U.S. stocks battled into the green but closed down for the week. Meanwhile, speculation over China’s reopening pushed international stocks and commodities higher — let’s see what else you missed. 👀

Today’s issue includes an October jobs summary, a gamble that didn’t pay off, and the tech wrecks you need to see. 📰

Check out today’s heat map:

Every sector closed green. Materials (+3.48%) led, and health care (+0.61%) lagged. 🟢

Chinese stocks ranging from Alibaba to Bilibili jumped sharply on rising speculation that China will lift its Covid restrictions. Also, the low-float materials’ stock Huadi International continued its meteoric rise, jumping another 70%. 📈

Amazon dropped below the $1 trillion market cap, while the total crypto market cap broke back above $1 trillion. 😮

In crypto news, Fidelity and ForUsAll provide 401(k) investors access to crypto. A $1 billion crypto hack causes a 20% drop in GALA tokens. DogeCoin sinks after reports that Musk told Twitter employees to pause its crypto wallet efforts. And the IRS is gearing up for an increase in crypto cases this coming tax season. ₿

Other symbols active on the streams included: $PERF (+26.48%), $MMTLP (+3.03%), $TSLA (-3.64%), $MULN (-6.91%), $PKBO (+105.79%), $LUNC.X (+9.68%), and $MATIX.C (+20.62%). 🔥

P.S. Stocktwits’ “Chips For Charity” poker tournament is back and taking place on December 3rd. The first 100 donors receive a free Stocktwits hat, so come support a great cause and compete for a $5,000 grand prize! We’ll see you there. 👍

Here are the closing prices:

| S&P 500 | 3,771 | +1.36% |

| Nasdaq | 10,475 | +1.28% |

| Russell 2000 | 1,800 | +1.13% |

| Dow Jones | 32,403 | +1.26% |

Earnings

Investors’ Gamble Didn’t Pay Off

As the Federal Reserve continues to raise rates and the economy heads for a recession, investors have little patience for money-losing companies. Especially those that aren’t growing.

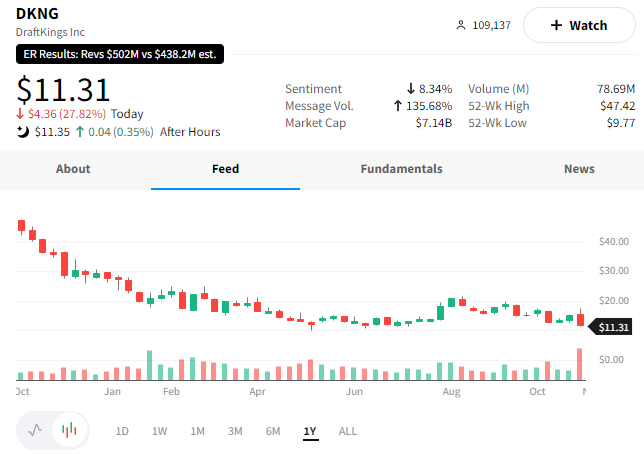

If you don’t believe us, just ask DraftKings investors, who saw their investment plunge today after the company’s quarterly earnings report. 📉

Although its revenues beat expectations ($502 million vs. 437 million) and it raised its full-year guidance, its monthly users fell short of estimates. DraftKings said it had 1.6 million monthly unique paying customers in the quarter. While that’s 22% YoY growth, it fell well short of the 2 million analysts expected.

The company hopes its online Sportsbook product expansion, which launched in September, will help drive key metrics like customer acquisition, engagement, and retention. However, investors are not waiting around to find out. $DKNG shares tumbled 28% on the day as investors jumped ship. 👎

Sponsored

The Global Shift Towards Fast-Food Kitchen Robots

Miso Robotics is already improving kitchen efficiency at top U.S. fast-food restaurants like Jack in the Box.

But demand for robotic kitchen assistants is even greater abroad.

The restaurant industry is down 500,000 workers each month, and it’s only getting worse in places like Europe, where it’s 50% more costly to fill roles than in the states.

That’s why Miso Robotics is going global, raising their addressable market to over 20 million potential locations worldwide – a 17X increase. And, they’ve already established a major international partner.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Learn about this opportunity before the campaign closes on 11/18.

Economy

October’s Employment Recap

While this week’s Federal Reserve interest rate decision was the main event, October’s labor market data was the encore. And unfortunately, neither was good news for investors. 🤢

As we’ve discussed regularly, the Federal Reserve is trying to crush demand enough to cool the labor market and housing so that record-high inflation decreases. 🥵

So far, housing has softened, and prices have begun to come down marginally. However, the labor market remains resilient. There was a slight jolt in the data last month, but October’s numbers were pretty darn good.

Let’s summarize it all:

- The September JOLTs report showed employment postings rose to 10.72 million, meaning there are 1.9 job openings for every available worker;

- The October ADP Private payrolls report showed 239k jobs were added, with wages increasing by 7.7% YoY;

- Thursday’s initial/continuing jobless claims report showed that both measures continue to hover near historic lows; and

- The October nonfarm payrolls report showed 261k jobs were added, with average hourly earnings rising 0.4% MoM and 4.7% YoY. The unemployment rate also ticked up to 3.7%, while the labor force participation rate declined by 0.1% to 62.2%.

