It was a volatile day on Wall Street as the market digested what appeared to be a hotter-than-expected inflation print. Let’s recap what you missed on this *lovely* Valentine’s Day. 👀

Today’s issue covers the jump in consumer prices, Biden’s next “top economic advisor,” and Airbnb’s earnings beat. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Consumer discretionary (+1.20%) led, and real estate (-1.04%) lagged. 💚

Oil prices dipped on news that the U.S. strategic oil reserve will continue with its scheduled 26 million barrel sale. Overseas, European Union lawmakers approved a ban on new fossil fuel cars that begins in 2035. 🛢️

Meanwhile, Ford is cutting another 3,800 jobs in Europe as it prioritizes resources for electric vehicle production. It also halted production and shipments of its F-150 Lightning over a battery issue. 🪫

Peabody Energy rose 13% after reporting strong results and indicating that it intends to return some of that cash to shareholders. 🤑

In crypto news, Binance’s CEO is taking steps to distance himself from the BUSD stablecoin as regulators circle. The U.S. Securities & Exchange Commission (SEC) is attempting to make it harder for crypto firms to become “qualified custodians,” reducing their ability to work with hedge funds and other large investment institutions. And the SEC set its sights on a new target, ordering Circle ($USDC) to cease the sale of unregistered securities. ₿

Other symbols active on the streams included: $BBBY (-4.90%), $PLTR (+21.16%), $WISH (-14.65%), $AMST (+81.62%), $LMFA (+9.24%), $GNS (-3.46%), $VLON (-26.13%), and $TRKA (-5.49%). 🔥

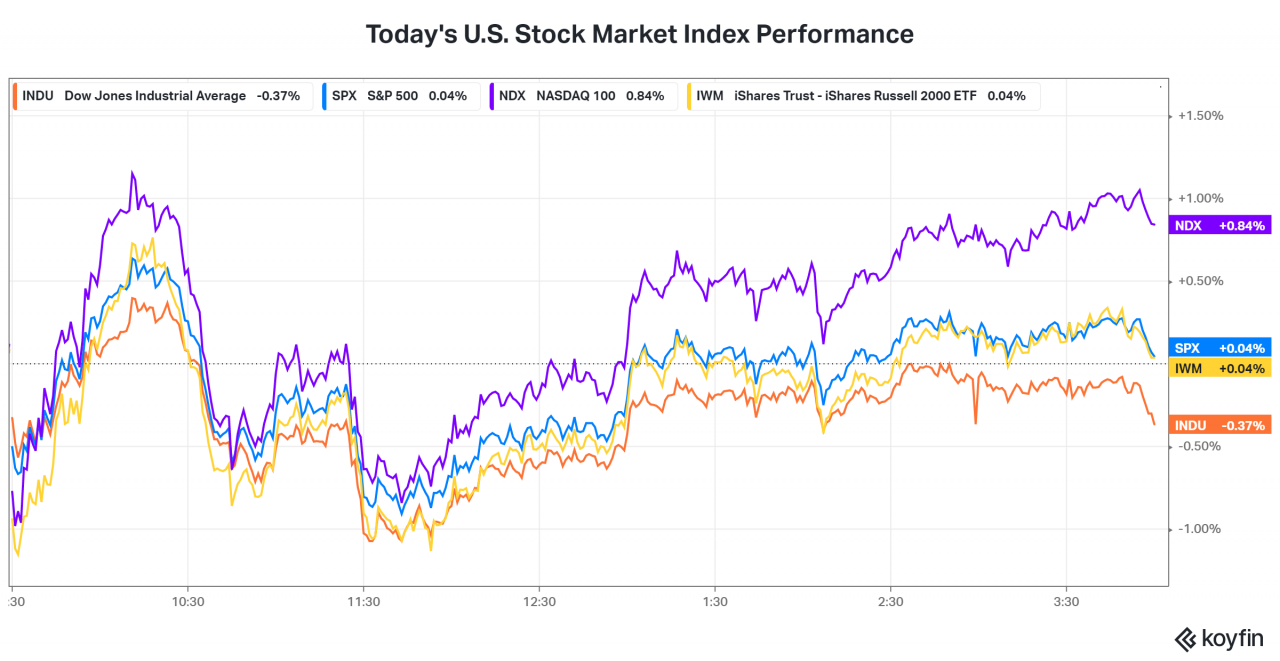

Here are the closing prices:

