Welcome to the Stocktwits Top 25 Newsletter for Week 44 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 44:

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+1.71%) outperformed the S&P 500 index (-3.35%).

There were two major changes to the list this week.

Diamondback Energy (+4.91%) and W.R. Berkley Corporation (+2.20%) joined the list.

They replaced Northrop Grumman (-4.62%) and Huntington Ingalls Industries (-5.21%).

Energy stocks and health care remained the bright spots this week. A recurring theme of sorts…

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

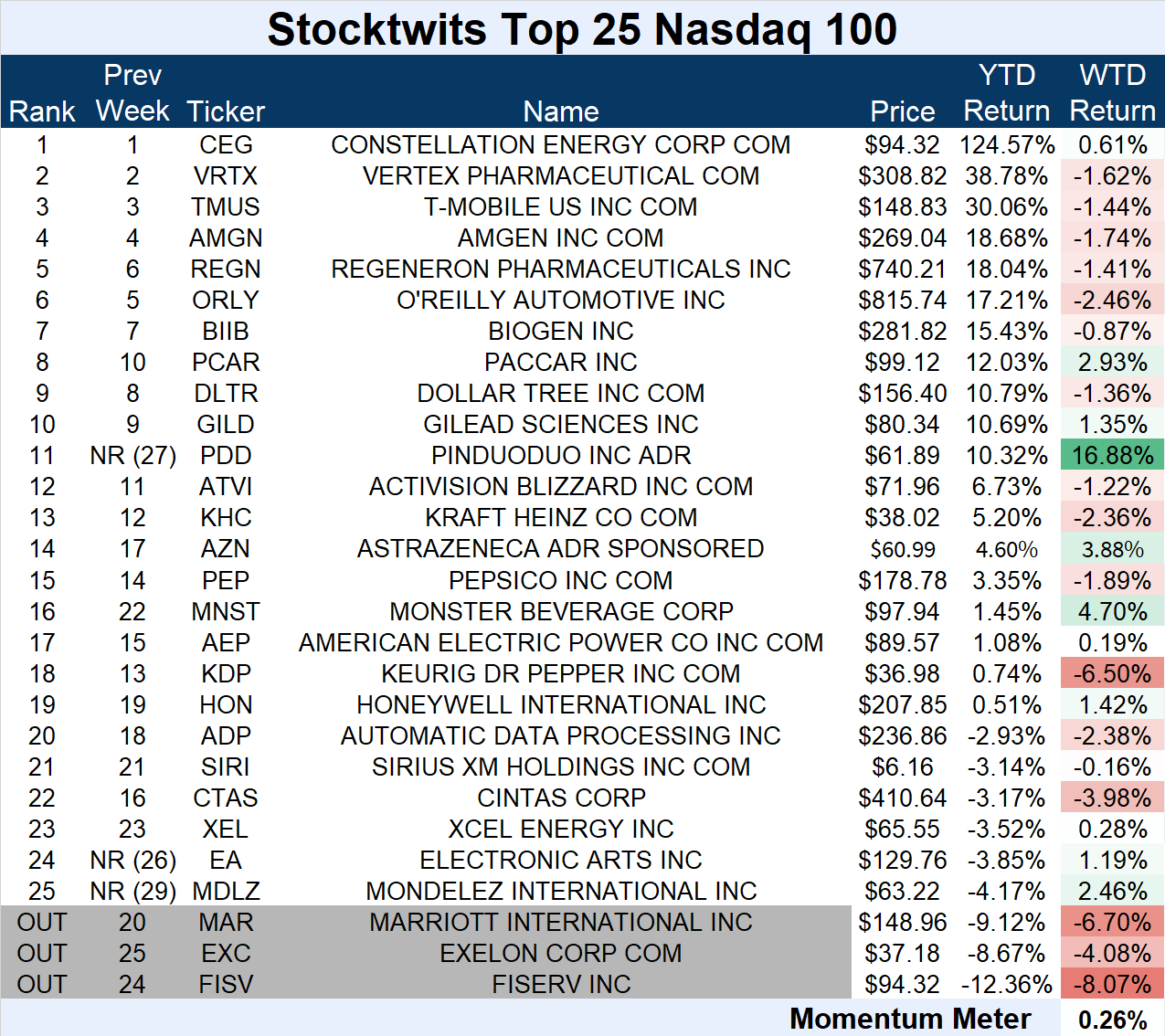

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+0.26%) outperformed the Nasdaq 100 index (-5.97%).

There were three major changes to the list this week.

Pinduoduo (+16.88%), Electronic Arts (+1.19%), and Mondelez Int’l(+2.46%) joined the list.

They replaced Marriott International (-6.70%), Exelon Corp. (-4.08%), and Fiserv (-8.07%).

Weakness was pretty broad-based, with some standouts like Pinduoduo, Fiserv, Keurig Dr. Pepper, and a few others. Everything else was up or down by a marginal amount.

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+4.09%) outperformed the Russell 2000 index (-2.55%).

There were three major changes to the list this week.

Helix Energy Solutions (+5.23%), Modine Manufacturing (+18.29%), and Patterson UTI Energy (+4.74%) joined the list.

They replaced Amylyx Pharma (-5.47%), Cincor Pharma (-13.81%), and Veru (-15.23%).

Oil and gas companies were winners, while health care and biotech were losers.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was W&T Offshore, which rallied 18.53%. 📈

The small-cap ($1.25 billion) oil and natural gas producer did not have any specific news this week, it just rallied along with other energy commodities and stocks. 🛢️

However, the company will report earnings on Tuesday, November 8th, after the market close. Investors can expect some volatility around that event. 📝

$WTI is up 147.86% YTD.

See Y’all Next Week 🤙