- September’s job number was also revised higher by 52,000 and August’s revised lower by 23,000, for a net positive revision of 29,000.

The summary above indicates that the labor market is still historically strong despite the Fed’s efforts. The Fed knows that its policies will take time to work through the economy and into the data. That’s partially why it changed its language this week to acknowledge that rates will have to stay higher for longer. 📆

Within that data, we also see the service industry continuing to be the primary source of labor demand. Meanwhile, technology, management, and other general business jobs have ticked down. That data very much jives with the “tale of two labor markets” narrative we’ve been covering.

Layoffs in tech, real estate, and other industries that overexpanded during covid get all the headlines. But in the real economy, there’s still a lot of labor demand. And reducing that demand is not going to happen overnight.

So, for now, the tightening continues. And growth stocks and other risk assets are responding accordingly. 😨

Stocks

Some More Tech Wrecks

This week we received earnings reports from several former growth darlings. And most of their stocks’ reactions were absolutely dismal.

So before we send you off to enjoy your weekend, we wanted to share some of the worst charts from the week. Just in case you forgot what type of environment we’re in for broken growth stocks. 🙃

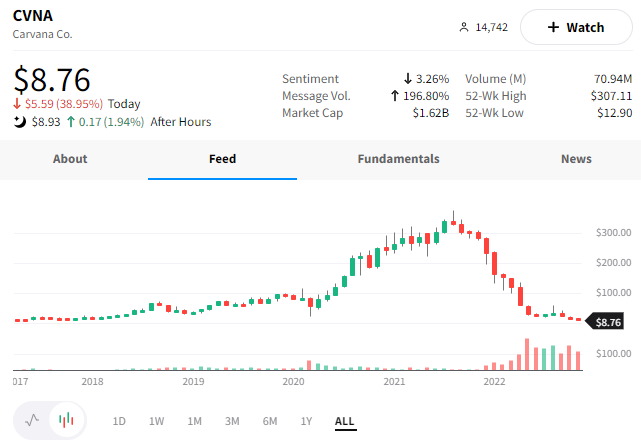

First, let’s start with a quick joke. What do you call a stock that’s down 97.68%? A stock that was down 96.19% but fell another 39%. More formally, it’s known as Carvana.

$CVNA shares suffered their worst day ever after it missed already lowered top and bottom-line expectations. Additionally, Morgan Stanley gave up on trying to cover the stock…pulling its rating and price target altogether. A 98% drop in 15 months has to be a record of some sort. Big yikes.😬

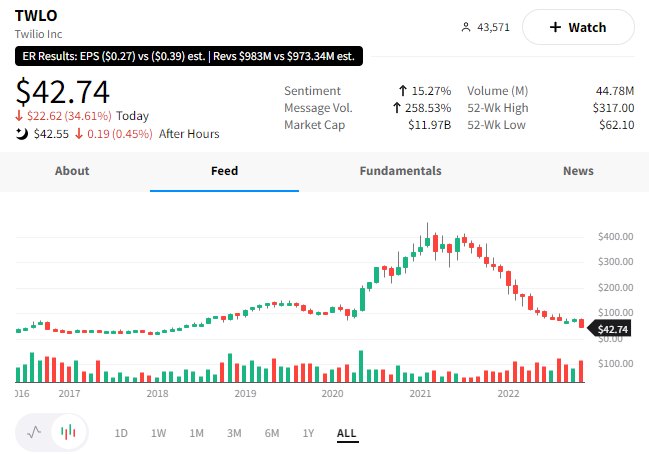

$TWLO shares crashed 35% after issuing weaker-than-expected guidance.

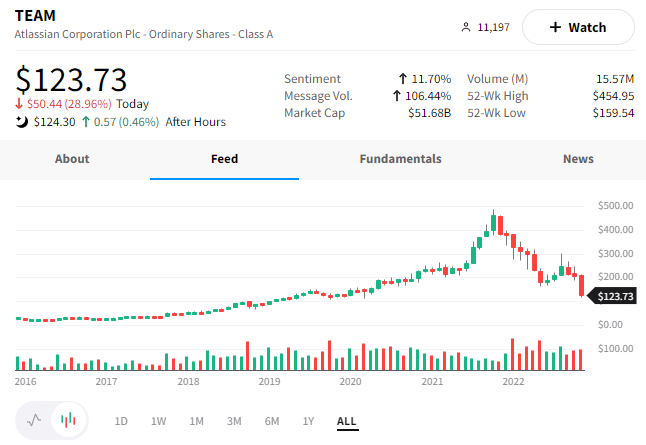

$TEAM shares fell 29% after revenue missed expectations and the software maker issued a disappointing forecast.