| S&P 500 | 4,136 | -0.03% |

| Nasdaq | 11,960 | +0.57% |

| Russell 2000 | 1,940 | -0.06% |

| Dow Jones | 34,089 | -0.46% |

Today’s consumer price index showed inflation rose more than expected in January. 📝

Headline inflation rose by 0.5% MoM and 6.4% YoY (vs. the 0.4% and 6.2% expected). Stripping out food and energy, core CPI rose 0.4% MoM and 5.6% YoY (0.1% higher than expected). 🔺

Driving those increases were two things. ✌️

First, energy prices rose 2% MoM, and food prices rose 0.5% MoM. Those numbers are typically volatile and not something the Fed is too focused on. Within the core CPI number, rising shelter costs contributed a good portion of the gain…but those numbers involve a significant lag. ⏲️

As a result, many market participants and the Fed are looking at “super-core” inflation, which takes out shelter prices. That value rose just 0.2% MoM and 4% YoY. The argument is that this way of looking at inflation is a lot more reflective of the prices the Fed can directly impact through its policy. And for now, those are headed in the right direction.

That’s likely why the stock market’s initial reaction was to sell off. Meanwhile, the bond market is no longer pricing in any rate cuts in 2023. Instead, it sees a terminal rate between 5% and 5.25%, where it’s likely to stay until more progress is made on inflation.

Overall, the stock market continues to err on the side of optimism. Leading today’s gainers was the tech-heavy Nasdaq index. 👍

Now we wait to see if the producer price index on Thursday indicates a similar trend. ⌚

Earnings

Airbnb-eating Earnings

Airbnb reported better-than-expected fourth-quarter earnings after the bell.

The company’s earnings per share of $0.48 and revenue of $1.90 billion topped their $0.25 and $1.86 billion estimates. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $506 million also beat the $432 consensus estimate. 📈

Other relevant stats included:

- Gross booking value of $13.5 billion

- Nights and experiences booked of 88.2 million (+20% YoY)

- Average daily rates of $153 (-1% YoY)

- Active listings of 6.6 million (+16% YoY)

Driving the results was strong demand from consumers and cost-cutting efforts taken by management during the pandemic. Executives are encouraged by the market share gains in Latin America and continued recovery within Asia Pacific. Overall, they say both short and long-distance travelers are returning to major cities, which should be a major tailwind for the company’s results. ✈️

As a result of the company’s positive outlook, its first-quarter revenue forecast of $1.75 billion to $1.82 billion also came in higher than expected.

$ABNB shares were up roughly 9% after the bell, adding to their 4% regular session gains. 👍

It’s widely expected that U.S. President Joe Biden will name Federal Reserve Vice Chair Lael Brainard to the White House’s top economic policy position this week. 📝

She will replace White House National Economic Council (NEC) Director Brian Deese, who recently resigned. Additionally, Jared Bernstein will likely replace Cecilia Rouse as chair of the Council of Economic Advisers. And many expect the Labor Department’s chief economist, Joelle Gamble, to be made a deputy NEC director.

In her new position, Brainard will advise Biden on policy and personnel decisions and coordinate policy-making across executive branch agencies. Many speculate her long career in government could set her up to take Janet Yellen’s place as Treasury Secretary if Democrats win reelection in 2024. 🗳️

As a member of the Federal Open Market Committee (FOMC), Brainard recently presented her colleagues with a marginally less aggressive monetary policy case. Her concerns are that if the Fed overtightened in its fight against inflation, it could lead to economic difficulties on the back end of that policy decision. She’s also known for consistently opposing various measures to ease financial regulations between 2018 and 2020.

