The markets are experiencing turbulence ahead of the Fed announcement — here’s what you missed.

Walmart is once again setting a gloomy tone for earnings season, pre-announcing a weaker forecast yesterday after the bell. As a result, the stock was down 7.60% today and ushered in a dark cloud over the market, which will hear from a metric ton of companies this week and next. ⛈️

Given the circumstances, some might say the market has a “Wal(mart) of Worry” to climb. 🥁

Anyway, moving on…here’s today’s heat map.

3/11 sectors closed green, with defensive areas like utilities (+0.61%) leading and consumer discretionary (-3.23%) and communication services (-1.99%) lagging. 🟢

In economic news, the S&P Case-Shiller data showed that home price growth slowed in May for the second straight month, coming in at *only* 19.7%. Meanwhile, U.S. new home sales dropped 8.1% in June, with actual unit sales of 590,000 coming in well below estimates of 663,000. The median price of new homes sold was $402,400, while the average price was $456,800. In a cooling market, homebuilders are boosting incentives to help spur demand which has cratered as higher interest rates and prices pushed affordability out of reach for many. 🏘️

Meanwhile, the International Monetary Fund (IMF) reduced its outlook for the global economy to 3.2% in 2022 and 2.9% in 2023. It finds the adjustments necessary given the downside risks it outlined in its April are playing out, including soaring global inflation, a slowdown in China, and the war in Ukraine. 👎

Additionally, Russia says it will quit the International Space Station after 2024, though we’ll have to see if they actually follow through on their threat. 🤷♂️

Shopify fell 14.06% after announcing it will lay off 10% of its global workforce amid a broader pullback in online spending. The company also reports earnings tomorrow before the opening bell.

Coinbase tumbled 21.08% on reports that the SEC is investigating whether the platform offered unregistered securities. In addition, the House Financial Services Committee is delaying the bipartisan stablecoin bill after Treasury Secretary Janet Yellen pushed for changes to a key provision of the legislation. Lastly, Kraken is now under investigation by the U.S. Treasury Department for alleged sanctions violations. ₿

Other symbols active on the streams included: $SIGA (+11.09%), $RDBX (+14.05%), $GOVX (+10.69%), $XELA (-36.43%), $BBIG (-20.80%), $SNDL (-23.34%), $AUPH (-16.00%), and $MULN (-14.36%). 🔥

Here are the closing prices:

| S&P 500 | 3,921 | -1.15% |

| Nasdaq | 11,563 | -1.87% |

| Russell 2000 | 1,805 | -0.69% |

| Dow Jones | 31,762 | -0.71% |

Earnings

Earnings Recap

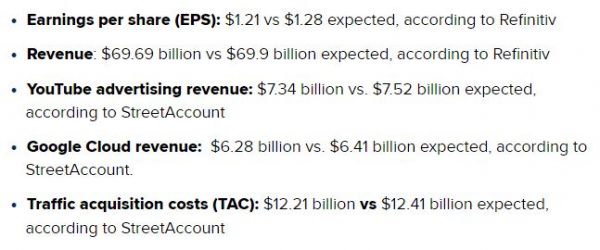

Alphabet shares are up around 3% after hours despite the company missing on the top and bottom lines. The screenshot below from CNBC is a good summary of the stats investors are paying attention to. Additionally, ad revenue slightly exceeded expectations, which may be calming some of investors’ fears after Snapchat’s awful earnings report last week. 😌

Microsoft shares are flat after the company also missed earnings and revenue expectations. The company blamed foreign exchange rate pressure (strong dollar) and a deteriorating PC market, both themes that we’ve covered in the Daily Rip over the last few months.

The company saw revenue reduced by $595 million and earnings per share reduced by 4 cents due to worsening foreign exchange rates. 💱

Despite those troubles, investors seem to be focused on the core areas of Microsoft’s business, which remain *relatively* resilient despite a challenging environment.

General Motors missed earnings expectations after supply chain issues caused it to ship fewer vehicles than expected. The company is maintaining its previous earnings guidance for FY 2022, saying it’s confident it will be able to ramp up production in the year’s second half. 🚗

Revenues did beat, though the company’s EBIT-adjusted margins did fall to 6.6% in the quarter. CNBC highlights the numbers in focus.