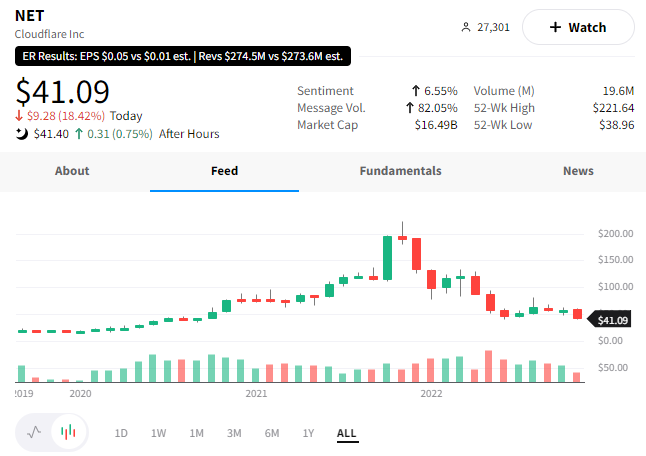

$NET shares dropped 18% despite beating earnings and revenue expectations. Once again, forward guidance was key and clearly did not appease investors.

While not a tech stock, we can’t exclude this disaster of a chart…

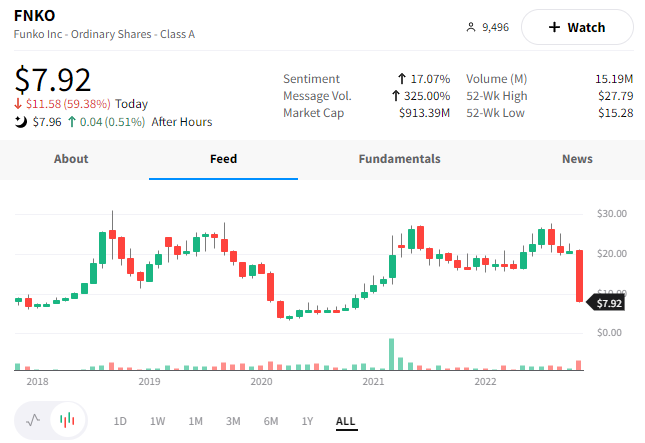

$FNKO investors were left saying “what the Funko” happened, as shares dove more than 60%. The toy company missed earnings and slashed its outlook, indicating no growth in the coming quarters. Much like its customers, the company’s investors did not play around…opting to aggressively offload shares on the news. 👎

Bullets

Bullets From The Day:

🥦 Sean ‘Diddy’ Combs acquires a cannabis business. The hip-hop mogul and businessman is expanding his empire by venturing into the cannabis world. He has acquired licensed cannabis operations in New York, Massachusetts, and Illinois for $185 million. The opportunity came because Cresco Labs was legally required to divest some of its assets after acquiring Columbia Care in a $2 billion deal, making it the top U.S. cannabis producer. The assets allow Combs to own the entire process, from growing and manufacturing to marketing and distribution. CNBC has more.

🛢️ G7 coalition agrees to a fixed price for Russian Oil. Rather than adopting a floating rate, The Group of Seven nations and Australia will set a fixed price when they finalize a price cap on Russian oil in late November. The fixed price system will require more meetings to review and adjust the pricing, but proponents argue the cap will squeeze funding to Russia without cutting supply to consumers. Russia has said it will not ship oil to countries that set price caps. More from Reuters.

🛒 Holiday shopping has another headwind – higher travel spending. Airlines, hotel chains, and other travel-related industries are seeing big revenue and profit boosts as travel demand surges in the post-pandemic environment. This coming holiday shopping season will be the first major test of consumers’ spending priorities, particularly as more of their discretionary income is eaten up by inflation. As a result, retailers are making sizeable efforts to lure customers back into the store, including longer and steeper promotional pricing periods. CNBC has more.

📝 Twitter begins its mass layoffs. As expected, Twitter has begun notifying staff that they are being laid off. The cuts are expected to affect 50% of the company’s employees, many of whom found out this morning when they opened their email accounts. The partially-leaked email shows the company getting straight to the point, letting them know they’re on a non-working notice period and will be officially let go on February 2nd, 2023. With that said, some employees have begun a lawsuit against the company, stating it did not provide sufficient notice as required by various federal and state laws. More from Yahoo Finance.

🛑 Judge halts $4 billion dividend payout to Albertsons’ shareholders. A Washington state judge has temporarily blocked the grocery retailer from issuing the dividend, which was scheduled to be paid on Monday. The lawyers argue that the dividend is illegal because it potentially limits the ability of Albertsons to keep all of its locations open in the years required to complete the merger with Kroger. Overall, blocking the dividend is part of a broader effort to identify and argue the anti-trust concerns of the merger before it’s approved or disapproved. Fortune has more.

Links

Links That Don’t Suck:

📈 Take advantage of market volatility with SwingTrader, IBD’s one-stop shop for swing trade ideas*

🚗 It’s not just buying a car — owning one is getting pricier, too

🚛 Ford will now sell you a “Van Life” ready transit straight from the factory

💰 $1.6B Powerball jackpot hits world record amount

💊 Teens with obesity lose 15% of body weight in trial of repurposed diabetes drug

💉 New antibiotic appears to be effective against urinary tract infections, drug company says

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.