We hope you’re enjoying your three-day weekend! 😊

As a reminder, U.S. markets are closed Monday for Independence Day. 🥳

Let’s recap and look to the week ahead.

What Happened?

👩🏾⚖️ The Supreme Court remains in the headlines as Ketanji Brown Jackson officially became the first Black woman on the Supreme Court. Additionally, the court handed down several decisions regarding the Environmental Protection Agency’s powers, the “Remain In Mexico” rule, and the ability of state legislatures to set rules for federal elections.

📆 The year’s first half is over, and commodities were the best performing asset class. Investors ponder whether traditional assets will pick up in the second half or if more pain is ahead.

🤩 This week’s Stocktwits Top 25 report showed marginal outperformance from the market’s top stocks.

🤔 The final Q1 print was -1.60%, and now the Atlanta Fed’s GDPNow gauge forecasts a 2.10% decline for Q2. So have we all manufactured a recession by pre-emptively preparing for a downturn?

😮 Fed Chair Jerome Powell was criticized for admitting ‘we now understand better how little we understand about inflation.’ at the European Central Bank Forum in Sintra, Portugal.

⚖️ The annual Russell Index rebalance moved some unlikely names into the value index, including Facebook, Netflix, Paypal, and Zoom.

📰 In international news, Russia was pushed into its first default on foreign debt since 1918 as G7 leaders kept the sanction/economic pressure on. Meanwhile, NATO has reportedly addressed Turkey’s concerns, paving a path for Sweden and Finland to join.

🤝 Also, the EU and New Zealand sealed a free trade deal after four years of negotiations, showing the region’s commitment to diversifying its business ties away from Russia. And Credit Suisse was found guilty of a cocaine cash laundering scheme in Switzerland’s first criminal trial of its major banks.

📉 Private companies continue to have a tough time, whether raising another round or going public. Buy now, pay later giant Klarna is reportedly looking down the barrel of a massive down round. Meanwhile, Panera Bread is canceling its SPAC deal, citing market conditions.

₿ Crypto markets remain in turmoil as hedge fund Three-Arrows Capital filed for chapter 15 bankruptcy and broker Voyager suspended all trading, deposits, and withdrawals Friday afternoon. Meanwhile, Sam Bankman-Fried and FTX continue to shop for bargains amid the crypto wreckage.

😂 Lastly, in lol news of the week, Apple’s former securities lawyer pled guilty to insider trading. The man had one job, and he failed miserably.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $RDBX, $SIGA, $TSLA, $MULN, $BTC.X, and $ETH.X.

Those are the major stories from the week. And here are the final prints:

| S&P 500 | 3,825 | -2.21% |

| Nasdaq | 11,128 | -4.13% |

| Russell 2000 | 1,728 | -2.15% |

| Dow Jones | 31,097 | -1.28% |

Bullets

Bullets from the Weekend

🤝 BlockFi and FTX strike a deal. Cryptocurrency lending company BlockFi and FTX U.S. have agreed on a $400m revolving line of credit and potential acquisition. The deal represents a total value of $680 million and includes an option to acquire BlockFi at a variable price of up to $240m based on performance triggers. The deal comes as BlockFi CEO Zac Prince looks to calm fears about the company’s health. Decrypt has more.

⚡ Tesla EV deliveries fall 18% in the second quarter. Supply chain constraints, China’s extended COVID-19 lockdown, and challenges opening factories in Berlin and Austin took a toll on the company’s Q2 performance. The drop is the first time that Tesla deliveries have fallen QoQ in two years, although they are still up 26.5% YoY. Read more from TechCrunch.

💸 U.K. government proposes the biggest tax cut in a decade. U.K. Prime Minister Boris Johnson and Chancellor Rishi Sunak have outlined what they’re calling “the single biggest tax cut in a decade” as they look to show unity on the cost-of-living crisis. The announcement comes amid recent inflation readings reaching a 40-year high of 9.1%. Moreover, many experts expect inflation to continue rising through the end of the year as the war in Ukraine exacerbates supply problems. Morningstar has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

07/05 RBA Interest Rate Decision (12:30 AM ET)

07/05 Factory Orders (10:00 AM ET)

07/06 S&P Global Services/Composite PMIs (9:45 AM ET)

07/06 JOLTS Job Openings (10:00 AM ET)

07/06 ISM Non-Manufacturing PMI (10:00 AM ET)

07/06 FOMC Minutes (2:00 PM ET)

07/07 ADP Employment Change (8:15 AM ET)

07/07 Balance Of Trade (8:30 AM ET)

07/07 Initial Jobless Claims (8:30 AM ET)

07/08 Non Farm Payrolls & Unemployment Rate (8:30 AM ET)

07/08 Wholesale Inventories (10:00 AM ET)

Employment data will be in focus as it remains the one part of the economy that’s yet to show any meaningful cracks. In addition to the above, check out this week’s full list of economic releases.

