Good afternoon to everyone working today – hope your commute wasn’t too bad. It’s a shortened trading session, so we’ve got a shortened but news-filled issue.

Today’s issue covers the soccer club that’s been rising all week, global automobile news, and a quick China update. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Consumer discretionary (+1.47%) led, and energy (-1.08%) lagged. 💚

In crypto news, Binance and other crypto firms continue bidding for the bankrupt Voyager Digital. Binance has allocated another $1 billion to its crypto recovery fund. And Cathie Wood is sticking by her $1 million Bitcoin price target. ₿

Other symbols active on the streams included: $MMAT (+3.80%), $DWAC (+6.44%), $MMTLP (-6.37%), $MULN (-10.01%), $JCSE (+21.41%), $XGN (-10.59%), $COSM (+40.16%), and $DOGE.X (+10.44%). 🔥

Here are the closing prices:

| S&P 500 | 4,026 | -0.03% |

| Nasdaq | 11,226 | -0.52% |

| Russell 2000 | 1,869 | +0.30% |

| Dow Jones | 34,347 | +0.45% |

You scratch our backs. We’ll scratch yours. 😉

Answer a quick 11-question survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation.

Company News

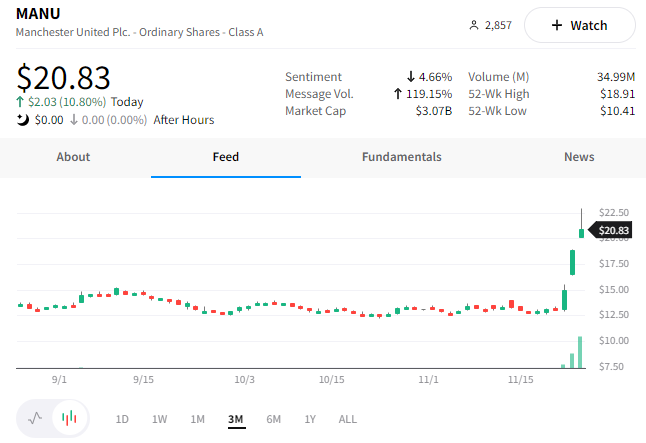

Man U Have Got To See This

Soccer is not just trending because of the World Cup this week. It’s also trending because Manchester United’s stock is going gangbusters. 😮

The soccer franchise saw its shares rise 60% this week on news that its owners are exploring a sale. And they expected a “bidding war” to take place. It was also in the news because Cristiano Ronaldo and the club mutually agreed that the superstar would leave the club “with immediate effect.”

Whether or not the rally will lead to investors scoring a goal remains to be seen. But for now, this trending stock seems to have some staying power in the minds of investors and traders. 🧠

There was a slew of car news today, so let’s recap. 🚗

Tesla has to recall over 80,000 cars in China over software and seatbelt issues. This has investors watching, given China is one of its most important markets.

Ford recalls 518,000 SUVs in the U.S. over a possible fuel leak and fire risk. The company also put out tips for owners to maximize their Ford F-150 lightning range during the colder winter weather. 🥶

Vietnam’s VinFast is shipping its first 999 electric vehicles to U.S. customers. This ends a five-year bid to develop an auto production hub for markets in North America and Europe. The company expects its second batch of cars to be shipped to the U.S. in January.

Renault wants to use water from 4,000 meters below the surface to supply heat to an old production plant. The idea is “one of the most ambitious decarbonization projects on a European industrial site.” Geothermal technology could also produce carbon-free electricity during the summer months. Overall, this is an important step for Renault and Europe to reach their carbon neutrality goals. ⚡

Economy

A Quick China Update

After a strong month of gains, Chinese stocks are pulling back on news that lockdowns are once again hurting its economy.

The country’s capital city, Beijing, struggles to keep Covid under wraps as Thursday’s local infections rise to 1,800. That brings the monthly total to 10,000, prompting additional lockdown measures that will grind its economy to a halt. Road, subway, and other transportation use are down dramatically in Beijing and smaller cities.

Additionally, unrest continues at Foxconn plants where Apple iPhones are made. Roughly 20,000 workers, most of which were recently recruited, have left their posts over concerns about lockdowns and working conditions. They’ve also clashed with security personnel this week as tensions remain high. Many analysts expect this and other Covid-related conditions in China to weigh on supply chains further.

Meanwhile, China’s central bank is strengthening efforts to support its struggling property market, which makes up 25% of its economy. It plans to offer cheap loans to financial firms that buy bonds issued by property developers. It’s also drafting a list of good-quality and systemically important developers eligible for broader government support to improve their balance sheets.

The central bank is also reducing its reserve requirement ratio for banks by 25 bps beginning on December 5th. This frees up $70 billion for banks to support the country’s slowing economy.

We’ll have to see how this develops. But for now, tensions in the country are high. And global investors remain concerned.

Bullets

Bullets From The Day:

✂️ Report claims Twitter has lost more than half its top 100 advertisers. A report from Media Matters for America claims that these advertisers have spent almost $2 billion on Twitter ads since 2020. Seven other advertisers have paid more than $255 million since 2020 and have slowed their advertising on the site to almost nothing. This amounts to a significant hit for the company, which is struggling to keep revenue traction as it cuts costs and revamps features to keep people on the platform. NPR has more.

⚠️ Mohamed El-Erian warns of “violent shocks” ahead. One of the world’s top economists is warning that the global economy is headed for a severe recession and expects more uncertainty ahead, with shocks growing more frequent and violent. He expects the recession to be drawn-out rather than the “short and shallow” many expect. As for the drivers of this, he views the shift from insufficient demand to insufficient supply, the end of unlimited liquidity from central banks, and the increasing fragility of financial markets. More from Business Insider.

🛢️ European leaders fail to finalize gas price cap details. The meeting concluded on Thursday without much progress, with the proposed gas price cap not satisfying any country’s needs. The current proposal for a cap of 275 euros per megawatt hour is criticized as being far too high to be effective. Since the 27 EU leaders could not reach an agreement at this meeting, they’ve called for a new emergency meeting in mid-December. CNBC has more.

Links

Links That Don’t Suck:

⚖️ Jeffrey Epstein victims sue several major banks

💉 Universal flu vaccine could counter future pandemic

🚀 Watch Artemis 1’s Orion spacecraft enter lunar orbit Friday

✅ Elon Musk says Twitter’s new multicoloured verification will launch next week

🧾 IRS warns taxpayers about new $600 threshold for third-party payment reporting