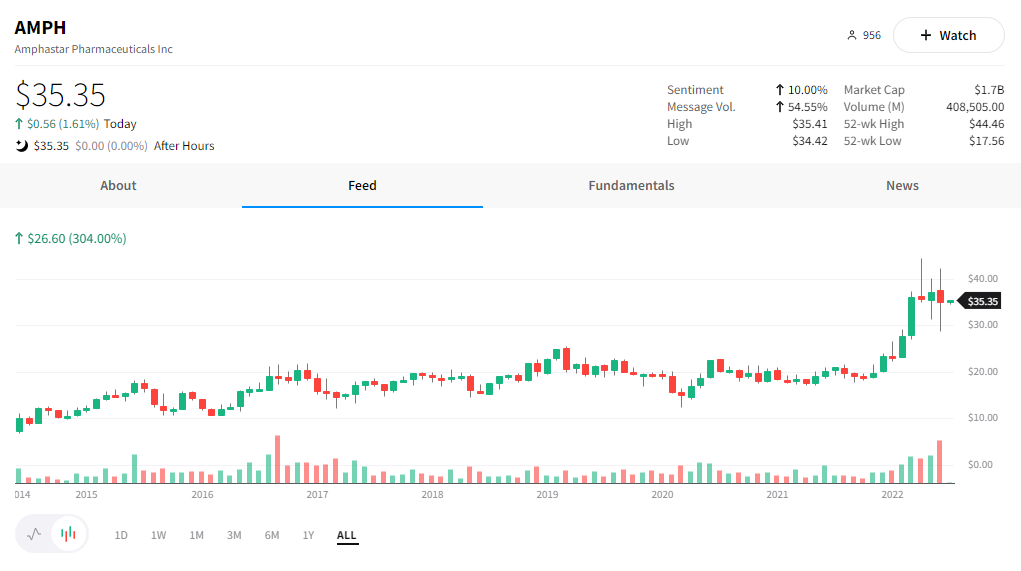

The Top 25 list’s Top Dawg was Amphastar Pharmaceuticals, which rallied 11.23% this week.

The $1.73 billion bio-pharma company continues to grind higher after a 30%+ loss earlier in the month when the FDA rejected its generic osteoporosis drug.

Despite the pullback, the stock continues to hover near all-time highs.

$AMPH is up 53.23% YTD.

See Y’all Next Week 🤙