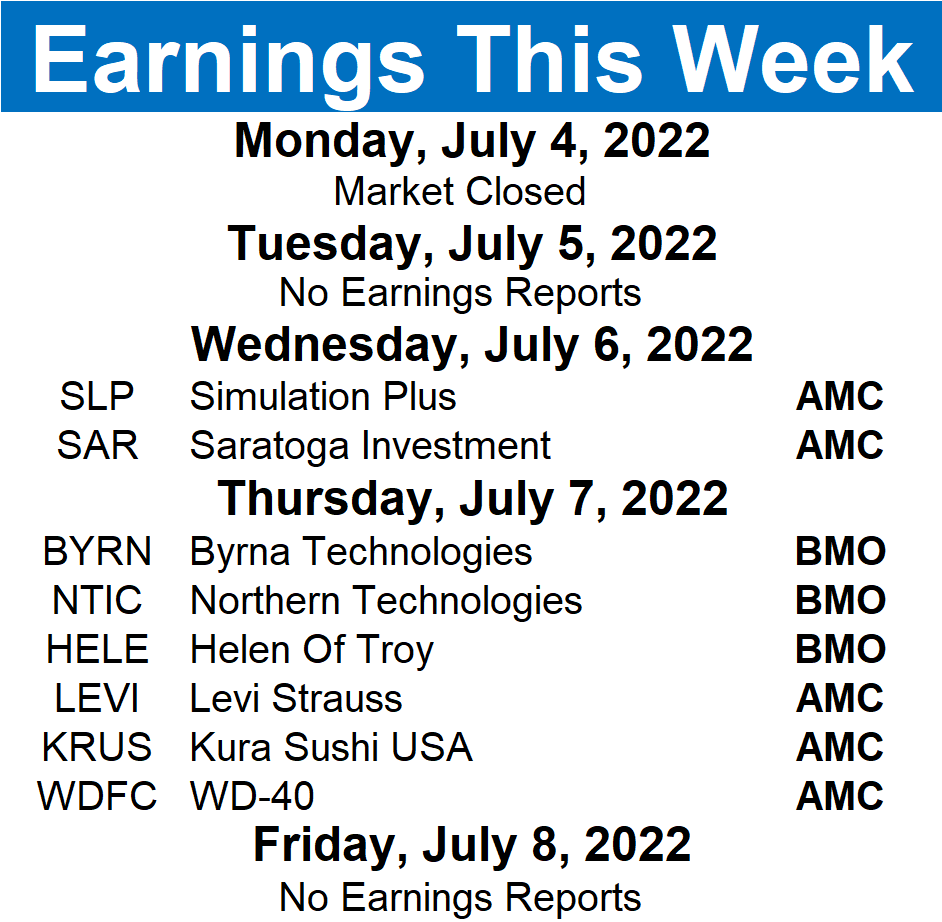

Earnings This Week

Only 8 companies report this week. Below is the full list.

Check out the full Stocktwits earnings calendar to see the names reporting in future weeks.

Links

Links That Don’t Suck:

🦖 Study of ancient mass extinction reveals dinosaurs took over earth amid ice, not warmth

🏗️ Chinese property developer Shimao misses repayment on $1 billion bond

📰 Peter Brook, tony-winning theater director, dies at 97

🔭 The Webb telescope just took the deepest photo of the universe ever

🏛️ Vatican takes big loss in sale of London building at heart of trial

🚀 Astronaut study reveals effects of space travel on human bones

💰 Sequoia Capital reportedly raising two funds, and despite slower VC environment, it’s not alone

🤖 Florida man allegedly poses as Disney employee to steal $10k Star Wars R2-D2 replica