Despite the position being all but officially confirmed, the market’s response was muted. This could suggest people are not rushing to speculate on what this means for future economic policy. There are bigger fish to fry at the moment. 🤷

While we’re on the subject of government officials, there were two more announcements today. 📰

First is that the last remaining Republican FTC Commissioner, Christine Wilson, resigned from her post. She stated that Democratic Chair Lina Khan’s “disregard for the rule of law and due process.” was her primary reason. The vacancy means President Biden can nominate two commissioners, though neither can be a Democrat.

Secondly, California Democratic senator Dianne Feinstein says she will retire at the end of her current term. That opens the door for representatives Adam Schiff and Katie Porter, California Democrats, to fight for her seat. At 89, Feinstein is the oldest sitting U.S. senator and longest-serving California senator. ⚔️

Bullets

Bullets From The Day:

✈️ Air India inks a historic jet order with Boeing and Airbus. Under new owners, Tata Group, the nation’s airline is continuing its rebirth with a record-breaking deal. Air India is set to buy 220 planes from Boeing and 250 from Airbus as part of the agreement. It’s also set to lease an additional 25 jets as it gears up to compete with Gulf carriers. Reuters has more.

🏦 Kazuo Ueda is set to be Japan’s next central bank governor. He is set to take over from the current governor Kuroda, who was appointed in March 2013. Japan is one of few developed countries that has maintained its accommodative policy as others aggressively tighten. Analysts expect the central bank’s dovish approach to continue under his watch, especially since the country’s Q4 GDP rebound was weaker-than-expected. However, it remains a complex environment where officials must balance stimulating economic growth while not stoking inflation. More from CNBC.

❌ Walmart is closing three of its U.S. tech hubs. According to a staff memo, the world’s largest retailer is shutting down three tech offices in Austin, Texas; Carlsbad, California; and Portland, Oregon. It’s also pushing all of its tech workers to return to the office at least two days a week, meaning workers at the closed offices will need to relocate if they want to stay with the company. It joins the slew of companies beginning to call workers back to the office as they attempt to maintain growth in a more challenging macroeconomic environment. Yahoo Finance has more.

🏭 Apple has a lot of work to do before India becomes a major parts supplier. As the tech giant looks to diversify its supply chains away from China, its recent efforts in India suggest that it could take longer than many expect. At a casings factory run by conglomerate Tata Group, only half of the production line’s components are in good enough shape to be sent to Apple’s supplier Foxconn for assembly. Apple has a ‘zero defect’ goal, which is a far cry from current performance. With that said, India has grown to account for roughly 5-7% of production since Apple expanded there in 2017. Reports indicate Apple wants that number to rise to 25% in the coming years. More from Reuters.

🛍️ Amazon is planning to ‘go big’ on physical grocery stores…eventually. While the company is pulling back on some of its growth plans and slashing expenses, it’s still looking to expand its reach in specific markets. Its CEO recently told the Financial Times, “We’re hoping that in 2023, we have a format that we want to go big on, on the physical side.” So while it recently closed several of its Fresh supermarkets, it’s opening new ones to test new formats and formulas until they find one that works. Whether or not physical locations can become a success for Amazon remains to be seen, but the company isn’t backing down from the challenge. Engadget has more.

Links

Links That Don’t Suck:

🤝 Tesla Autopilot workers are seeking to unionize in New York

😮 Car buyers face sticker shock as new vehicles prices skyrocket 30%

🥪 Sandwich chain Subway confirms reports it’s exploring a possible sale

🍷 Sommelier who’s tasted 15,000 wines: Never spend less than $30 on a bottle

🗨️ Most couples are ‘financially incompatible,’ survey finds. Having a money talk could help…

🚗 Hyundai, Kia rolling out free software to combat viral car theft videos on YouTube, TikTok