3M shares rallied ~5% after the company announced it would spin off its healthcare business into a separate publicly traded company. Outside of that, its earnings and revenue did come in slightly above analyst expectations. 🏥

UPS shares slumped by ~3.41% today as investors focused on volumes, which fell short by 222,000 packages per day. The company did beat earnings and revenue expectations as higher shipping rates offset the drop in volume. Despite the drop-off in volume, the company reiterated its full-year financial outlook. 📦

McDonald’s shares traded higher by nearly 3% after the company beat earnings estimates but missed on revenues. The company’s global same-store sales rose by 9.7%, highlighting strong international growth. The closure of its Russian and Ukrainian restaurants had a marginal impact on sales, which mattered given the company only missed revenue expectations by $0.09 billion. 🍟

Inflation remains the critical factor for the company, as it can only pass on a portion of its rising costs to consumers without hurting sales.

Chipotle shares rallied ~8% after hours, following the company’s earnings beat. U.S. same-store sales came in at the lower end of its 10%-12% guided range, and its restaurant-level operating margin increased to 25.2%. The company noted that most of its customers are higher household income consumers, which has helped it raise prices to keep pace with rising costs. 🌯

Keep track of all the upcoming releases with the Stocktwits’ earnings calendar! 📅

Sponsored

Supercharged Financial Learning (That’s Bloody Entertaining, Too)

You’re invited to join Real Vision’s Real Investing Course. WTF is that? It’s 10 hours from the world’s best investors teaching you to be a better investor. That’s coupled with fresh lessons filmed in an underground bunker, a cinema, and a bar. (Yeah, this is NOT like any other course you’ve seen).

Bullets

Bullets From The Day:

🚀 SpaceX is getting a new European competitor. U.K. satellite company OneWeb will be taken over by European rival Eutelsat in a $3.4 billion all-stock merger. The deal excludes special shares held by the U.K. government that gives it a say on national security matters. The companies expect the deal to close by the first half of 2023 after going through a strict national security clearance process in the U.K. The combined company hopes to compete with SpaceX and other competitors leading the industry. CNBC has more.

⛽ The White House hopes to kick oil prices while they’re down. Crude oil prices in the U.S. have come down roughly 25% since early June, helping bring down gas prices across the country and ease some inflation pressures. The White House hopes to keep that trend going by selling an additional 20 million barrels of oil from its strategic reserve. The administration will begin its efforts to replenish reserves, which have been depleted by 180 million barrels, sometime in the fall. More from Reuters.

📱 India receives $18 billion bids in its 5G auction. The race to bring 5G service to India is off to a hot start, with the government receiving bids from companies across the telecom industry. It expects 5G service to begin rolling out in September and reach around 50 million customers by the end of 2023 and 500 million by the end of 2027. TechCrunch has more.

📈 Alibaba shares jump after announcing plans for dual listing. The e-commerce giant’s stock already trades on the U.S. and Hong Kong exchanges, but its current listing in Hong Kong is a secondary one. The company expects the primary listing process in Hong Kong will wrap up by the end of the year. It will allow Alibaba to be included in the Shenzhen-Hong Kong Stock Connect, providing access to investors in mainland China. More from CNBC.

🛒 Startup hopes to bring one-click checkout to the B2B world. One-click shopping has dominated the business-to-consumer space for years; however, innovation in business-to-business commerce has lagged far behind. As a result, only 7% of the $120 trillion business-to-business payment volume occurs digitally today, which the startup Balance sees as a significant opportunity. The company, co-founded by former PayPal employees, looks to revolutionize payments for B2B e-commerce merchants and has raised $87 million in funding so far to support its mission. TechCrunch has more.

Links

Links That Don’t Suck:

🦈 Reach market shark status with 4 weeks of MarketSmith for just $29.95 (that saves you $120)*

🏈 Aaron Rodgers arrives at training camp looking like Nicolas Cage in ‘Con Air’

🌮 The Choco Taco is dead, but it will never be forgotten

🤖 General Motors is fighting EV misinformation with a video chat hotline

💸 CEO sold worthless crypto tokens and used proceeds for Hawaii condo, DOJ says

👀 Facebook parents Meta raises price of its Quest 2 VR headset by $100

*this is a sponsored post